By Adam Jourdan

SHANGHAI (Reuters) - A war of words is brewing in China between a highly acquisitive insurer and a leading business journal, a rare public clash amid growing pressure on firms to improve governance and transparency.

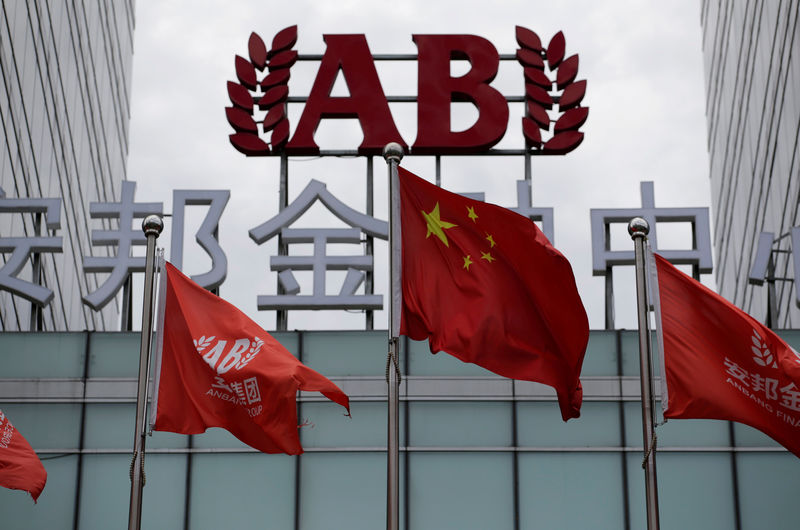

Anbang Insurance Group Co Ltd [ANBANG.UL] said in an open letter published online on Wednesday it would take legal action against business publication Caixin and one of its reporters over what it called "malicious" and "inaccurate" reports driven by commercial aims.

A Caixin report published on April 29 said Anbang's ownership structure was "opaque" and that its funding was a "maze" of capital flow involving more than 100 firms.

Anbang's open letter to Caixin publisher Hu Shuli was the second notice in four days published by the insurer threatening the publication with a lawsuit.

Anbang, which rose to international prominence through its purchase of New York's landmark Waldorf Astoria hotel in 2015, also accused Caixin of publishing a series of malicious reports against the company and conducting personal attacks on Anbang Chairman Wu Xiaohui. Wednesday's letter also threatened to sue in Canada the author of Caixin's most recent report.

Caixin declined to comment on Wednesday. Caixin has said Anbang's allegations are groundless and that it could take legal action itself against the insurer.

Anbang, which is owned by a series of privately-held companies, did not comment beyond the open letter.

China's financial and corporate regulators have yet to comment directly on the growing spat between the two firms.

While public spats between Chinese media and corporations are not unheard of, the case is unusual because of the high-profile nature of both parties, risk consultants said.

"Caixin in China is like The Economist or the Wall Street Journal in the United States. There's no more well-respected business publication and people take it very seriously," said Andrew Gilholm, director of analysis for China and North Asia at risk consultancy Control Risks.

He said Anbang was on par with global insurers like American International Group Inc (AIG) (N:AIG) in terms of scale.

The New York Times reported last year about the Chinese company's complex structure and networks.

"Most Chinese hadn't heard of it 5-10 years ago, but it's probably now, along with Dalian Wanda and HNA Group, among the top Chinese firms making headlines worldwide," Gilholm said.

In March, Kushner Companies, the real estate firm headed by U.S. President Donald Trump's son-in-law until recently, said it ended talks to redevelop its flagship New York office tower with Anbang.

Established in 2004, Anbang burst onto the global scene by signing more than $30 billion worth of corporate deals in the last two-and-a-half years.