Benzinga - by Zacks, Benzinga Contributor.

Roche (OTC: RHHBY) obtained a Breakthrough Therapy Designation for its investigational oral therapy inavolisib for treating adult breast cancer patients in the United States.

The FDA granted this designation to inavolisib in combination with Ibrance (palbociclib) and Faslodex (fulvestrant) to treat adult patients with PIK3CA-mutated, hormone receptor-positive, human epidermal growth factor receptor 2 (HER)-negative, locally advanced or metastatic breast cancer, following recurrence on or within 12 months of completing adjuvant endocrine treatment.

HR-positive breast cancer is the most prevalent type of breast cancer and roughly accounts for approximately 70% of cases.

The designation is based on phase III INAVO120 study results, which showed that the inavolisib-based regimen more than doubled progression-free survival compared with palbociclib and fulvestrant alone in the first-line setting. The study included 325 patients, who were randomly assigned to either the investigational or control treatment arm. Overall survival data were immature at this time, but a clear positive trend has been observed.

Breakthrough Therapy Designation accelerates the development and regulatory review of drugs that are intended to treat fatal disease conditions where preliminary clinical evidence has indicated they may demonstrate substantial improvement over existing therapies.

Data from the INAVO120 study is also being submitted to other global health authorities, including the European Medicines Agency.

Apart from INAVO120, inavolisib is currently being evaluated in two additional company-sponsored late-stage clinical studies in PIK3CA-mutated locally advanced or metastatic breast cancer in various combinations.

A phase III study, INAVO121, is evaluating inavolisib in combination with Faslodex versus Piqray (alpelisib) plus Faslodex in HR-positive/HER2-negative breast cancer post cyclin-dependent kinase 4/6 inhibitor and endocrine combination therapy

Another phase III study, INAVO122, is evaluating inavolisib combination with Perjeta (pertuzumab) plus Herceptin (trastuzumab) for subcutaneous injection versus Perjeta plus Herceptin for SC and optional physician's choice of endocrine therapy as a maintenance treatment in HER2-positive disease.

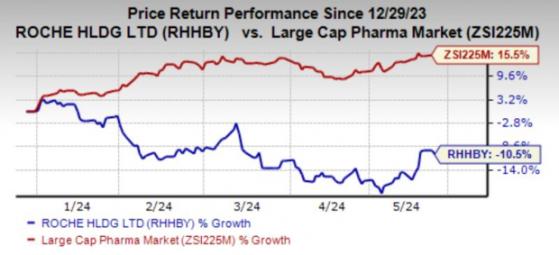

Year to date, Roche's shares have lost 10.5% against the industry's 15.5% growth.

Image Source: Zacks Investment Research

Roche has a dominant position in the breast cancer market. The HER2 franchise includes Herceptin, Perjeta and Kadcyla. While Herceptin is being affected by biosimilar competition, the increased patient demand for Perjeta for adjuvant early breast cancer therapy maintains momentum. Kadcyla is also performing well, driven by increased demand from patients with residual disease after surgery. The approval of the fixed-dose combination of Perjeta and Herceptin as Phesgo strengthened the portfolio. Phesgo is gaining traction and maintaining momentum for this franchise.

Approval of additional drugs for breast cancer will strengthen this franchise.

However, competition in this lucrative space is stiff which will limit market share gains.

Novartis (NYSE: NVS) Kisqali has put up a spectacular performance in recent times. Sales of Kisqali grew strongly in the first quarter (+54%) across all regions, based on increasing recognition of consistently reported overall survival in HR+/HER2- advanced breast cancer. Kisqali is now one of the top growth drivers of NVS.

The approval of Piqray for advanced or metastatic breast cancer further strengthened NVS' breast cancer portfolio.

Zacks Rank & Stocks to Consider Roche currently carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks from the healthcare industry are Ligand Pharmaceuticals (NASDAQ: LGND) and ANI Pharmaceuticals (NASDAQ: ANIP). Both stocks carry a Zacks Rank #2 (Buy).

In the past 30 days, the Zacks Consensus Estimate for Ligand's 2024 and 2025 earnings per share has remained constant at $4.56 and $5.27, respectively. Shares of LGND are up 22.9% year to date.

In the past 60 days, estimates for ANI Pharmaceuticals' 2024 EPS have improved from $4.43 to $4.44. Shares of ANIP have jumped 12.6% year to date. ANIP's earnings beat estimates in each of the trailing four quarters, delivering an earnings surprise of 53.90%, on average.

To read this article on Zacks.com click here.

Read the original article on Benzinga