Benzinga - by Zacks, Benzinga Contributor.

Jacobs Solutions, Inc. (NYSE: J) is all set to provide professional engineering services to Singapore's National Water Agency — PUB — for the development of the new Kranji Water Reclamation Plant ("WRP").

The scope of the work includes engineering design, construction supervision and commissioning for the plant, which will likely be operational by 2035. Moreover, Jacobs will assist with the compliance efforts to develop the plant in an environmentally sustainable manner.

The plant will also deploy smart automation and controls to achieve operational efficiencies and leverage advanced treatment technologies, potentially co-locating with Singapore's National Environment Agency's waste management facility to harness synergies for long-term operation.

The Kranji WRP will cater to the projected increase in used water collection and treatment with major residential and industrial developments in northern Singapore. It will provide an initial treatment capacity of 120 million imperial gallons of used water per day (mgd) and will include a fully integrated 50 mgd NEWater Factory.

Solid Project Execution to Drive Growth Jacobs' ability to execute projects efficiently has played a pivotal role in driving the company's performance in recent quarters. The continuous success in securing new contracts stands as evidence of this proficiency.

The solid project execution efforts are supported by its ongoing backlog growth. At the fiscal second-quarter end, the company reported a backlog of $29.4 billion, up 2% year over year. This reflects persistent solid demand for Jacobs' consulting services. People & Places Solutions' backlog was $17.93 billion in the fiscal second quarter compared with $17.56 billion in the year-ago period. The backlog at the Critical Mission Solutions segment was $8.45 billion in the fiscal second quarter, up from $8.14 billion a year ago.

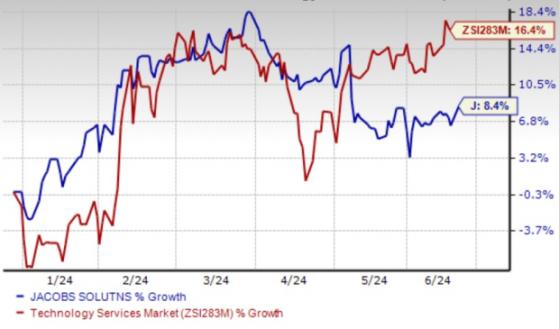

Image Source: Zacks Investment Research

Shares of the company have gained 8.4% so far this year compared with the Zacks Technology Services industry's 16.4% growth. Although J's shares have underperformed the industry, its earnings per share estimates for fiscal 2024 suggest 10.8% year-over-year growth.

Zacks Rank & Stocks to Consider Currently, Jacobs carries a Zacks Rank #4 (Sell).

Here are some better-ranked stocks in the same space:

AppLovin Corporation (NASDAQ: APP) currently sports a Zacks Rank of 1 (Strong Buy).

APP delivered a trailing four-quarter earnings surprise of 60.9%, on average. The Zacks Consensus Estimate for APP's 2024 sales and EPS indicates growth of 31.7% and 202%, respectively, from the prior-year levels.

Duolingo, Inc. (NASDAQ: DUOL) currently sports a Zacks Rank of 1. DUOL delivered a trailing four-quarter earnings surprise of 115.2%, on average.

The Zacks Consensus Estimate for DUOL's 2024 sales and EPS indicates growth of 37.8% and 397.1%, respectively, from the prior-year levels.

SPX Technologies, Inc. (NYSE: SPXC) presently flaunts a Zacks Rank of 1. SPXC has a trailing four-quarter earnings surprise of 13.9%, on average.

The Zacks Consensus Estimate for SPXC's 2024 sales and EPS indicates an increase of 14.7% and 24.4%, respectively, from the year-ago period's reported levels.

To read this article on Zacks.com click here.

Read the original article on Benzinga