(Bloomberg) -- In a global market where hardly anything made sense this year, one trend seems to be supported by economic reality: Asian stocks’ outperformance versus the rest of the world driven by the region’s better containment of the coronavirus.

The MSCI Asia Pacific Index is set to beat the S&P 500 and the MSCI Europe Index for a second straight month in July as Asia scores high on curbing the virus as well as reopening economies. That, along with attractive valuations and Asian shares’ relative insulation from risks related to the U.S. presidential election, is prompting money managers to call for more gains.

“We have a heavy bias toward Asian equities,” said Sebastien Galy, senior macro strategist at Nordea Investment Funds SA, which oversees the equivalent of $255 billion in assets. “We expect this theme to prove resilient to what should eventually be a much more difficult time in equity markets in September and October.”

Galy’s comments echo views from funds like Fidelity International Ltd. and Capital Group Cos., who see Asian stocks winning more allocation from investors. Virus cases in the region -- the focal point when the pandemic originated in China -- have been below 20% of the global count since world equity markets hit 2020 lows in March, data compiled by Bloomberg and Johns Hopkins University show.

On the other hand, infections in the U.S. now make up for more than a fourth of the global count, while the Europe, Middle East and Africa region accounts for about a third of the total.

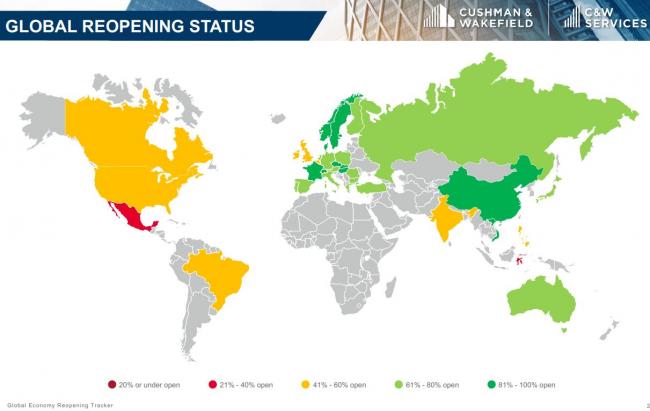

While most of the Asian economies have reopened between 70-95%, that run rate for most of the U.S. stands at 45-60% as of last month, according to Cushman & Wakefield’s global economic reopening tracker, which takes into account factors such as essential services, borders, schools, retail and manufacturing.

“Asia and in particular countries like China, South Korea, Taiwan have controlled the virus quite well and we are seeing economic activities picking up quite fast,” according to Tuan Huynh, chief investment officer for Europe and Asia at Deutsche Bank (DE:DBKGn) Wealth Management.

Investors also cite a recovery in China’s economy as reason to be bullish on Asian equities. China’s gross domestic product expanded 3.2% in the second quarter from a year ago, data showed Thursday, reversing a decline in the first quarter and beating forecast.

READ: BlackRock (NYSE:BLK) Favors Asia Markets Closely Tied to China’s Recovery

The economic rebound will spread all around Asia Pacific with a lag of a few months, said Galy of Nordea Investment.

Risks Remain

Nevertheless, there are some risks that can botch the bullish Asia narrative.

For one, a resurgence in virus infections from Hong Kong and Tokyo is forcing policy makers to delay or reverse business re-openings. India’s cases have exceeded 1 million, becoming the third country in the world to cross that tally. Such moves could thwart an economic recovery and dampen appetite for regional stocks.

READ: Here’s One Metric That May Have Asia Stock Bulls Worried

At the same time, investor enthusiasm may wane if earnings upgrades continue to lag positive revisions seen in the U.S. and Europe.

“I would not agree that Asia will perform the best,” said David Wong, an investment strategist at AllianceBernstein (NYSE:AB) in Hong Kong. “If we’ve learned anything from the pandemic, it is that the equity market is not equal to the economy and that returns have no correlation with GDP growth.”

Appealing Valuations

That said, advocates of investing in Asian shares also cite better valuations.

“Asian equity valuations are attractive in the context of the long-term growth opportunities and a potential rebound in earnings next year,” said Sumit Mangal, a fund manager for Asia ex-Japan equities at Goldman Sachs Asset Management. “We could see a strong recovery in demand.”

Bloomberg-compiled data on the estimated return on equity show that Asian company valuations are way cheaper than their U.S. and European peers even as the efficiency of Asian companies to generate profits using their assets remains in double digits.

The MSCI Asia Pacific Index has rebounded more than 35% from its March low. Still, the gauge can rise about 10% over the next one year, according to price forecasts by analysts surveyed by Bloomberg. That’s set to outpace the roughly 5% advance predicted for U.S. and European stocks.

The gauge was little changed on Monday as investors weighed potential for additional policy support and a ramp up in the earnings season.

U.S. Election

While the pandemic remains a challenge, investors globally are also starting to factor in risks related to the U.S. presidential election as recent polls show President Donald Trump trailing Democratic nominee Joe Biden. Goldman Sachs Group Inc (NYSE:GS). analysts have flagged the potential for earnings-depressing tax hikes should Democrats do well in November.

Expectations that Democrats will win the U.S. election will keep a lid on stocks in the U.S. and Europe, while Asian equities remain insulated from that risk, according to John Vail, chief global strategist at Nikko Asset Management Co. in Tokyo.

“Europe also has some correlation with the U.S. stock market,” he said. “We are strongly preferring Asia ex-Japan to the rest of the world.”

Equities in Asia excluding Japan have outperformed the U.S. heading into elections in three of the four previous cycles, with an average outperformance of about 6% in four months until the polls, according to Nomura Holdings (NYSE:NMR) Inc.

(Updates market performance)

©2020 Bloomberg L.P.