Benzinga - by Shanthi Rexaline, Benzinga Editor.

Nimble Chinese electric vehicle startups have injected competition into the EV market, challenging global leader Tesla, Inc. (NASDAQ:TSLA) on their home turf. Prominent U.S.-listed Chinese startups, including Nio, Inc. (NYSE:NIO) and Li Auto, Inc. (NASDAQ:LI), have not only survived the competition but have also demonstrated consistent delivery success.

Let’s compare these two companies across various metrics and examine their stock performance.

NIO vs. LI: A Comparative Analysis

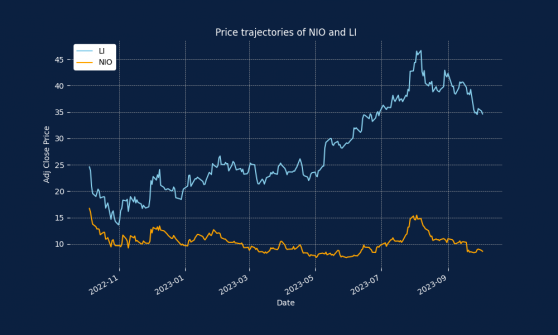

Looking at their performance over the past year, Nio and Li Auto initially moved in sync until February when their paths diverged.

In the past year, Li Auto has outperformed Nio, achieving approximately a 41% gain compared to Nio’s nearly 49% decline.

Figure: Comparison of market price trajectory of NIO and LI over a period of one year.

Chart Courtesy Benzinga

The divergence is not without reasons. Li Auto, which prefers to keep a low profile, has been consistent with its sales performance. At the end of September, cumulative deliveries so far in 2023 reached 244,225 units. This marked an increase from the 211,015 units it delivered in the same period last year.

Nio’s year-to-date deliveries totaled 109,993 units, up from 82,434 units. Shanghai-based Nio sells high-end EVs, which potentially explains the relatively softer volumes amid an uncertain macroeconomic backdrop. Nio’s product lineup includes: Given Nio’s EVs carry higher ASPs, it could outdo Li Auto in terms of value.

- ES8, a six-seater flagship SUV

- ES7 (EL7 in Europe), a mid-large five-seater SUV

- ES6, a five-seater SUV

- EC7, a five-seater flagship coupe SUV

- EC6, a five-seater coupe SUV

- ET7, flagship sedan

- ET5, a mid-size sedan

- ET5T, a smart electric tourer.

Li Auto’s current model lineup includes:

- Li L9, a six-seat flagship SUV

- Li L8, a six-seat premium SUV

- Li L7, a five-seat flagship SUV

NIO Or LI: Which Offers Better Returns?

Figure: Comparison of scaled returns delivered by NIO and LI over a period of one year.

Chart Courtesy of Benzinga

A $100 hypothetical investment in Li Auto would have increased to $140.81, while if an investor had chosen to invest the same $100 in Nio, his capital would have dwindled to $51.46.

Nio’s stock came under pressure amid the lukewarm deliveries this year and the aggressive price war in the industry, led by Tesla. To make matters worse, capital raise plans and rumors of capital raises also exerted downward pressure on the stock.

Do NIO And LI Often Move Together? Linear regression analysis, which gives the correlation between two variables — in this case, the stock performances of Nio and Li Auto, throws up a coefficient of determination of 0.551. The number suggests a loose correlation between the stocks.

Figure: Linear regression analysis of NIO and LI to see if there is a correlation in how the stocks move.

Chart Courtesy of Benzinga

Conclusion

Given down the beaten-down nature of the Nio stock, it offers a better risk-reward, provided fundamentals take a turn for the better. The average analysts’ price target for Nio, according to data compiled by TipRanks, is $14.24, suggesting over 65% upside potential. Li Auto’s upside potential is a more modest 53%, going by the average analysts’ price target of $52.91.The price war in China poses a risk to volume growth but Nio has been expanding vigorously into Europe. This could be a long-term positive for the stock. For Nio, the task is cut out. The company needs to capture the increasing mindshare of Chinese consumers to keep its volume growth ticking. There have been rumors of Nio striking a partnership with Mercedes-Benz Group AG (OTC:MBGAF), although the company has refuted it as unfounded speculation.

Li Auto, meanwhile, with its focused approach and focused product lineup, could push ahead as long as the Chinese economy does not collapse, which is a very unlikely scenario with the Chinese government always standing ready to support.

In premarket trading on Wednesday, Nio traded down 1.16% at $8.61 and Li Auto slipped 1.85% to $34, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: Li Auto August Deliveries Skyrocket 664% On Strength In Li L Series Models

Images via Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga