By Silke Koltrowitz

ZURICH (Reuters) - The Swiss competition watchdog on Thursday restricted Swatch Group's (S:UHR) shipments of watch mechanisms to other companies ahead of a final decision in mid-2020 in a long-running dispute.

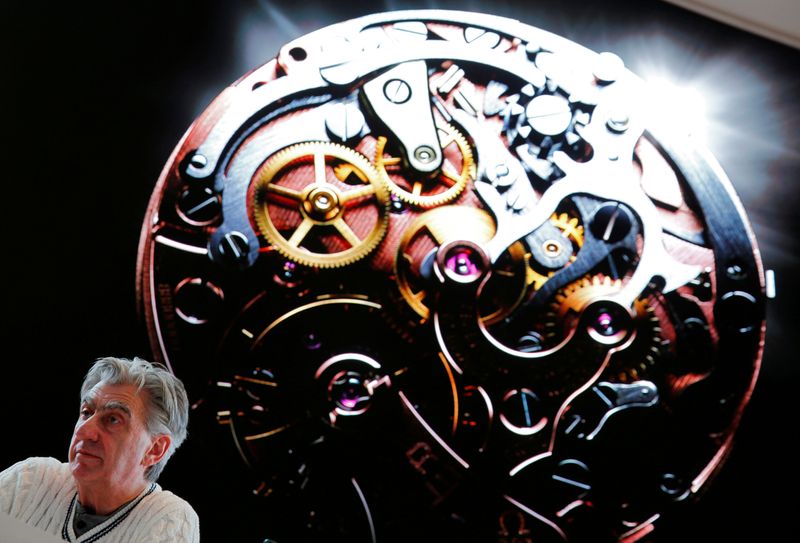

The world's biggest watchmaker is also an important supplier of watch movements that power mechanical timepieces. If it cannot sell them, Swatch itself and its customers, from Cartier maker Richemont (S:CFR) to independently owned Chopard and Breitling, may face problems.

Anti-trust agency WEKO said deliveries of watch movements to Swatch Group's existing customers would be suspended from Jan. 1, with an exception for small and mid-sized companies of up to 250 staff, until the watchdog reaches a final decision.

The decision creates uncertainty over supplies at a time when Swiss watchmakers face competition from smartwatches and slowing demand in key market Hong Kong. Swiss watch export data on Thursday showed shipments to Hong Kong fell 27% in November.

Swatch shares were indicated 1.1% lower in pre-market trade.

A Swatch Group spokesman said the lion's share of the watch movements sold by Swatch's ETA unit was absorbed by companies with more than 250 staff and the group expected not to be able to deliver any movements to third parties next year.

WEKO Director Patrik Ducrey said Swatch Group was still allowed to supply smaller customers, but had to treat them all equally.

"Is there really going to be a shortage of watch movements? I'm not sure. There's also a grey market and brands have built inventories," he told Reuters.

Swatch Group had said on Wednesday that it could seek damages.

The question of how to end Swatch Group's historical quasi-monopoly on mechanical watch movements has kept the competition authority busy for years.

WEKO and Swatch struck a deal in 2013 under which the company known for high-end Omega and colourful plastic watches agreed to gradually phase out movement supplies to the rest of the industry by the end of 2019 and would have been free to choose its customers and prices from 2020.

Swatch itself had initiated the change at the time, saying it no longer wanted to serve as a "supermarket" for other brands, but had to keep supplying rivals for several years because of its dominant market position.

Privately owned Sellita has since emerged as the main alternative supplier. Swatch Group said in its statement on Wednesday Sellita would benefit from WEKO's decision.

Sellita and Richemont could not immediately be reached for comment.