Benzinga - by Anusuya Lahiri, Benzinga Editor.

Trump Media & Technology Group (NASDAQ:DJT), the owner of Truth Social, has seen its valuation soar to a surprising $6 billion, even after a recent decline in its share price.

This figure has drawn incredulity from industry experts, given the company’s modest revenue and user base compared to major social media platforms.

Microsoft Corp’s (NASDAQ:MSFT) LinkedIn co-founder and venture capitalist Reid Hoffman expressed his disbelief at the valuation, CNN reports.

In 2023, Trump Media generated only $4.1 million in revenue, resulting in a price-to-sales ratio of over 1,400.

In contrast, social media giant Meta Platforms Inc (NASDAQ:META) has a price-to-sales ratio of just nine. Hoffman suggested a more appropriate valuation for Trump Media would be around $40 million.

The sharp decline in Trump Media’s share price began on May 30, following Donald Trump’s conviction on 34 felony counts.

University of Florida finance professor Jay Ritter and media mogul Barry Diller have both criticized the stock’s valuation, with Diller describing it as a “scam.”

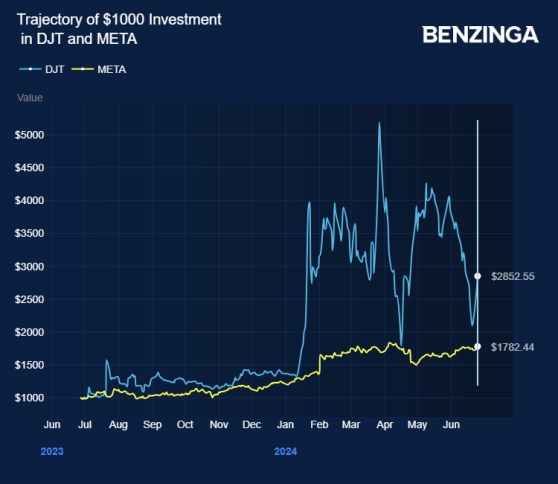

TMTG stock gained 186% in the last 12 months.

Should I Sell My DJT Stock?

Whether to sell or hold a stock largely depends on an investor's strategy and risk tolerance. Swing traders may sell an outperforming stock to lock in a capital gain, while long-term investors might ride out the turbulence in anticipation of further share price growth.Similarly, traders willing to minimize losses may sell a stock that falls a certain percentage, while long-term investors may see this as an opportunity to buy more shares at a discounted price.

Shares of Trump Media & Technology have gained 187.28% year to date. This compares to the average annual return of 54.04%, meaning the stock has outperformed its historical averages. Investors can compare a stock's movement to its historical performance to gauge whether this is a normal movement or a potential trading opportunity.

Investors may also consider market dynamics. The Relative Strength Index can be used to indicate whether a stock is overbought or oversold. Trump Media & Technology stock currently has an RSI of 53.06, indicating neutral conditions.

For analysis tools, charting data and access to exclusive stock news, check out Benzinga PRO. Try it for free.

Price Action: DJT shares were trading lower by 3.13% to $35.22 premarket at the last check on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga