By Liz Moyer

Investing.com -- Stocks staged a rally despite earlier data on initial jobless claims that stoked fears about interest rates staying higher for longer.

Initial jobless claims fell last week and were below 200,000 again, evidence of a still-tight labor market despite thousands of layoffs in big tech in the last few months. That combined with hotter-than-expected inflation data only adds to the Federal Reserve's conviction that its work to tame inflation isn't close to being finished.

Investors are expecting the Fed to raise rates again when it meets this month and again in May, and some Fed officials have said in recent days that they believe rates need to move higher. Futures traders see the benchmark rising above 5.25% by late summer.

Big retailers have reported somewhat mixed results. Lowe's (NYSE:LOW) sees still-softening demand for home improvement projects, while Dollar Tree (NASDAQ:DLTR) is seeing an influx of higher-income shoppers seeking bargains.

Next week, investors will get data on jobs for February, both from private payroll firm ADP (NASDAQ:ADP) and from the government on Friday, March 10. Fed Chair Jerome Powell is also scheduled for his periodic testimony before the Joint Economic Committee on Capitol Hill on Tuesday.

Here are three things that could affect markets tomorrow:

1. Services PMI

The ISM non-manufacturing PMI for February is due out at 10:00 ET (15:00 GMT). Analysts expect a reading of 54.5, which is slightly lower than the 55.2 reported for January.

2. Fed speakers

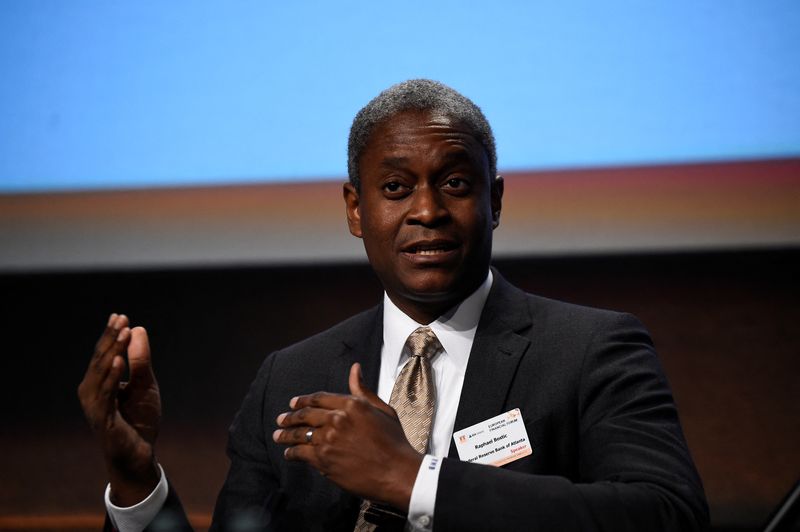

An array of Fed officials are scheduled to speak at various times tomorrow, including Dallas Fed President Lori Logan, Atlanta Fed President Raphael Bostic, Fed Gov. Michelle Bowman, and Richmond Fed President Tom Barkin.

3. Hibbett earnings

Retailer Hibbett Sports (NASDAQ:HIBB) is expected to report earnings per share of $3 on revenue of $482.6 million.