Benzinga - by The Arora Report, Benzinga Contributor.

To gain an edge, this is what you need to know today.

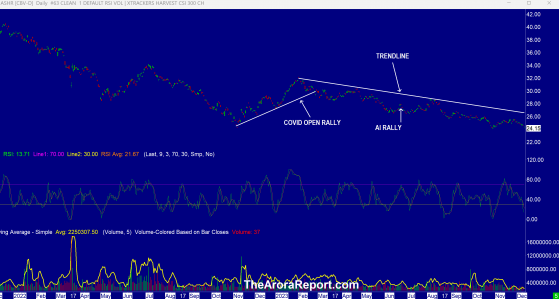

China Credit Outlook Please click here for a chart of Xtrackers Hvst CSI 300 China A-Shs ETF (ARCA: ASHR).

Note the following:

- The chart shows that at a time when the U.S. stock market has been rising, the Chinese stock market has been declining.

- RSI on the chart shows that the Chinese market is oversold.

- Many strategists are making calls to buy China as it is an opportunity to buy low. ZYX Emerging has covered China for 16 years continuously. The Arora Report ratings on China are currently suspended, but an opportunity to buy China may be near. Please stay tuned to the ZYX Emerging Real Time Feed by The Arora Report.

- Moody’s is cutting China’s credit outlook to negative. This indicates that the risk of default by China has increased. Moody’s call has been triggered by the property sector crisis and local government debt. The largest property developer in China, Evergrande, took more than $300B, mostly from individuals, to buy properties but never built them. Evergrande is close to liquidation.

- The magnificent seven stocks are seeing slight profit taking. The magnificent seven stocks are Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA). What happens to the magnificent seven stocks is very important for the following reasons:

- S&P 500 is up 19% this year. Excluding the magnificent seven stocks, it is up only 9%.

- The magnificent seven stocks are very expensive. They trade at an average forward PE of 32.

- 44% of stocks in S&P 500 have negative returns for the year.

- Important economic data is ahead. Most important are the following;

- JOLTS job report will be released at 10am ET.

- ISM Services PMI will be released at 10am ET.

- Of note is earnings from J M Smucker Co (NYSE: SJM), the producer of JIF peanut butter and Foldgers coffee. Revenues rose 7% year-over-year, including a 4% increase in volume and 3% increase in price. This indicates that consumers are still willing to pay higher prices.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

In the early trade, money flows are negative in Amazon (AMZN), Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOG), Meta (META), and Tesla (TSLA).

In the early trade, money flows are negative in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is