Benzinga - by Piero Cingari, Benzinga Staff Writer.

Exchange-traded funds (ETFs) focused on growth equities – characterized by robust revenue growth, high valuations, and strong potential for innovation – experienced elevated inflows in June.

This surge in interest towards growth-linked funds coincided with a significant outperformance of growth over value stocks, reflecting increased investor confidence in the tech sector and disruptive innovations like artificial intelligence.

The eight largest growth-linked ETFs by assets under management (AUM) collectively experienced a substantial $12.2 billion in inflows from the beginning of the month through June 24.

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF’s record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

| Vanguard Growth ETF | $139.84B | $5.68B |

| IShares Russell 1000 Growth ETF (NYSE:IWF) | $97.00B | $0.03B |

| IShares S&P 500 Growth ETF (NYSE:IVW) | $52.96B | $4.01B |

| Schwab U.S. Large-Cap Growth ETF (NYSE:SCHG) | $30.62B | $0.44B |

| SPDR Portfolio S&P 500 Growth ETF (NYSE:SPYG) | $29.40B | $0.47B |

| Vanguard Mega Cap Growth ETF (NYSE:MGK) | $22.39B | $1.08B |

| Vanguard Russell 1000 Growth ETF (NYSE:VONG) | $20.81B | $0.08B |

| IShares Core S&P U.S. Growth ETF (NYSE:IUSG) | $18.94B | $0.15B |

| Vanguard Small-Cap Growth ETF (NYSE:VBK) | $17.25B | $0.26B |

| Total | $12.2B |

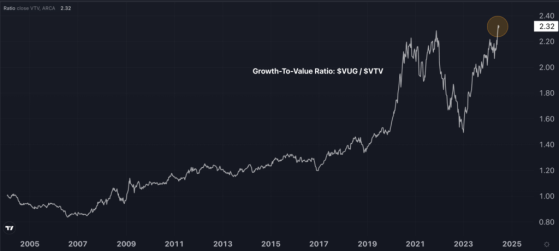

Growth Stocks Surge To Record Highs Against Value The Vanguard Growth ETF’s relative performance against its counterpart, the Vanguard Value ETF (NYSE:VTV), set new record highs in June, surpassing the previous peaks achieved in November 2021, as illustrated in the chart below, sourced from Benzinga Pro.

The primary drivers of the growth style’s outperformance in June were tech giants Nvidia Corp. (NASDAQ:NVDA) and Apple Inc. (NASDAQ:AAPL), which saw robust rallies of 15% and 8.8%, respectively.

Read Next:

- Growth Stocks Leave Value Stocks In The Dust: 4 Reasons For Biggest Monthly Lead In Over A Year

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga