By Ankit Ajmera and Joshua Franklin

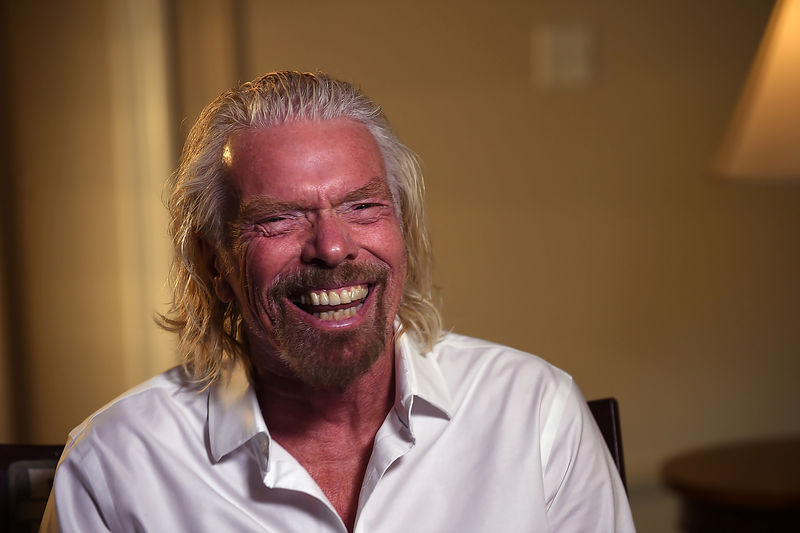

(Reuters) - British billionaire Richard Branson will take Virgin Galactic public by year-end, giving it the much-needed funds to take on Jeff Bezos' Blue Origin in the race to space.

The company will list its shares as part of a merger with Social Capital Hedosophia Holdings Corp, a special purpose acquisition company (SPAC), which will also take a 49% stake in Virgin Galactic for about $800 million (£642 million), a source who worked on the deal told Reuters.

The SPAC deal allows Virgin Galactic to go public sooner, compared with a traditional initial public offering, which the company might have considered in six to nine months following its first commercial flight, the source said.

They were working on this deal for the best part of nine months, according to the source.

Branson founded space ventures like Virgin Galactic and Virgin Orbit to cash in on burgeoning demand for space travel and launch services for a boom in the number of smaller satellites.

The traditional launch services market has been long dominated by industry stalwarts such as United Launch Alliance - a partnership between Boeing (NYSE:BA) Co and Lockheed Martin Corp (NYSE:LMT).

But since its early days, Branson's ambitious timeline for taking customers into space has suffered delays and setbacks.

In February, the company took a step closer to its goal of suborbital flights for space tourists when its rocket plane soared to the edge of space with a test passenger for the first time.

Rival Blue Origin has launched its New Shepard rocket to space, but its trips have not yet carried humans. SpaceX last year named Japanese billionaire Yusaku Maezawa as its first passenger on a voyage around the moon, tentatively scheduled for 2023.

Hundreds of people from 60 countries, including actor Leonardo DiCaprio and pop star Justin Bieber, have paid or put down deposits to fly on one of Virgin's suborbital flights. Some of Virgin Galactic's ticket holders have been waiting over 14 years for their trip.

A 90-minute flight, which allows passengers to experience a few minutes of weightlessness, costs about $250,000.

The cost is expected to come down "dramatically" over the next decade as space travel becomes more accessible to common people, Branson told CNBC on Tuesday.

"I think we can do it a lot quicker than aviation did it."

Virgin's current reservations represent about $80 million in total collected deposits and $120 million of potential revenue.

Social Capital Hedosophia's chief executive officer, Chamath Palihapitiya, who is investing $100 million as part of the deal, will become chairman of the combined company.

"By embarking on this new chapter, at this advanced point in Virgin Galactic's development, we can open space to more investors and in doing so, open space to thousands of new astronauts," Branson said in a statement.

With the acquisition, Social Capital is pulling off perhaps the highest profile SPAC deal to date. A SPAC uses proceeds from an IPO, together with borrowed funds, to acquire companies that are usually privately held. Investors in the SPAC IPO do not know in advance which company a SPAC will buy, although many outline in advance the sectors they want to be active in.

Credit Suisse (SIX:CSGN) advised Social Capital Hedosophia, while M Klein and Co, LionTree Advisors and Perella Weinberg Partners advised Virgin.