Investing.com - Pundit commentary continues to cascade on Nvidia (NASDAQ:NVDA) after it became the world's largest company by market capitalisation. "This achievement is driven by an unprecedented rally, as Artificial Intelligence has gone from being a media phenomenon to becoming a reality," says Ben Laidler, global markets strategist at eToro.

- If you're investing in Nvidia, try InvestingPro and win even further on your decisions, NOW AT AN EXCLUSIVE DISCOUNT! Sign up HERE for just over £5 a month (16p a day) and get almost 50% off your 1 year plan! HALF PRICE!

"Nvidia is now the largest company by market capitalisation in the index S&P 500 and in the world. Sales rose 260% last quarter compared to a year earlier, and its profits have increased tenfold since the rally began in earnest at the end of 2022. The company's advantage as a pioneer in GPU chips has provided strong drivers for both volume and pricing power," notes Laidler.

"The S&P 500 has only seen 12 companies hold the title of largest market capitalisation in the last century. Companies like General Electric (NYSE:GE), General Motors (NYSE:GM), Cisco (NASDAQ:CSCO), Philip Morris (NYSE:PM), DuPont (NYSE:DD) and AT&T remind us that success does not last forever. Many of the best companies fade over time as competition catches up or as they are affected by the next big technology," he says.

AI, The New Investment Universe

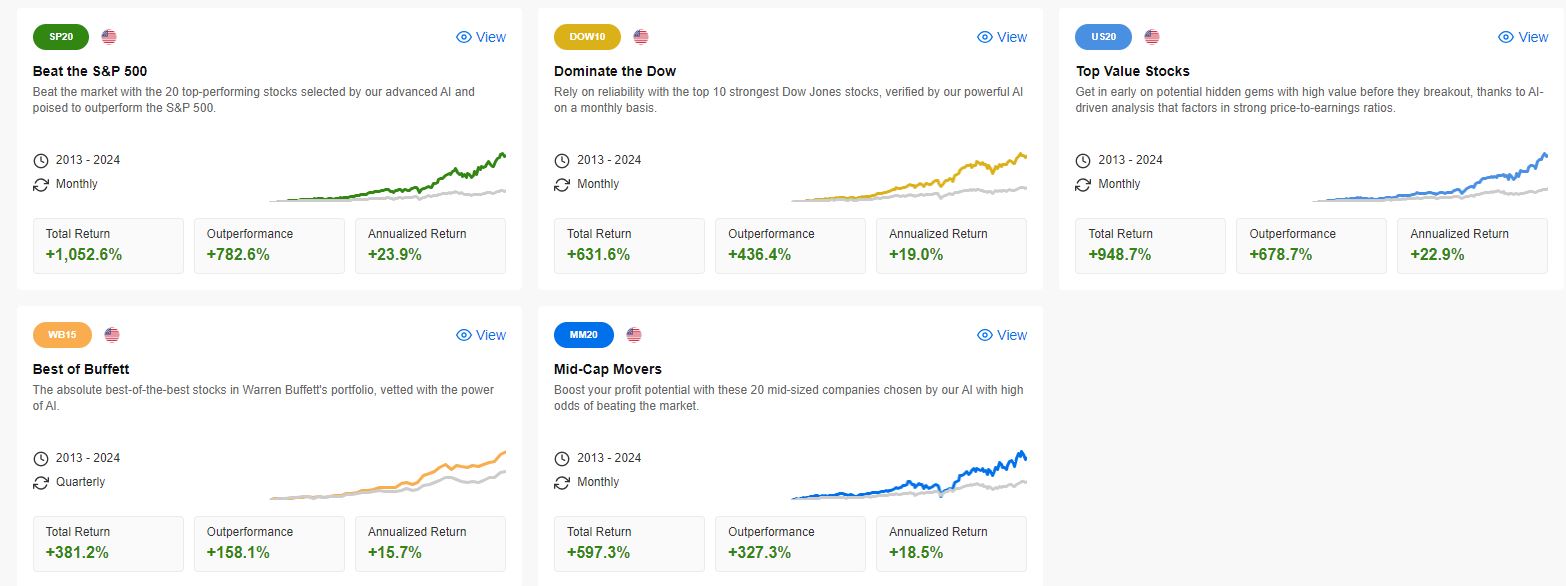

In this scenario, the professional tool InvestingPro offers investors ProPicks strategies, which use a combination of Artificial Intelligence (AI) and expert human analysis to highlight stocks with the potential to outperform market benchmarks.

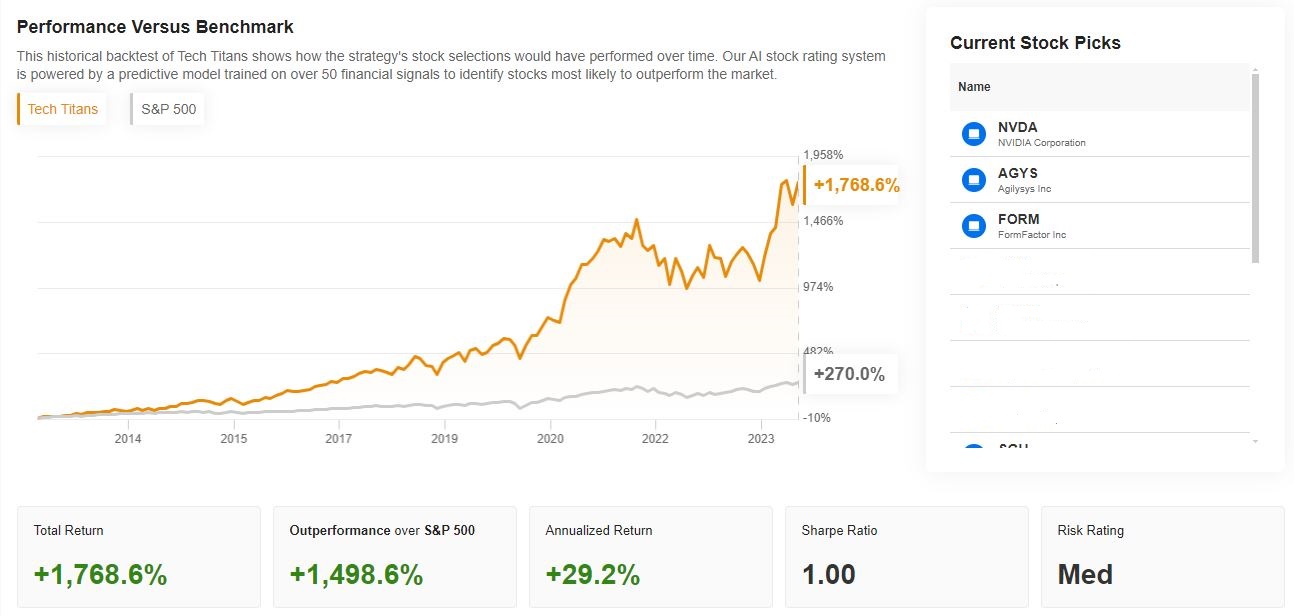

Investing.com's proprietary AI model analyses historical financial data, with the intention of categorising and rating different stocks and their historical performance.

This system learns to identify different financial parameters and their correlation to overall stock performance over the years and assign relative weights to the different financial parameters.

The top-rated stocks are placed into different groups based on the criteria that Investing.com considers most relevant and useful for our users, such as the strongest stocks in the S&P 500, top-rated technology stocks, etc.

Source: InvestingPro

Based on the results of the analysis, the AI model ranks each of the stocks by assigning them one of the following labels: Underperform, Neutral Performer or Outperformer and, in doing so, attempts to identify stocks that may have historically outperformed the market benchmarks over certain time periods.

Best Historical Data

The historical data set includes more than 25 years of financial data and more than 50 financial metrics for thousands of companies in a variety of industries. This extensive data set is necessary to increase the accuracy of the weighting assigned to each financial metric, which contributes to a more rigorous analysis of stock performance. This also serves to mitigate any bias that may occur, as explained below.

Once the AI model has assigned a rating to historical stocks, a number of constraints and selection criteria can be applied to the data, e.g. trading frequency, sector and industry, trading region, whether they are included in any stock index, market capitalisation or liquidity.

In addition, through this criteria process, the system eliminates stocks that might be irrelevant to the average investor, such as low-cost stocks.

Each of these groups constitutes a different ProPicks strategy that will be available to you through Investing.com. This step serves to make the ProPicks strategies robust, relevant and pragmatically applicable in real-world trading contexts.

Want to try ProPicks strategies, don't hesitate, INVESTINGPRO IS HALF PRICE! Take the opportunity to get the InvestingPro annual plan for just over £5 per month HERE & NOW. Use the code INVESTINGPRO1 and get almost 50% off your 1-year subscription (and you get more out of your investments too). With it, you get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So fundamental analysis professionals can drill down into all the details themselves.

- And many other services, not to mention those we plan to add soon.

Act fast and join the investment revolution - get your OFFER HERE!