Benzinga - by Anusuya Lahiri, Benzinga Editor.

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) has significantly outperformed China’s largest chipmaker, Semiconductor Manufacturing International Corp (SMIC), this year, highlighting Beijing’s challenges in advancing its domestic chip industry.

Despite China’s substantial semiconductor investment fund, Big Fund III, aimed at boosting local industry, SMIC needs to work on technological advancements, Bloomberg reports.

China can produce 7-nanometer chips but aims to progress to 5nm amid U.S. export controls.

TSMC, however, uses advanced extreme ultraviolet lithography to manufacture 3nm chips, a capability not accessible to China due to these restrictions.

Also Read: Nvidia’s AI Chip Has A Tough Competitor From China – Huawei’s Latest Ascend 910B

Bloomberg Intelligence analyst Charles Shum noted that even if SMIC could produce 5nm chips, costs would be significantly higher without EUV equipment.

The gap is about more than just reaching technological levels; it is about achieving them cost-effectively.

Recent reports indicated that Chinese AI chip firms are downgrading designs to fulfill the U.S. sanctions, underscoring the importance of TSMC.

TSMC’s May sales grew by 30% to $7.1 billion, driven by the AI frenzy. The key Nvidia Corp (NASDAQ:NVDA) supplier expects the AI to drive a sector-wide recovery in 2024.

SMIC’s market share climbed to 6% in the first quarter, putting it in third place behind TSMC and Samsung Foundry, which held 62% and 13%, respectively.

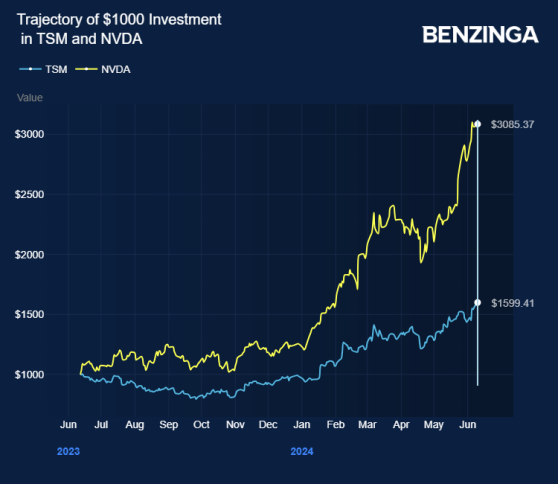

Taiwan Semiconductor stock gained over 57% in the last 12 months. Investors can gain exposure to the semiconductor sector via First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and ProShares UltraShort Semiconductors (NYSE:SSG).

Price Action: TSM shares were trading lower by 1.00% to $166.47 premarket at the last check Tuesday.

Also Read: Broadcom Rises As Top AI Chip Supplier After Nvidia, Thanks To Google And Meta Partnerships: Analyst

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Ivan Marc via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga