Benzinga - by Anusuya Lahiri, Benzinga Editor.

PDD Holdings (NASDAQ: PDD) stock is trading higher after Goldman Sachs analyst Ronald Keung upgraded the stock from Neutral to Buy and raised the price target from $145 to $184.

Following PDD’s significant beat, Keung lifted his near-term online marketing revenue growth and 2024-2026 group profit estimates by 25%- 43%, citing PDD’s sustained advertising revenue growth momentum in the first quarter and the faster turnaround of Temu unit economics on its business model shift.

The analyst noted that the market has now more than priced in the two critical concerns behind his earlier March 2024 downgrade.

Also Read: Alibaba Rival PDD Has Major Upside with New Market Openings and Rising Adoption: Analysts

The concerns included potentially slower domestic take rate expansion due to domestic competition and geopolitical risks that he saw with Temu’s US business.

As a result, Keung continued to value only Temu’s non-US business. Yet, he noted Temu’s business model shift in the U.S. market since the second quarter of 2024, with the comprehensive introduction of the semi-entrusted model, thus reducing Temu U.S. reliance on air shipments under de-minimis.

Accordingly, given the shares’ underperformance vs. peers year-to-date, Keung upgraded the stock’s rating to reflect its higher upside compared to the median of 18% upside within the China internet sector.

Keung said China eCommerce is emerging as one of the more undervalued sub-sectors within China’s internet, given a gradually stabilizing eCommerce market landscape, with adtech upgrades that can drive faster advertising revenue growth than GMV growth while generating strong FCF generation, and with their ‘going global’ option value not priced in at current share prices.

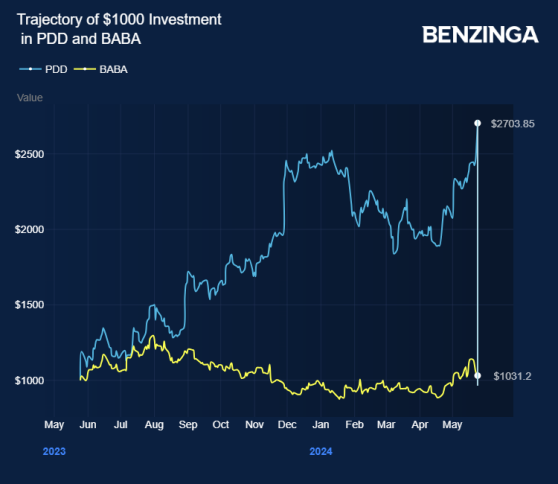

PDD stock gained 1665 in the last 12 months, while Alibaba Group Holding Limited (NYSE:BABA) lost 1.3%.

Price Action: PDD shares traded higher by 3.12% at $158.35 at the last check on Friday.

Photo via Shutterstock

Latest Ratings for PDD

| Jan 2022 | DBS Bank | Upgrades | Hold | Buy |

| Nov 2021 | Barclays | Initiates Coverage On | Equal-Weight | |

| Aug 2021 | B of A Securities | Maintains | Buy |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga