Benzinga - by Zacks, Benzinga Contributor.

Humana Inc. (NYSE: HUM) recently entered into an in-network deal with The University of Alabama at Birmingham ("UAB") Health System in a bid to provide HUM's Medicare Advantage members in Alabama greater access to care. The agreement came into effect earlier this year.

This partnership provides Medicare Advantage members in Alabama with in-network access to several UAB and UAB-affiliated facilities, such as UAB Hospital, UAB Hospital-Highlands, UAB Callahan Eye Hospital & Clinics, UAB Medical West and UAB Medicine Outpatient Clinics. With the availability of high-quality healthcare services at such facilities, improved health outcomes will remain an inevitable result for Humana members.

The recent move indicates HUM's efforts to expand treatment options in Alabama and subsequently, strengthen its presence across the United States. With access to UAB's facilities, more individuals are likely to opt for HUM's Medicare Advantage plans. The resultant benefit of membership growth will be higher premiums, which remain the most significant top-line contributor of a health insurer.

Individual Medicare Advantage premiums advanced 13.3% year over year in the first quarter. Management anticipates this business line to witness a membership growth of around 150,000 in 2024.

Humana resorts to such contracts with leading healthcare providers to expand its local provider networks and better serve its members spread across different U.S. communities. It also remains quite active in integrating lucrative features within its plans. The Medicare business of Humana boasts a widespread presence and as of Mar 31, 2024, it served around 8.4 million Medicare customers, out of which Individual Medicare Advantage members of roughly 5.5 million were a significant portion.

In October 2023, Humana inked a deal with Denver Health to bring enhanced care access and convenience for its Medicare Advantage customer base across the Denver area.

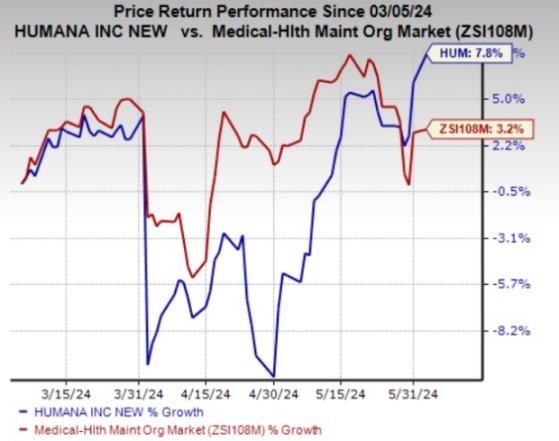

Shares of Humana have gained 7.8% in the past three months compared with the industry's 3.2% growth. HUM currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider Some better-ranked stocks in the Medical space are Bioventus Inc. (NASDAQ: BVS), Alcon Inc. (NYSE: ALC) and Encompass Health Corporation (NYSE: EHC). While Bioventus sports a Zacks Rank #1 (Strong Buy), Alcon and Encompass Health carry a Zacks Rank #2 (Buy) at present.

Bioventus' earnings surpassed estimates in three of the last four quarters and missed the mark once, the average surprise being 151.67%. The Zacks Consensus Estimate for BVS' 2024 earnings is pegged at 27 cents per share, which has increased nearly 14-fold from the prior-year reported figure. The consensus estimate for revenues indicates 6% growth from the year-earlier actual. The consensus mark for BVS' 2024 earnings has moved 68.8% north in the past 30 days.

The bottom line of Alcon outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 5.27%. The Zacks Consensus Estimate for ALC's 2024 earnings indicates a rise of 11.3% from the year-earlier actual. The consensus estimate for revenues implies growth of 6.2% from the year-earlier actual. The consensus mark for ALC's 2024 earnings has moved 0.7% north in the past 60 days.

Encompass Health's earnings surpassed estimates in each of the last four quarters, the average surprise being 18.74%. The Zacks Consensus Estimate for EHC's 2024 earnings indicates a growth of 12.6%, while the consensus mark for revenues implies an improvement of 10.5% from the respective year-earlier actuals. The consensus mark for EHC's 2024 earnings has moved 0.7% north in the past 30 days.

Shares of Bioventus, Alcon and Encompass Health have gained 28.8%, 5.6% and 12.9%, respectively, in the past three months.

To read this article on Zacks.com click here.

Read the original article on Benzinga