Despite the succession of all-time highs for US indexes, January closed as a month of mostly stable performance, with the S&P 500 raising 1.6% and the Dow Jones Industrial Average posting a steady 1.2% gain.

But in the face of slowing overall market gains, savvy investors were still able to notch above-average returns as stock-picking proved once again the go-to strategy amid heightened stock volatility brought by earnings season and the Fed's decision.

That's where our state-of-the-art AI stock-picking tool, ProPicks, came in handy. By selecting only companies with favorable growth potential and positive fundamentals, ProPicks once again provided its users with top market-beating picks.

In fact, our Dominate the Dow strategy comfortably doubled the S&P 500's returns in the month while maintaining a safe level of risk exposure.

Join now for under $9 a month for a limited time only and see all the picks from Dominate the Dow, as well as from our other six strategies!

*Readers of this article enjoy an extra 10% discount on the yearly and by-yearly plans with the coupon codes PROPICKS2024 (yearly) and PROPICKS20242 (by-yearly).

But wait... there's more.

Our AI not only creates great strategies but also chooses standalone market winners. In fact, had you joined ProPicks at the start of 2024, you would have scored a whopping 86% gain on Super Micro Computer (NASDAQ:SMCI) alone.

Pushed by an impressive Q4 earnings performance, the San Jose, California-based IT solutions provider not only topped analysts' estimates for profitability and sales growth but also provided clear guidance of further growth for the year ahead.

But how would you know enough to buy it ahead of time?

Well, our predictive AI tool, ProPicks, did. By compiling a multitude of factors, including the long-term history of the stock market and state-of-the-art fundamental analysis, ProPicks was able to include SMCI in its Tech Titans strategy at the beginning of January.

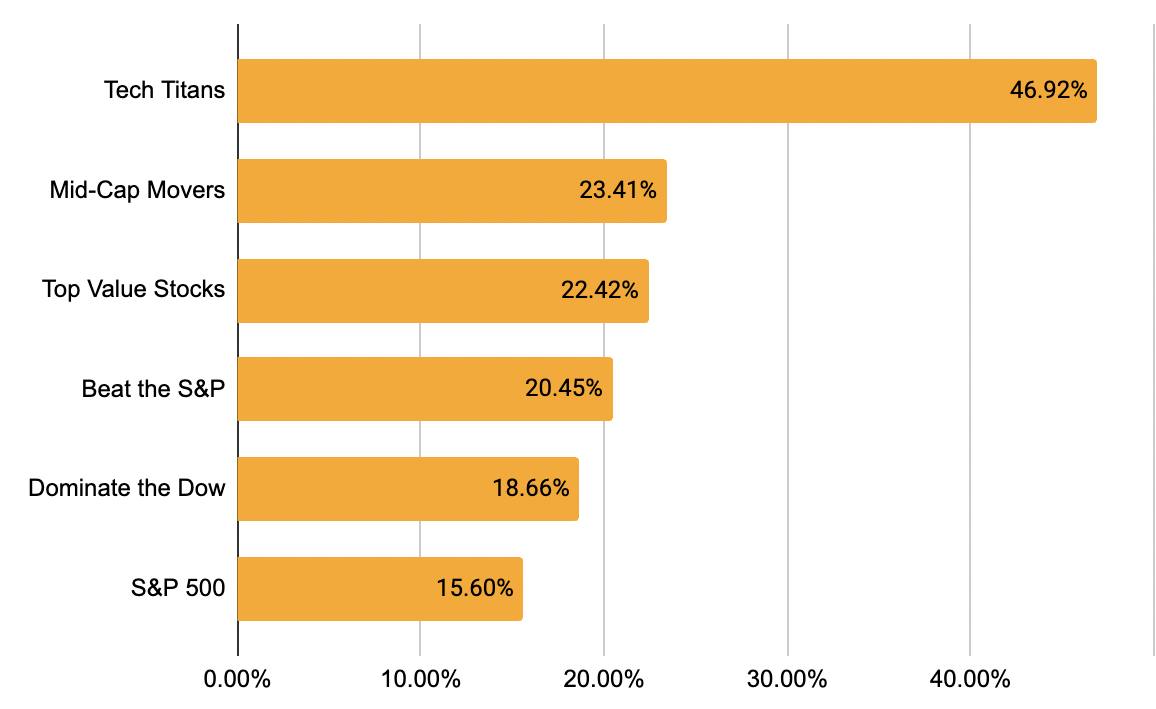

With a list of 15 marketing-beating companies such as SMCI, Tech Titans was able to outperform the market even as it notched a series of all-time highs in the last quarter. As a matter of fact, the strategy posted a whopping 49.6% gain since the beginning of November, while the S&P 500 gained 15.6%.

See how our other monthly rebalanced strategies fared during this period:

- Beat the S&P 500: + 20.4%

- Dominate the Dow: + 18.6%

- Top Value Stocks: 22.4%

- Mid-Cap Movers: 23.4%

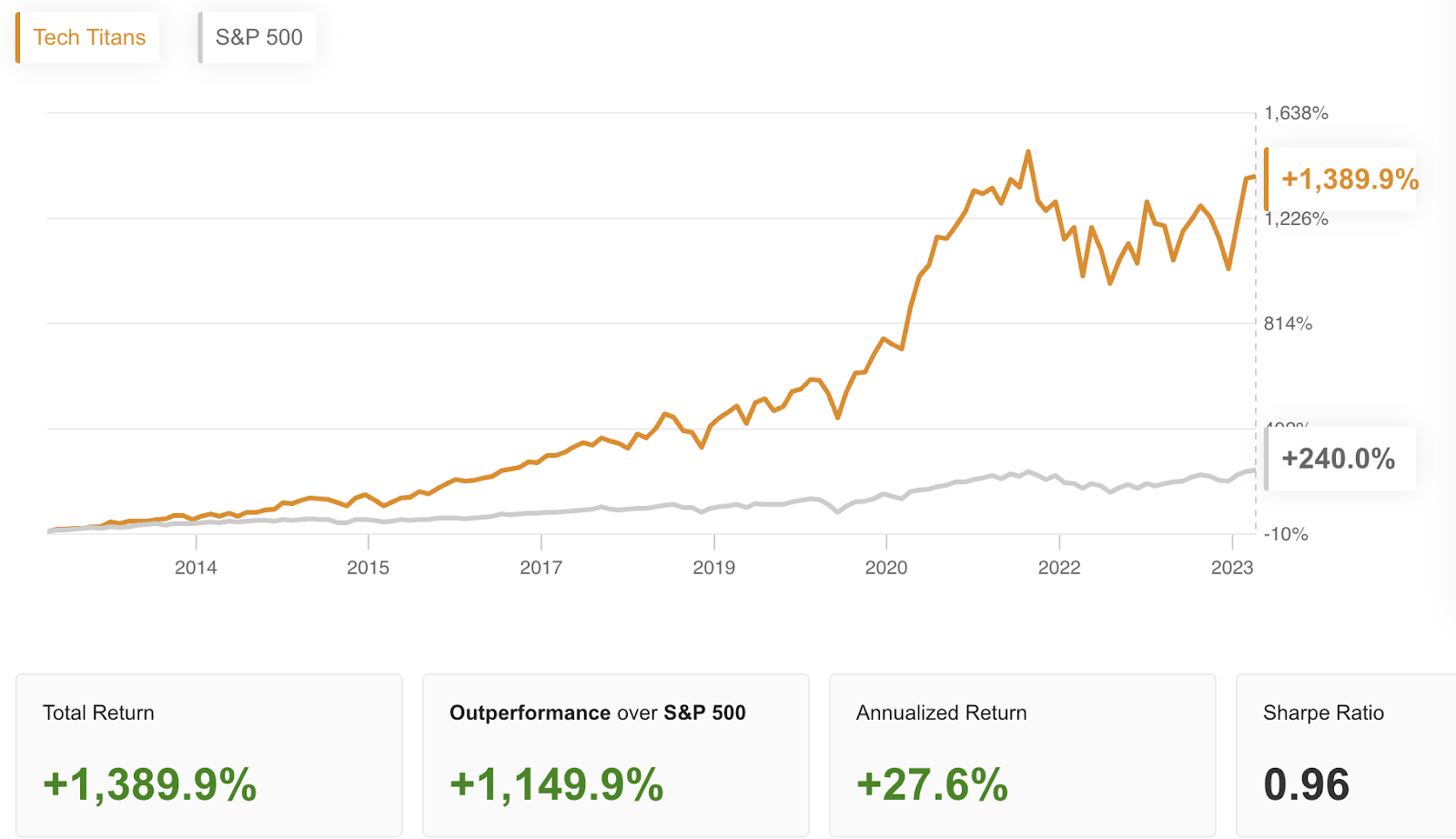

This has pushed Tech Titans' 10-year outperformance against the benchmark to an incredible 1,149%.

And SMCI is just one stock from a robust selection of 70+ companies distributed across our six market-beating strategies. The true key to our outperformance is the resilience of our carefully curated list of winners—not solely reliant on individual picks.

In fact, during the month, several other ProPicks beat analysts' estimates on their earnings reports. See three of them below:

Want to see more stock picks like these? Subscribe now for up to 50% off as part of our New Year's sale for a limited time only!

*Readers of this article enjoy an extra 10% discount on the yearly and by-yearly plans with the coupon codes PROPICKS2024 (yearly) and PROPICKS20242 (by-yearly).

And how does ProPicks keep beating the market?

Simple. By constantly adapting to the ever-changing market conditions through monthly rebalancing, ProPicks gives its users only stocks ready to take off - rather than companies already past their prime.

Differently from everything else that's out there, our models are forward-looking.

The stock picks are then divided into six market-beating strategies designed to fit the individual investor's risk tolerance.

For the month of February, amid heightened earnings season volatility, our AI has run one of its most significant updates on record, with more than 30 new stocks added to the six different strategies and 30 others labeled a sell.

InvestingPro users can see the full list of what to buy and what to sell here.