Benzinga - by Shanthi Rexaline, Benzinga Editor.

Rivian Automotive, Inc. (NASDAQ:RIVN) CEO R.J. Scaringe recently discussed his relationship with billionaire and Amazon.com Inc (NASDAQ:AMZN) founder Jeff Bezos.

What Happened: Scaringe revealed that he and Bezos quickly developed a strong rapport upon their introduction to one another.

In an interview with GQ, Scaringe described Bezos as someone who resonates with entrepreneurs and individuals willing to embrace high-risk ventures.

Bezos and his team engaged in a detailed conversation with Scaringe prior to Amazon’s investment in Rivian. They aimed to understand his commitment to the business.

Bezos posed probing questions such as “Do we understand the chessboard?” and “Are we planning a two-move strategy or do we have a 25-move strategy?”

“It takes a lot of build-up. It's a complex, multi-dimensional 20-year chess game,” he added.

Why It’s Important: Rivian’s relationship with Amazon runs deep. Ahead of the electric vehicle startup’s Nov. 2021 initial public offering, Amazon disclosed in a filing that at the end of September 2021, it held equity investments, including preferred stock of Rivian, representing about 20% ownership interest. The holding had a carrying value of $3.8 billion at that time.

In September 2019, Rivian struck a deal with Amazon to produce 100,000 electric delivery vans. Rivian received revenue of $314 million from Amazon and its affiliates for the six months ended June 30, 2023.

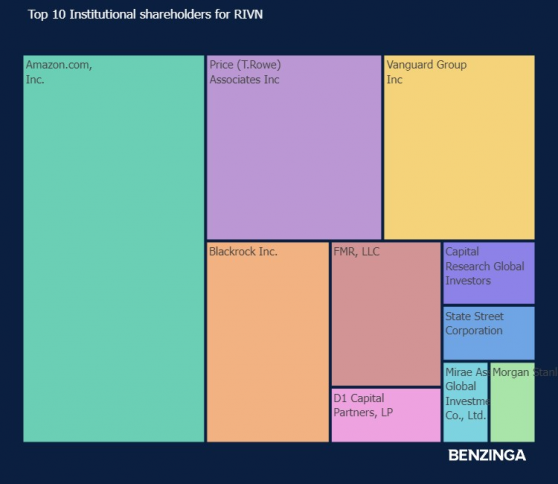

Amazon continues to be Rivian’s top investor with a 16.7% stake in the EV startup following some disposals.

Chart Courtesy of Benzinga

Rivian’s fundamental soundness has come into question in recent times notwithstanding its fairly good execution, with a recent Wall Street Journal highlighting the massive losses the company incurs per vehicle.

Despite the apprehensions, Rivian is the only U.S. EV startup that has earned some degree of credibility and is touted as a potent rival to market leader Tesla.

Rivian closed Thursday’s session down 0.21% to $19.33, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: Elon Musk’s ‘Puff-Yourself-Up’ Style Vs. R.J. Scaringe’s ‘Quiet’ Approach: Rivian CEO Says ‘We Let The Products Do A Lot Of The Speaking’

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga