Benzinga - by Piero Cingari, Benzinga Staff Writer.

A cooler-than-expected U.S. inflation report fueled a rally on Wall Street, ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting at 2:00 p.m. Wednesday.

What happened: Inflation slowed to 3.3% annually in May, below both the expected and previous rate of 3.4%. On a monthly basis, the Consumer Price Index (CPI) remained flat, below the anticipated 0.1% increase and a significant drop from April’s 0.3% rise.

Additionally, the core measure of inflation, which excludes energy and food, weakened more than predicted. Annually, core inflation slowed from 3.6% to 3.4%, falling short of the 3.5% expectation.

Why it matters: Lower-than-expected inflation data is bolstering hopes for a steady return to the Federal Reserve’s 2% target and raising expectations for interest rate cuts later this year.

Markets are now assigning a probability of over 70% for a September rate cut, up from 54% before the inflation report. Notably, Fed futures now indicate 55 basis points of rate cuts priced in by the end of the year, implying two rate cuts.

Prospects of a declining cost of borrowing are aiding interest-rate sensitive sectors and stocks, which had lagged in recent weeks due to fears of prolonged higher rates.

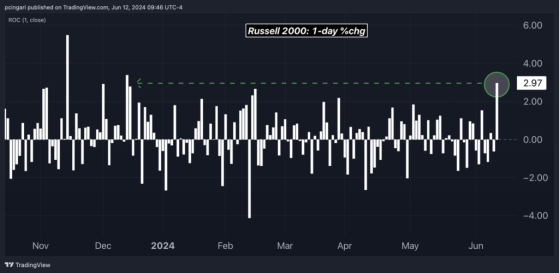

Market reactions: Small caps, as tracked by the iShares Russell 2000 ETF (NYSE:IWM), were the brightest spot in the market, opening 2.9% higher and on track for the best-performing day year to date.

Chart: Small Caps Eye Best Day Since Mid-December 2023

In comparison, large-cap indices such as the S&P 500, the Nasdaq 100, and the Dow Jones Industrial Average were all about 0.9% higher.

Sector-wise, real estate and materials were the best performers, with the Vanguard Real Estate ETF (NYSE:VNQ) and the Materials Select Sector SPDR Fund (NYSE:XLB) up 2.2% and 1.6%, respectively.

Industry-wise, homebuilders, regional banks, solar, and biotech stocks were the top performers, showing notable increases.

- SPDR S&P Homebuilders ETF (NYSE:XHB) up 4%

- Invesco Solar ETF (NYSE:TAN) 3.9%

- SPDR S&P Regional Banking ETF (NYSE:KRE) up 3.3%

- SPDR S&P Biotech ETF (NYSE:XBI) up 2.3%

Read now: Fed Meeting Preview: Economists Predict Steady Rates In June, Fewer Cuts Ahead

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga