Benzinga - by Dmitriy Gurkovskiy, Benzinga Contributor.

By RoboForex Analytical Department

The US stock market has surged to new heights, with the S&P 500 index reaching a record high of 5,325 points and the DJIA index touching 40,000 points. Investors are experiencing euphoria, spurred by the unexpectedly low US inflation figures released earlier.

Inflation has recently been a critical driver of market volatility, thus its stabilisation is a cause for significant optimism. The April CPI increase, lower than expected at just 0.3% month-on-month, suggests a potential return to a downward inflation trajectory. Year-on-year, the CPI climbed by 3.4% in April, a slight dip from 3.5% in March. Inflation peaked in June 2022 at 9.1%, and while there was progress, the current deceleration is encouraging for investors.

The April inflation report marked the first decline in year-on-year inflation since January 2024. The CPI rose slower, raising market hopes that the Federal Reserve might soon ease monetary conditions.

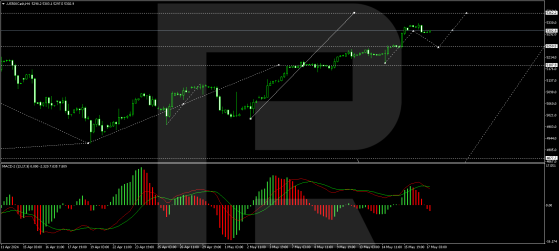

Technical Analysis Of S&P 500

On the H4 chart of the S&P 500 index, a consolidation range has formed around the 5188.0 level. With an upward breakout, extending the fifth wave to 5363.0 is possible. The growth link to 5315.0 has been executed, and we now expect a consolidation range to form around this level. A downward breakout could lead to a range expansion to 5250.5, while an upward breakout could extend to 5363.0. The market is developing the fifth wave of growth without any significant correction, and a sharp decline along the trend to 4735.0 could begin at any moment. This scenario is technically supported by the MACD indicator, with its signal line at the maximums and pointing strictly downwards.

On the H1 chart, the upward move to 5315.5 has been completed. A consolidation range is forming around this level, and a downward impulse to 5296.0 has been fulfilled. We expect a growth link to 5315.5 (testing from below) today. A downward breakout from the range could lead to a continuation of the decrease wave to 5250.5. The Stochastic oscillator technically confirms this scenario, with its signal line above 20 and expected to rise to 80, indicating a potential for continued growth.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga