By Gernot Heller, Annika Breidthardt and Matthias Sobolewski

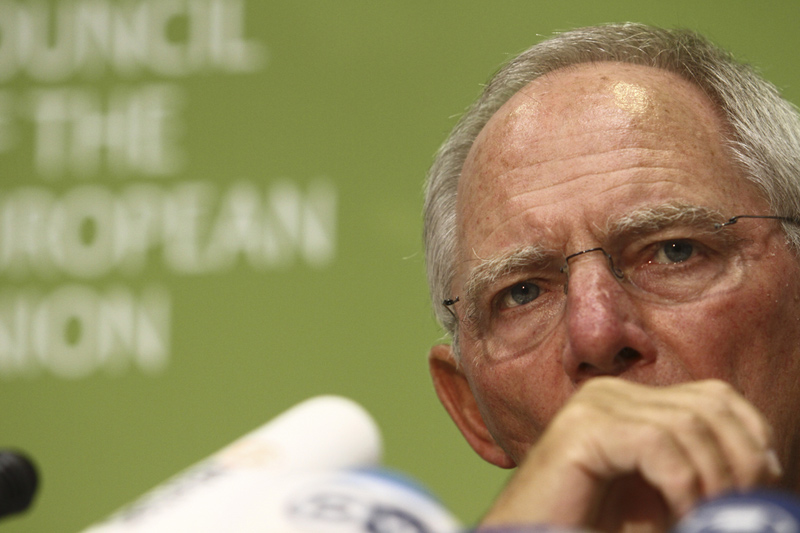

BERLIN (Reuters) - German Finance Minister Wolfgang Schaeuble would consider granting tax breaks to companies for income generated from patented or licenced research as long as uniform rules are put in place to prevent unfair competition for foreign investment.

The comments to Reuters, days before a meeting of G20 finance ministers in Australia, are the clearest sign yet that Germany could accept a practice that industry has long supported, but which in its current form has allowed mulitnational firms to avoid paying taxes.

Schaeuble, who has long fought against corporate tax avoidance, said in an interview that solutions similar to so-called "patent box" schemes might work even for Germany if they were part of an international solution.

Crucially, he said that tax breaks would need to relate to research within the country.

"We are urging that tax breaks be given on patents and licences only if they have a connection to research and development activities in your own country," Schaeuble said.

Patent boxes have proven hugely valuable for companies looking to cut their tax bills. GlaxoSmithKline (L:GSK), for instance, has made multi-million pound investments in Britain due to the draw of the tax break scheme.

Germany has, until now, not granted any "patent box" tax advantages and income from patents and licences here is taxed like corporate profits, at around 30 percent. That compares with just 10 percent in Britain.

In the interview, Schaeuble said there were still two or three countries in Europe that objected to new international rules to address unfair tax competition, but he was confident their reservations could be addressed.

"If we have a solution like this, patent box income cannot be moved arbitrarily anymore. Then, we can consider a similar solution in Germany, just like in other countries... That has to be embedded in a European and international solution."

Countries offering so-called "patent boxes" levy lower corporate tax rates on profit related to innovations and patents. They include the Netherlands, Hungary and Belgium.

With only a few states offering such regimes currently, critics has called patent boxes unfair, discriminatory and a form of tax avoidance. Governments which offer them say patent boxes encourage innovation and high-value jobs in research.

Corporate tax avoidance has risen to the top of the international political agenda in recent years and finance ministers of the Group of 20 (G20) of industrialised nations meeting in Cairns later this week will discuss the issue.

German business has long lobbied for tax support for research and development to boost innovation in the German economy. Earlier this week, Germany's main business lobby BDI called for lower taxes on R&D.

Schaeuble expected the G20 could take first steps to implement a 15-point plan known as Base Erosion and Profit Shifting (BEPS), a project calling for revising tax treaties, tightening rules and more government tax information sharing.

BEPS is scheduled to finish by the end of next year.

(Writing by Annika Breidthardt)