Investing.com - "We believe that the strong gains in tech stocks have been driven by the market's focus on Artificial Intelligence (AI) and investors' preference for quality given the high macroeconomic and market uncertainty."

- How can you take advantage of the best opportunities offered by AI? Try InvestingPro and make winning decisions! NOW WITH AN EXCLUSIVE DISCOUNT! Subscribe HERE and get almost 50% off your 1-year plan! HALF PRICE!

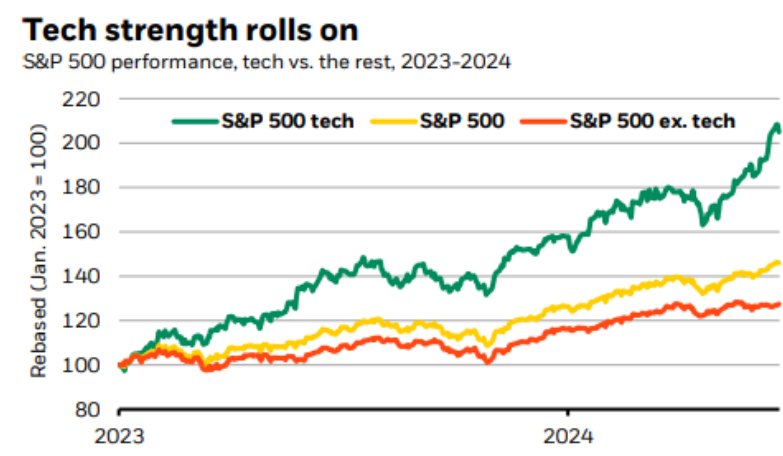

That's how convinced they are about the rise of AI at BlackRock (NYSE:BLK), highlighting that the sector has risen 30% this year, almost four times more than the rest of the S&P 500, according to LSEG Datastream data.

"Looking back to 2023, tech’s dominance is even clearer: The sector has soared 100% since then, while the rest of the index rose 24%. AI has helped drive that outperformance by brightening corporate earnings for tech firms," explain BlackRock analysts in their latest weekly market commentary.

These experts echo analysts' forecasts, expecting a 20% increase in the next 12 months, well above the predictions for the rest of the market. "Tech firms have so far delivered on lofty expectations: Their earnings grew 23% year over year in Q1. In a world where mega forces – big structural shifts – drive returns now and in the future, we eye the short- and long-term impacts of AI on earnings," added the firm.

Solid Balance Sheets

"Strong balance sheets are also a reason we like tech, and we are less concerned about valuation metrics. Free cash flows – excluding operational costs – as a share of sales are nearly double for tech than for the broader market, and tech has the largest profit margins across sectors, LSEG Datastream data show,” notes BlackRock.

"Plus, many top tech names are highly profitable and cash-flush, allowing them to fund the buildout of AI infrastructure such as data centers," add the analysts.

U.S. Versus Europe

According to BlackRock, "A search for such quality may have spurred investors to flock to U.S. stocks even more in recent weeks as their European counterparts have retreated."

"Much of the slide in European stocks came after the results of the European Union elections and news of a snap election in France," they state.

Risks?

What could stop the rise of tech stocks? According to BlackRock, "Markets could lose favor for the sector if hopes for AI are dampened, such as if they feel corporate spending on AI hasn’t paid off in a boost to earnings or margins."

"Any regulatory changes limiting adoption could also affect AI’s potential to keep supporting tech. In a less likely scenario, other sectors could jump ahead of tech if growth accelerates, and inflation falls enough to allow the Federal Reserve to cut interest rates more than expected," the experts add.

"Bottom line: The concentration in U.S. tech stocks is a feature, not a flaw, of the AI theme. We stay overweight U.S. stocks on a six- to 12-month, tactical horizon and still prefer the AI theme. We like industrials and healthcare as stock gains broaden," they conclude.

How to continue taking advantage of market opportunities? INVESTINGPRO IS HALF PRICE! Take advantage HERE AND NOW of the opportunity to get the annual InvestingPro plan. Use the code INVESTINGPRO1 and get almost 50% off your 1-year subscription. Less than the cost of a Netflix (NASDAQ:NFLX) subscription! (And you get more value for your investments). With it you will get:

- ProPicks: AI-managed stock portfolios with proven performance.

- ProTips: Digestible information to simplify a large amount of complex financial data.

- Advanced stock screener: Find the best stocks according to your expectations, considering hundreds of financial metrics.

- Historical financial data of thousands of stocks: So that fundamental analysis professionals can delve into all the details.

- And many other services, not to mention those we plan to incorporate in the near future.

Act quickly and join the investment revolution! Get your OFFER HERE!