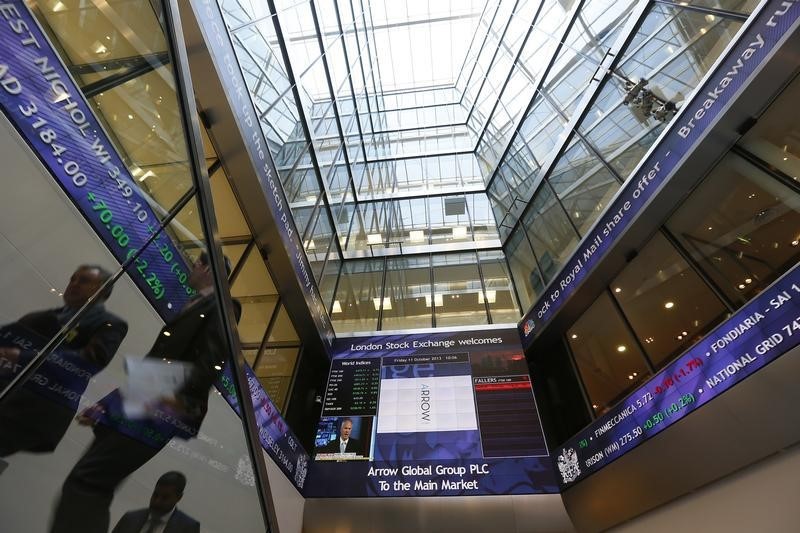

(Reuters) - London Stock Exchange Group Plc (LSEG) (L:LSE) posted a rise in its third-quarter revenue from continuing operations, aided primarily by growth at its information services division.

LSEG said its fourth quarter had started well and there was an encouraging pipeline of companies seeking to join the markets in Italy and the UK.

Worldpay Group's (L:WPG) initial public offering last week, the largest on the London Stock Exchange this year, and the expected listing of Poste Italiane - which will be the largest in Europe this year - are likely to boost the company's results.

LSEG, which owns Borsa Italiana, MillenniumIT and the London Stock Exchange, said revenue from continuing operations rose 12 percent to 326.4 million pounds in the quarter ended Sept. 30.

Revenue from information services rose 44 percent to 133.7 million pounds, boosted by growth at its FTSE and Russell index businesses.

Technology services revenue rose 20 percent to 19.8 million pounds.

Weaker primary markets and a fall in fixed income trading offset growth in cash equities trading, hurting LSEG's capital markets division.

The unit makes money from fees paid by companies listing on its markets and from trading of stocks and bonds.

Revenue at LCH.Clearnet, the company's clearing house, fell 8 percent to 75.8 million pounds.

LSEG said earlier this month that it would sell Frank Russell Company's asset management business to U.S. private equity firm TA Associates for gross proceeds of about $1.15 billion.

Shares in the company rose about 1 pct in early trading on the London Stock Exchange.