After years of delays and speculation, the Ethereum Merge successfully dropped on Thursday September 15 at around 7:45 British Standard Time, finally transitioning the world’s largest cryptocurrency ecosystem from proof-of-work (PoW) to proof-of-stake (PoS).

With the landmark protocol upgrade, Ethereum is now over 99% more energy efficient, and the foundations been laid down to make it vastly more scalable and cheaper to operate.

And we finalized!Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

The stakes were high for the US$200bn digital ecosystem.

With such a complex project being handled by hundreds of developers, one small glitch could have seen the whole ecosystem go dark.

Ultimately, there was nothing to worry about, with just a single block being missed during the whole process.

Can't say enough about all of the builders, researchers, coordinators and more that made this all happen.It's an absolutely incredible feat to transition a globally used blockchain to PoS without most end users even noticing or having to do anything.

Truly incredible. Cheers.

— eric.eth (@econoar) September 15, 2022

Anyone with their eyes off the news would hardly have noticed one of the biggest events in cryptocurrency history, with price action staying essentially flat and little changing in terms of transaction speeds or gas prices.

Reflecting on the event, Lars Seir Christensen, chairman of the Concordium Foundation and founder of Saxo Bank, commented: “I would not call the Merge a non-event, but the reality is that it does not change a lot.

“Overall, I don't see it as a major positive that will change the current negative market sentiment and there is considerable downside risk if anything goes wrong.”

Christensen reckons that any potential upside will face heavy resistance above US$2,000.

But even if little changes for investors in the short term, the same can’t be said for the miners.

Ethermine shuts up shop

While the benefits will be vast for users and developers, cryptocurrency miners are the biggest net losers in the switch to PoS.

Operated by blockchain technology firm Bitfly and once the world’s largest ETH miner, Ethermine has effectively been made redundant as of today.

Since March 2016, Ethermine mined over 12,400 Ethereum blocks and at its peak, had an account balance greater than US$22mln.

Webpage visitors are now greeted with the following message: “After seven years of intensive research & development, the mining phase of Ethereum has ended on the 15th of September 2022.

“As of now it is no longer possible to mine Ether on the Ethereum Network using Graphic Cards (GPUs) or ASICs.

“As a consequence of this transition, the Ethermine Ethereum mining pool has switched to withdraw-only mode.”

But not all miners are powering down.

Even if their hardware is unsuitable for Bitcoin, there are many other cryptocurrencies that require miners, including Litecoin, Ethereum Classic, Ravencoin, Monero, Dogecoin and more, though their rewards pale in comparison to ETH.

Over 50 million in ETH rewards were distributed to miners over the network’s PoW lifespan- that’s over US$79bn at today’s ETH prices (without taking into account ETH value at reward date).

Will the news be sold?

In the lead up to The Merge, some including myself speculated whether investors were gearing up to ‘sell the fact’ after fairly robustly buying the news in the build up.

But there has been little-to-no price action post-Merge so far.

Joel Kruger, crypto strategist at digital asset exchange LMAX Digital, believes that risk was already priced in, “which could leave the balance of risk tilted to the downside over the coming sessions”.

Everything seems to have gone as expected, with little additional headroom for buying on the news, “thereby exposing ether to some selling on the fact,” surmised Kruger.

While the operational impact of the Ethereum Merge cannot be understated, investors are likely preoccupied with more important issues.

“The reality right now, is that the Merge has been overshadowed by developments in global markets, with crypto still trading more on risk sentiment and the outlook for Fed policy than anything else.”

At the time of writing, ETH was changing hands at US$1,590, less than 3% down against the week.

New era of centralisation?

Despite the clear benefits, not all are enamoured by Etherum’s new PoS consensus method.

Sure, the environment benefits are big, as is the potential for scalability, but critics have been vocal about the dangers of centralisation

Jason Soroko, chief technology officer at cybersecurity firm Sectigo, explained: “PoS is more energy efficient than PoW, but cryptocurrencies such as bitcoin that utilise PoW do so for reasons beyond sustainability.

“The argument for PoW is that it enables a more decentralised participation than PoS, where those who provide the highest stake amounts most likely have the greatest influence in decisions about the cryptocurrency.”

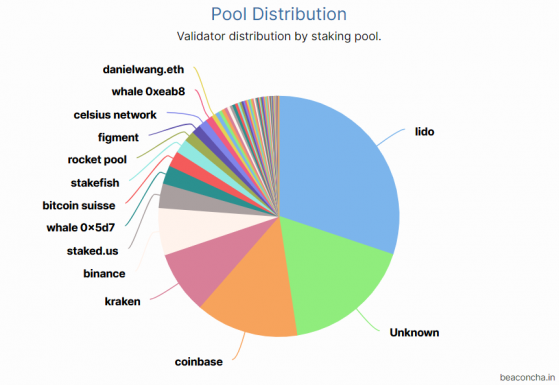

Indeed, as seen in the below chart, over 75% of all network consensus is being handled by just five pools, including some being run by large corporations such as NASDAQ-listed Coinbase (NASDAQ:COIN) and global digital asset exchange Binance.

Even the disgraced Celsius Network has a large portion of staked ETH – Source: beaconcha.in

But it’s a slightly misleading statistic, given that each pool comprises thousands of individual delegates.

In reality, there are over 425,000 active validators contributing to Ethereum’s network consensus right now.

After The Merge: Now what happens?

The Merge was the first in a series of rhyming upgrades, with more planned for the years ahead, including The Surge, The Verge, The Purge and The Splurge.

The Surge is likely to happen next year, and in some respect, could have an even greater impact than The Merge.

We can get into the technicalities another time, but the main takeaway is that The Surge with usher in a new era of significantly faster and cheaper Ethereum transactions.

It doesn’t look like the The Merge will result in the flippening (i.e. the day ETH overtakes BTC’s market cap), but who knows, maybe The Surge will.

Read more on Proactive Investors UK