Benzinga - by Shanthi Rexaline, Benzinga Editor.

Luxury electric vehicle manufacturer Lucid Group, Inc. (NASDAQ:LCID) has yet to release its third-quarter deliveries report, while competitors Tesla, Inc. (NASDAQ:TSLA) and Rivian Automotive, Inc. (NASDAQ:RIVN) have already disclosed their delivery numbers.

What Happened: Lucid typically reports its delivery numbers around the 12th or 13th of the month following the end of the quarter. The lack of updates from the company has led to speculation.

In jest, a Tesla influencer using the handle @WholeMarsBlog suggested, “Lucid deliveries were so good they didn't want to announce them.”

Lucid has faced teething problems since it started producing its luxury EVs, called Air, in late September 2021, with deliveries beginning on Oct. 30, 2021. The company has encountered execution issues, particularly related to supply chain disruptions in the early days following the launch, exacerbated by the COVID-19 pandemic.

Demand for Lucid’s higher-priced EVs has been lukewarm due to economic uncertainties following the Federal Reserve’s rate-tightening, which began in March 2022, and the aggressive price cuts initiated by Tesla in 2023, affecting the entire EV industry.

Lucid’s cheapest EV sedan, the Air Pure, starts at $77,400, making it challenging to increase sales volume. In the second quarter, the company produced 2,173 EVs, down from 2,314 in the first quarter. Third-quarter deliveries amounted to 1,404 units, significantly below the 2,000-unit forecasts of most analysts. In the first half, the company produced 4,487 units and delivered 2,810 units.

In February, Lucid aimed to produce 10,000-14,000 units in 2023, but it had to revise its guidance to over 10,000 units in May due to prevailing economic conditions and Tesla’s aggressive discounting and price cuts.

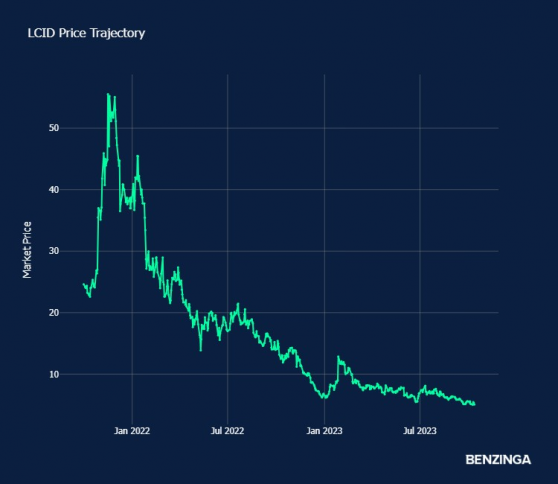

Lucid went public through a SPAC deal in late July 2021, but the company’s shares have steadily declined, currently trading near their all-time lows.

Chart Courtesy of Benzinga

Even as Lucid investors look for cheer from the company ahead of the weekend, the odds of an outperformance remain remote.

The solace, however, is the financial backing the company has from its cash-rich Saudi promoters.

In premarket trading on Friday, Lucid stock rose 0.39% to $5.09, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next: From Desert Sands To Electric Dreams: Lucid Group’s Groundbreaking Plant Powers Up In Saudi Arabia

Photo via Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga