Benzinga - by Piero Cingari, Benzinga Staff Writer.

Mexican-related financial assets suffered on Monday their worst day since the world entered into lockdown in March 2020, following the landslide victory of newly elected President Claudia Sheinbaum.

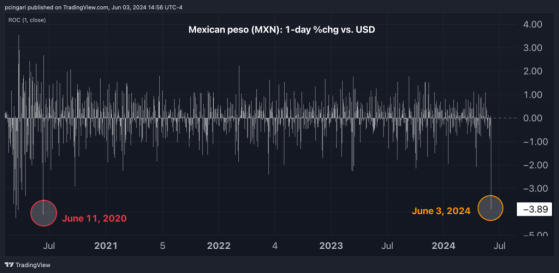

What Happened: The Mexican peso plummeted by 3.9% to 17.68 per dollar, recording its worst day in four years.

It’s heading toward closing the session at its weakest level since November 2023.

U.S.-listed Mexican equity exchange-traded funds (ETFs) endured double-digit losses. The iShares MSCI Mexico ETF (NYSE:EWW) tumbled 10.8%, marking its worst day since Monday, Mar. 16, 2020, when global investors abandoned emerging-market equities for safe-haven assets amid fears of a Covid-related global recession.

Leveraged ETFs on Mexican stocks experienced significant declines, as well. The Direxion Daily MSCI Mexico Bull 3X Shares (NYSE:MEXX) tanked by 31%. It’s eyeing its lowest close since late October 2023.

The election results, which saw President Claudia Sheinbaum win approximately 60% of the vote. That’s the highest in Mexico’s democratic history, triggering the violent volatility in the peso and Mexican ETFs.

Chart: Mexican Peso Notched Worst Day In Four Years Following Sheinbaum’s Election Victory

Chart: US-Listed Mexican Equity ETF Suffered Heaviest 1-Day Losses Since March 2020

Why It Matters: Economists at Goldman Sachs suggest that a Sheinbaum administration may not severely compromise macroeconomic stability. Nor will Sheinbaum limit the central bank’s independence, or significantly weaken the fiscal stance.

However, a Morena-led Congress may be hesitant to approve necessary reforms or adopt measures required to attract investment, leverage nearshoring opportunities, and maintain Mexico on a “fiscally disciplined path,” the firm noted.

And Sheinbaum’s parliamentary coalition comprises of Morena, the Labor Party, and the Ecological Green Party of Mexico. Sheinbaum could potentially secure a “supermajority” of two-thirds of the seats in parliament.

According to Mexican electoral sources, the Morena-PT-PVEM coalition is projected to win 346-380 seats out of 500 in the Lower House.

Recent history in Latin America has seen left-wing parties prioritize equality and social justice.

“These results give Ms. Sheinbaum a very strong mandate and strengthen Morena's presence in the central and local political power structures,” Goldman Sachs noted.

In February, the AMLO administration submitted a large package of bills to Congress. Many bills involve constitutional revisions aimed at reshaping key institutions such as the Electoral Institute and the Supreme Court. They also weaken or eliminate autonomous agencies.

These proposals also included populist and costly pension and minimum wage measures.

“Some bills are perceived as leading to institutional erosion and weakening the current checks and balances; and several are not viewed as market friendly,” the U.S. investment bank wrote.

The main challenge for Sheinbaum will be to “bolster market sentiment and provide a predictable and investment-friendly policy and regulatory framework.” Disciplined budget management, progress on public security, and effective management of state-owned enterprises are also crucial for preserving market sentiment and sovereign debt ratings.

Read Also: Mexico’s First Female President Supports Cannabis: Will Claudia Sheinbaum Legalize Marijuana?

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga