By Matt Scuffham

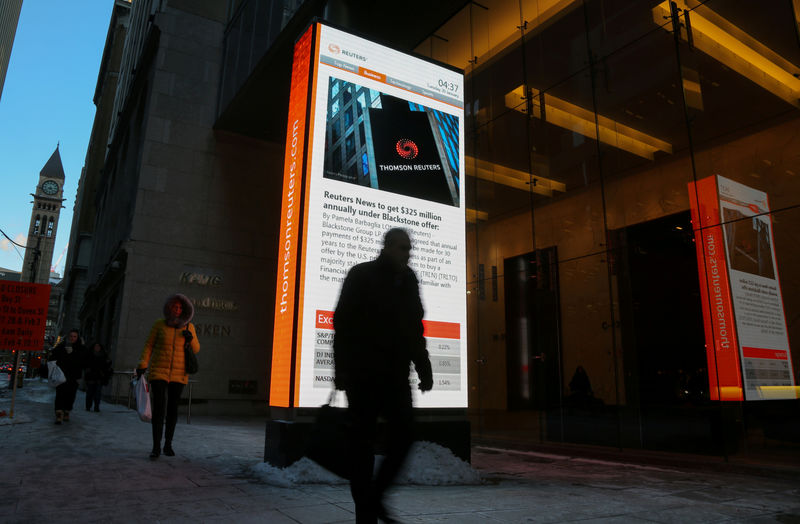

TORONTO (Reuters) - Thomson Reuters Corp (TO:TRI) (N:TRI) said on Monday it had completed the sale of a majority stake in its Financial & Risk (F&R) unit to private equity firm Blackstone Group LP (N:BX).

The news and information provider agreed in January to sell a 55-percent stake in the business, which provides data and news primarily to financial customers, in a deal which values the total F&R business at about $20 billion (15.3 billion pounds).

The transaction is Blackstone's biggest bet since the 2008 financial crisis and pits co-founder Stephen Schwarzman against fellow billionaire and former New York Mayor Michael Bloomberg.

Bloomberg's eponymous terminals are the market leader in providing traders, bankers and investors with news, data and analytics.

It also gives Thomson Reuters, controlled by Canada's Thomson family, an ally as it seeks to reinvigorate a business facing challenges from a shrinking and budget-conscious customer base.

Thomson Reuters retains a 45-percent stake in the F&R business, which has been renamed Refinitiv, a name derived from the 160-year-old Reuters brand with the objective of enabling "definitive action in financial markets."

The business will be led by David Craig, previously head of the F&R unit, who became CEO of Refinitiv following completion of the deal.

Thomson Reuters said it received about $17 billion in gross proceeds at the closing, out of which it plans to return $10 billion to shareholders. As part of that process, the company launched a $9 billion share buyback in August. The tender offer is scheduled to close on Tuesday.

From the remainder of the proceeds, the company said it would redeem $4 billion of debt, keep $2 billion of cash on its balance sheet to fund acquisitions, and use $1 billion to cover expenses related to the transaction.

Following the deal, Thomson Reuters had said it expects its legal business to account for 43 percent of its revenue.

Reuters News will remain a unit of Thomson Reuters Corp. Under the terms of the deal, Refinitiv will make minimum annual payments of $325 million to Reuters over 30 years to secure access to its news service, equating to almost $10 billion.