Benzinga - by Benzinga Insights, Benzinga Staff Writer.

Monolithic Power Systems's (NYSE:MPWR) short percent of float has risen 12.92% since its last report. The company recently reported that it has 979 thousand shares sold short, which is 2.71% of all regular shares that are available for trading. Based on its trading volume, it would take traders 1.81 days to cover their short positions on average.

Why Short Interest Matters Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

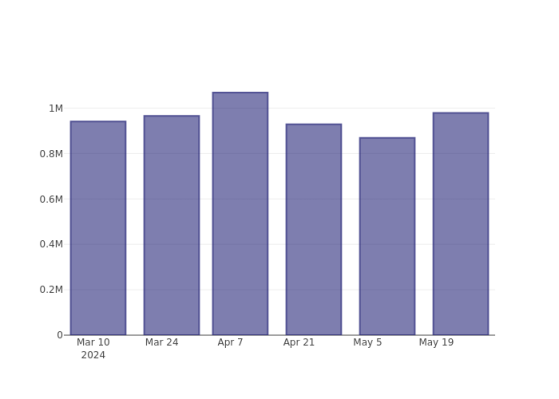

Monolithic Power Systems Short Interest Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold short for Monolithic Power Systems has grown since its last report. This does not mean that the stock is going to fall in the near-term but traders should be aware that more shares are being shorted.

Comparing Monolithic Power Systems's Short Interest Against Its Peers Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

According to Benzinga Pro, Monolithic Power Systems's peer group average for short interest as a percentage of float is 4.58%, which means the company has less short interest than most of its peers.

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

This article was generated by Benzinga's automated content engine and was reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga