Investing.com - Investors face a volatile week in financial markets, watching geopolitical risks and the central bank narrative.

"Equities got off to a flying start in 2024, with the S&P 500 annualising its best year in 70 years. However, April has been more challenging, as expected, and we are on the verge of a market 'pullback' that is long overdue. The proximate cause is the Fed's readjustment of rate cut expectations and rising bond yields. We see this as a healthy breather, with prolonged weakness to buy," says Ben Laidler, Global Markets Strategist at eToro.

- Want to take advantage of the best opportunities to outperform the S&P 500, try InvestingPro, sign up HERE & NOW for less than £9 per month and get almost 40% off your 1 year plan for a limited time! More information at the end of this article...

"The two pillars of the bull market, earnings growth and rate cuts yet to come, remain in place, while significant cash remains on the sidelines. We focus on the cheapest and most economically sensitive sectors and regions, from financials to Europe. A short-term counter-signal is the volatility of VIX," he adds.

Withdrawal

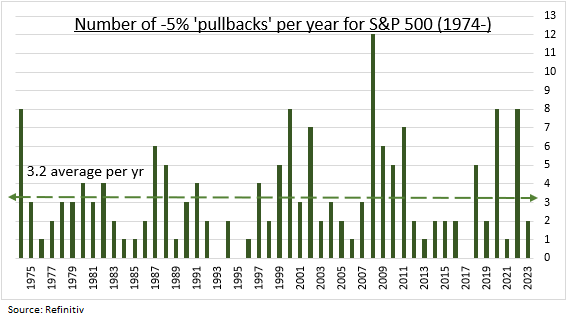

"Market crashes are inevitable. There is no profitable investment without risk," says Laidler. "US stocks have averaged a long-term annual return of 10%, and historically they go up much more than they go down. The S&P 500 has averaged three modest 'pullbacks' of more than 5% per year (see chart), far more frequent than 10% 'corrections' or rare 20% 'crashes', while the average intra-year decline of the S&P 500 has been a sizable -14%," Laidler explains.

"Last year, for example, the S&P 500 recorded an intra-year correction of -10%, but ended up 24% higher on a calendar year basis. Whereas 2020 saw a much worse intra-year slump of -34%, but the index still rose 16% for the full calendar year," he adds.

Drivers

Stock markets are in a short-term rut, Laidler warns, pressured in three ways.

- A repricing of later and smaller Fed rate cuts, stronger GDP growth and stronger inflation. This is pushing bond yields higher and particularly affecting those with high valuations, such as technology, or high debt, such as real estate.

- Elevated geopolitical uncertainty, from Ukraine to the Middle East, has contributed to the US dollar rally and the VIX rally to long-term average levels.

- The weak technical backdrop of strongly bullish markets, elevated investor sentiment and a statistically outperformed pullback, with weak mid-year seasonality that could now be brought forward to April.

Do you want to outperform the S&P 500?

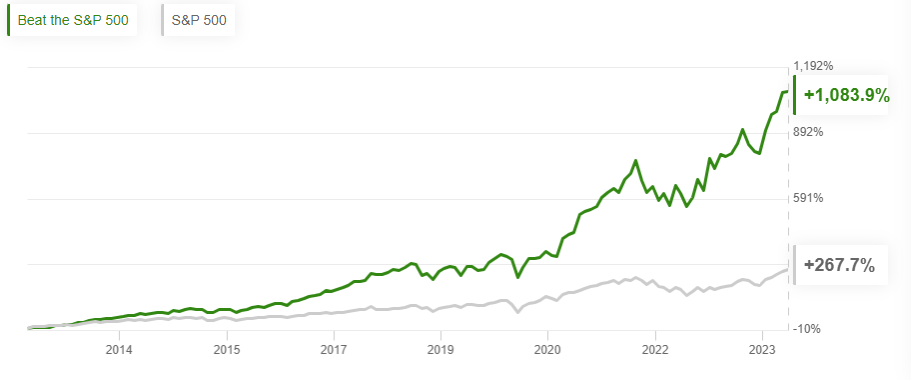

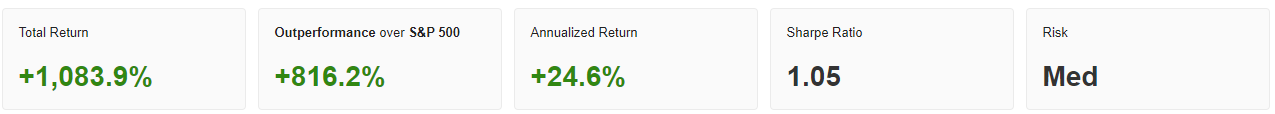

For investors who are constantly on the lookout for new market trends, this information may be of interest. The professional tool InvestingPro has one of its ProPicks strategies, called 'Better than the S&P 500' that includes the 20 best-performing stocks selected by advanced Artificial Intelligence (AI) and poised to outperform the S&P 500.

Source: InvestingPro

This 'Better than S&P 500' historical backtest shows how the strategy's stock picks would have performed over time. InvestingPro's AI-driven stock ranking system relies on a predictive model trained from more than 50 financial signals to identify the stocks most likely to outperform the market.

Source: InvestingPro

Using advanced AI models to painstakingly analyse the financial data of the S&P 500 stocks, this strategy highlights the 20 best-performing stocks most likely to lead the market each month.

Want to make the most of investment opportunities with the 'Better than S&P 500' strategy? Take advantage of the opportunity to get InvestingPro's annual plan for less than £9 per month HERE & NOW. Use the code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than a Netflix (NASDAQ:NFLX) subscription costs you! (And you get more out of your investments too). With it you get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So fundamental analysis professionals can drill down into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!