Benzinga - by Surbhi Jain, .

China's stock market has been a hot topic in 2024, and for good reason. After a rough start, marked by a sharp decline in January due to derivative-related issues, Chinese stocks have staged an impressive comeback.

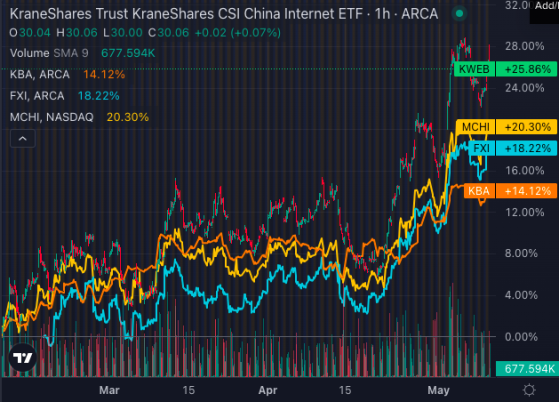

China ETFs Outperform U.S.

Chart: Benzinga Pro

Key ETFs such as KraneShares CSI China Internet ETF (NYSE:KWEB), KraneShares Bosera MSCI China A 50 Connect Index ETF (NYSE:KBA), iShares MSCI China ETF (NASDAQ:MCHI), and iShares China Large-Cap ETF (NYSE:FXI) have outperformed major U.S.-equity ETFs, such as the S&P 500 index-tracking SPDR S&P 500 ETF Trust (NYSE:SPY), since February, signaling a potential shift in the market landscape.

Chart: Benzinga Pro

Also Read: China’s Strong Q1 Economic Rebound Sparks Optimism for Apple, Tesla And These Companies

KraneShares’ CIO Gives 5 Reasons To Invest In a recent post, Brendan Ahern, chief investment officer at KraneShares, highlighted five key catalysts driving the current China market rebound.

State-linked entities like Central Huijin Investments have openly announced purchases of mainland-listed ETFs and increased holdings in mainland bank stocks. This level of transparency and support can instill confidence in investors and provide a strong foundation for the market to grow.

However, with signs of easing tensions and supportive policies, there is a growing interest in Chinese stocks. This shift in sentiment could lead to increased capital inflows into Chinese markets, driving up stock prices.

This uptick in economic activity could translate into higher corporate earnings and stock prices, making it an opportune time for investors to enter the market.

This not only demonstrates confidence in their own businesses but also reduces the supply of shares in the market, potentially driving up prices.

The recent resurgence in China's stock market presents an exciting opportunity for investors. With government support, changing investor sentiments, policy reforms, economic recovery and attractive valuations, Chinese equities could be poised for further growth.

Investors looking to capitalize on this trend should consider adding exposure to Chinese stocks in their portfolios, particularly through ETFs KWEB, FXI, MCHI and KBA, which offer diversified exposure to the Chinese market.

Read Next: Is China’s Stock Market Poised For A Turnaround? Analyst Points To 3 Promising Signs Amid Policy Shifts

Photo: Chonrawit Boonprakob via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga