By Ben Hirschler

LONDON (Reuters) - Novozymes, already grappling with the consequences of low oil and crop prices, is watching anxiously to see what Bayer's purchase of Monsanto (NYSE:MON) will mean for the Danish group's ties with its key agricultural partner.

Chief Executive Peder Holk Nielsen said in an interview that a merged Bayer-Monsanto could extend the market for the company's smart microbial crop-boosting products, known as inoculants, but added the union also brings uncertainties.

"Of course, in the short-term we can all worry about the distraction that a $66 billion (50.79 billion pounds) acquisition can bring and it is one of the things we have in our risk matrix," he told Reuters on a visit to London.

"But we think the results we have created together with Monsanto are quite significant and if the deal is concluded I think it would make a lot of sense to bring that into the new company."

Nielsen has not yet held any discussions with Bayer (DE:BAYGN) about the future of its strategic tie-up with Monsanto, the BioAg Alliance, but said he expected to do so before the takeover is completed. Novozymes is relying on the alliance, which covers the sale of inoculants, to drive growth and restore sales.

The agreed purchase of U.S. seeds company Monsanto by Germany's Bayer is the signature deal in a wave of agribusiness takeovers in recent years. Monsanto shares are still trading well below Bayer's offer price, however, reflecting worries that the merger could stall on antitrust issues.

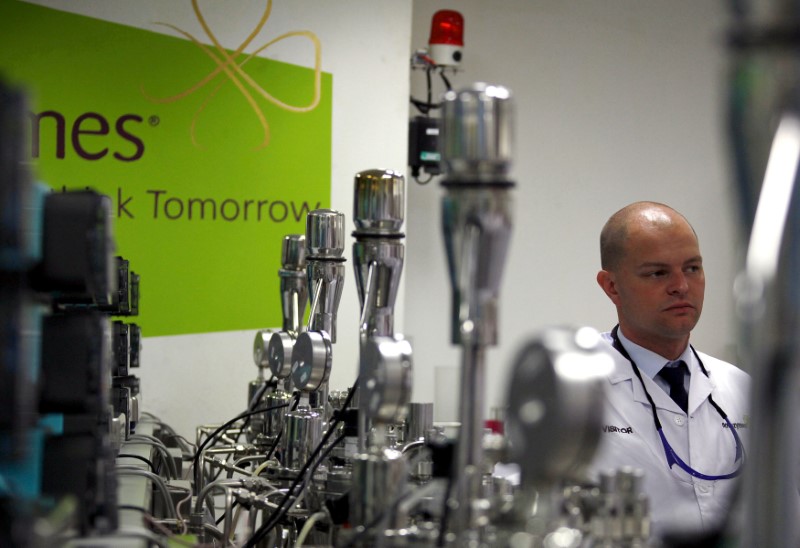

The takeover comes at a challenging time for Novozymes, which was spun off from drugmaker Novo Nordisk (CO:NOVOb) in 2000.

Nielsen disappointed investors last month by lowering the forecast for sales growth this year to only 2-4 percent and warning it would take time to return to more typical growth levels of 6-7 percent.

Novozymes had been doing well until recently by selling enzymes that replace chemicals in detergents and also help in the production of bioethanol and animal feed.

But it has been hit by a fall in oil prices, which has slowed the development of so-called advanced biofuels made from non-edible biomass. Weak agricultural commodity prices have also reduced the incentive for farmers to invest in its inoculants.

The U.S. Department of Agriculture predicted last month that farm incomes could reach their lowest point this year since 2009, hit by low corn and soy prices.

"Farmers in the U.S. are clearly being careful with their discretionary spending," Nielsen said.

The BioAg Alliance currently has around 65 million acres sown with seed using its products, mainly soybeans, but it is hoping to increase that to between 250 million and 500 million acres with the rollout of a corn inoculant in time for the 2017 season.

Analysts such as those at Berenberg Bank, which this week initiated coverage of Novozymes with a "sell" rating, fear that a weak agricultural economy will weigh on adoption of inoculants and hit selling prices, adding to the company's hard times.