By Sam Boughedda

Investing.com – Stocks continued their slide on Thursday even as oil prices dropped after President Joe Biden announced the release of 180 million barrels of oil from the Strategic Petroleum Reserve.

Biden is battling prices of gasoline at the pump, knowing American voters are feeing the pinch of rising prices for fuel and household goods.

On Friday, the government releases the much-anticipated jobs report for March, which should show signs of an improvement in the labor market even as core inflation released on Thursday showed prices rose across the economy.

Even with lower oil prices, there’s no guarantee gasoline prices will come down at the pump in any meaningful way. OPEC and its allies have decided to stick with their gradual production goals at least through May.

Still, investors may be happy to put the first quarter in the rear view mirror. Stocks notched the worst quarter since 2020, as tech and other big companies dropped on rising inflation. Russia’s ongoing war on Ukraine added a dose of uncertainty.

Here are three things that could affect markets tomorrow:

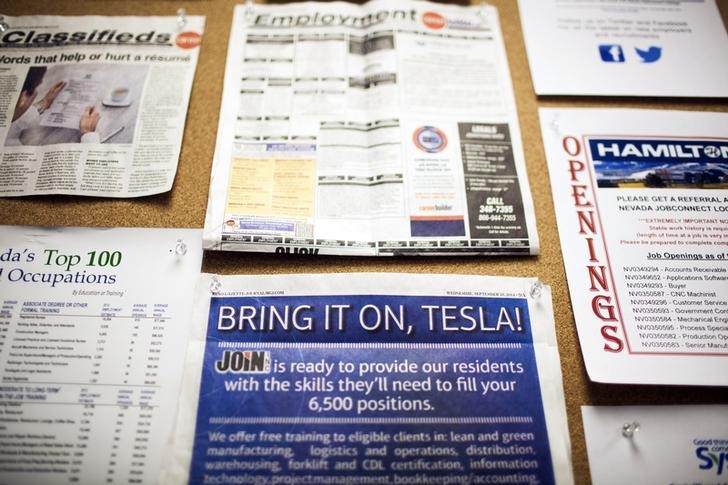

1. Jobs, jobs jobs

It is the start of April tomorrow, and nonfarm payrolls for March are to be released at 8:30 AM EST. Analysts are expecting a figure of 490,000, below the previous 654,000, but revisions will also be in focus.

2. Unemployment rate

Alongside NFP is the U.S. unemployment rate for March, which is forecast to come in at 3.7%, slightly below the 3.8% reported in February, according to analysts tracked by Investing.com.

3. Producer index

Meanwhile, consensus estimates for ISM manufacturing PMI see a reading of 59, above the previous number of 58.6. ISM manufacturing data is set to be released at 10 AM EST.