By Liz Moyer

Investing.com -- Stocks surged as President Joe Biden inched closer to signing his $1.9 trillion stimulus into law, an event that is now expected Friday.

Already, signs that inflation remained in check in February lifted stocks on Wednesday. The much-watched 10-year U.S. Treasury slipped as core consumer prices, excluding food and energy, rose slightly less than expected.

Investors have been nervous that the reopening of the economy plus the federal relief money might spark higher inflation, and that caused a big rise in government bond yields in the last few weeks that slammed technology stocks. Those fears have eased somewhat.

Now the guesswork begins on which sectors and stocks could benefit the most from the extra spending by individuals intended by the $1,400 stimulus checks.

It’s a light day for data, aside from the weekly jobless claims expected out Thursday morning. Here are three things that could affect markets tomorrow:

1. Robinhood meme-stocks continue to draw interest

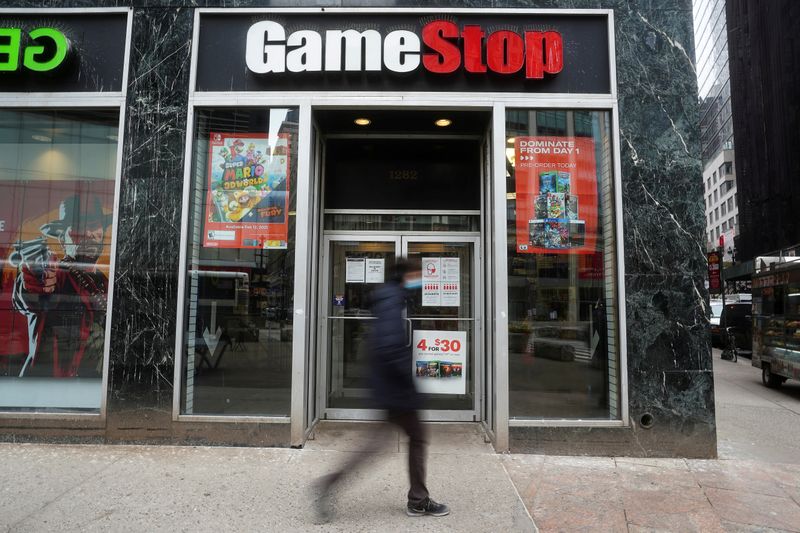

The retail trading frenzy inspired by members of a Reddit forum who have been goading each other to trade certain stocks over Robinhood continues to have teeth. GameStop Corp (NYSE:GME) shares soared another 19% on Wednesday then fell into the red, then recovered in volatile trading after in a rally that has already doubled the company's market value.

Among other "meme" stocks, Koss Corporation (NASDAQ:KOSS) and AMC Entertainment Holdings Inc (NYSE:AMC)also traded wildly. AMC is set to report fourth quarter earnings after the market close, and analysts are hoping to hear executives talk about the outlook post-pandemic.

2. Stimulus trade on as investors hunt for the next winner

The $1.9 trillion stimulus not only puts $1,400 in the pockets of people earning less than $80,000, it sets aside relief for airlines and restaurants among other hard-hit industries. That could be a boost for stocks like United Airlines Holdings Inc (NASDAQ:UAL), Southwest Airlines Company (NYSE:LUV) and Darden Restaurants Inc (NYSE:DRI), as the reopening trade picks up steam. Banks are also trading higher. Tame inflation signs benefit banks, but the added stimulus could be good for their credit card, auto and home lending operations, too.

Retailers such as Kohls Corp (NYSE:KSS) and Walmart Inc (NYSE:WMT) could also benefit from the extra consumer spending intended by the stimulus bill. Next up, the possibility of infrastructure projects boosting construction and materials stocks.

3. DraftKings a winner in sports betting legalization movement

Online and mobile gaming and sports betting is picking up momentum as more states consider legalizing the activity. That has put fire under shares of DraftKings Inc (NASDAQ:DKNG), which rose another 13% on Wednesday after a slew of analysts raised their price targets.

Also helping the shares: Cathie Wood’s ARK Innovation ETF (NYSE:ARKK) acquired more than 900,000 shares of DraftKings, a bullish sign. And Norway’s sovereign wealth fund has also reportedly been a buyer.