Benzinga - by David Pinsen, Benzinga Contributor.

We Won't Make This Mistake Again Ahead of the earnings report for International Business Machines Corporation (NYSE: IBM), our composite score for it was very bullish, but we didn't believe it. Because of that, we missed out on what might have been a >100% return on an options trade. Below we'll explain the approach we're using, and why we were skeptical of it this time--and why we shouldn't have been.

Our Current Approach To Analyzing Earnings Trades We’re using these ten factors when evaluating earnings trades,

- LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

- Portfolio Armor’s gauge of options market sentiment.

- Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

- Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

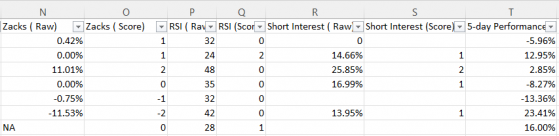

- Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

- Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

- The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

- Recent insider transactions.

- RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

- Short Interest.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

Our Data On IBM Ahead Of Earnings Here's how IBM scored on our ten metrics ahead of earnings this week. The number in parentheses is our composite score, and the higher it is, the more bullish it is. A 6.5 was the highest composite score we calculated on any stock this week.

IBM (IBM) (6.5)

- Social data: -21

- PA Options sentiment: Neutral.

- Setup rating: 2

- Valuation rating: 4

- F-Score: 6

- Recent insider transaction(s): No open market sales in the past 12 months.

- Zacks ESP: 0.54%

- Zacks Ranking: 2

- RSI: 77

- Short Interest: 2.82%

What We're Going To Do Differently Next Time Put aside our prejudices, and follow the empirical data where it leads. If you'd like a heads up when we place our next earnings trade following this approach, feel free to subscribe to our trading Substack/occasional email list below.

If You Want To Stay In Touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on Twitter here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.