Benzinga - by Shanthi Rexaline, Benzinga Editor.

Ark Investment Management, led by star investor Cathie Wood, is facing a harsh reality in 2024. While the broader market is hitting record highs, Ark’s actively managed funds are lagging far behind, raising concerns about their future viability. One investment advisor has sounded a stark warning, suggesting Ark’s funds could even go under.

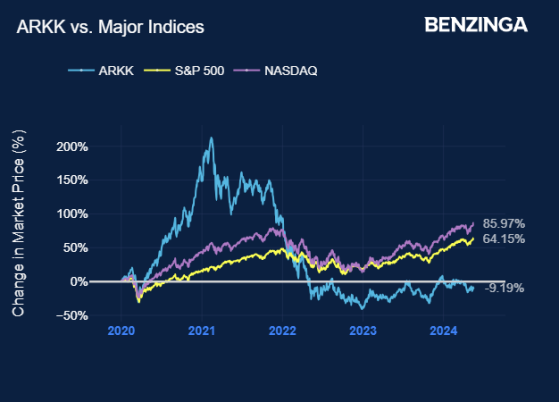

What Happened: Ram Ahluwalia of Lumida Wealth pointed to Ark’s flagship ETF, Ark Innovation ETF (NYSE:ARKK), which is currently trading over 70% below its all-time high, a stark contrast to the S&P 500’s recent record highs.

ARKK had its heydays amid the recent pandemic as a significant share of its holdings were COVID-19 plays, which capitalized on lockdown restrictions and the work-from-home environment that prevailed at that time. The ETF peaked at $159.70 in mid-February 2021.

Source: Benzinga

Here are the year-to-performances of Ark’s key ETFs vs the broader market:

| ETF | YTD Change |

| ARKK | -13.21% |

| ARK Next Generation Internet ETF (NYSE:ARKW) | +3.02% |

| ARK Genomic Revolution ETF (CBOE: ARKG) | -19.14% |

| ARK Autonomous Technology & Robotics ETF (CBOE: ARKQ) | -2.62% |

| ARK Fintech Innovation ETF (NYSE:ARKF) | +1.89% |

| ARK Space Exploration & Innovation ETF (CBOE: ARKX) | +1.23% |

| SPDR S&P 500 ETF Trust (NYSE:SPY) | +11.74% |

What Ails Ark Funds? Ahluwalia attributed Ark’s woes to a combination of missed bets and an over-reliance on “vision” over fundamentals.

He criticized Ark for selling Nvidia Corp. (NASDAQ:NVDA) stock early in the AI boom and pouring resources into companies like Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) and SoFi Technologies, Inc. (NASDAQ:SOFI).

“They sold Nvidia, bought Tesla (We did the opposite). They bought Ginko Biosciences (Never touched it),” he wrote. “They bought $SOFI (We shorted it).”

He argued that Ark prioritizes chasing “future ideas” without proper evaluation of traction, valuation, and management credibility.

This focus on disruptive innovation, a cornerstone of Ark’s strategy, seems to be backfiring in the current market. While Wood emphasizes long-term growth potential in areas like AI and robotics, many of Ark’s top holdings, including Tesla, Inc. (NASDAQ:TSLA), haven’t delivered the returns the firm anticipated.

“The consistency & statistical significance of how consistently ARKK under-performs is truly incredible,” Ahluwalia said. “If someone asked me to design a product with that kind of performance profile, I don’t think I could do it.”

“Literally throwing random darts at tickers would out-perform ARKK,” he added. “How do they do it!?”

Stock indices are at ATHs!Meanwhile $ARKK is 70% below its All Time High

They sold Nvidia, bought Tesla (We did the opposite)

They bought Ginko Biosciences (Never touched it)

They bought $SOFI (We shorted it)

The consistency & statistical significance of how consistently… https://t.co/0AgFLul8DK

— Ram Ahluwalia CFA, Lumida (@ramahluwalia) May 16, 2024

“Investing the assets of others is a special duty. The lives of others and their family goals are directly impacted,” Ahluwalia said. “Institutions that are chronic destroyers of wealth should absolutely be called out. Most people lack the skill to discern good from bad investing.”

Different View: Morningstar strategist Robby Greengold offered another perspective on Ark’s struggles. He suggested the firm lacks the forecasting talent needed for its focus on unproven companies and criticizes the high portfolio correlation due to its thematic investment approach. He argued Ark’s portfolio essentially resembles a tech-heavy fund, despite its focus on disruptive innovation.

Why It Matters: Wood’s Ark Invest reigned supreme in early 2021, managing a hefty $59 billion across its ETFs. Today, however, that figure has shrunk by 80% to a mere $11.1 billion, likely a consequence of rising interest rates dampening investor enthusiasm for Wood’s long-term tech bets.

In Monday’s premarket session on Monday, ARKK rose 0.33% to $45.60, according to Benzinga Pro data.

Read Next: Looking For Superlative Returns? Investor Flags Potential 30% Gains In This Sector After Warren Buffett Turns Market Focus Toward These Stocks

Image made via photos on Flickr and Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga