Benzinga - by David Pinsen, Benzinga Contributor.

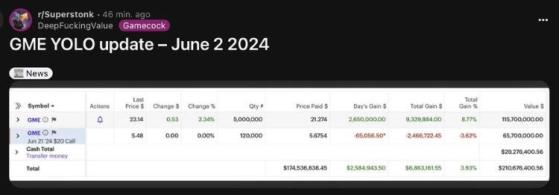

Roaring Kitty Returns “Roaring Kitty”, as the meme stock investor Keith Gill calls himself, returned to X after an absence of three years last month, and posted a few memes, with no specific stock commentary. On the basis of that alone, GameStop Corp. (NYSE: GME) shares spiked from $17.46 on May 10th, to $55.69 on May 14th, before giving back those gains. Yesterday, Gill returned to Reddit, posting a screen shot, purportedly of his account, showing a $116 million position in GameStop, and 120,000 call options on it. As a result the stock spiked over 64% in early trading on Monday.

Is He About To Become A Billionaire? Jordan Lupton of Lupton Capital suggested that on X on Monday:

I'm trying to figure out how Roaring Kitty ended up with $180M+ of $GME and here's my best guess.In a follow-up post, Lupton added:In late April or early May he sold most of his $GME equity and loaded up on calls. Then he came back to social media and pumped the stock which went up 330% in 3 days then dropped -75% in the next 3 days.

He probably sold all of his calls near the top and then started buying back $GME equity which is why is cost basis is in the $20s.

Then he decided to play this game again, so over the past couple weeks he's been selling his $GME equity and loading up on the June 21st $20 calls.

With $GME up 83% premarket, he's up more than $95M on the equity and he's probably up $450M+ on the calls so his account will probably be worth $750M+ after the open.

Fu*king insane!!!! Never seen anything like this before.

I would not be surprised if he only had $10M of $GME in April before he sold the equity and bought the calls, then when the stock pumped 330% over those 3 day he was probably averaging out and ended up doing 20x which is how his portfolio probably went from ~$10M to ~$200M over the past month.As we type this, GameStop is fading into the close, so Roaring Kitty may need the company to pull a rabbit out of a hat when it reports earnings this week to reach the three comma club. Or who knows? Maybe he can run the same playbook with AMC Entertainment Holdings, Inc. (AMC) next. AMC shares spiked today, presumably in anticipation of that.Now he's in a position to go from $200M to $800M or maybe even $1 billion depending on what the stock does today and tomorrow and when he starts unloading those calls.

Our Take On GameStop As regular readers know, each day the market is open, our system ranks every security with options traded on it in the U.S. by its potential return over the next six months. Since we started our Substack in December of 2022, our weekly top ten names have returned 22.73% over the next six months, on average, versus 12.63% for the SPDR S&P 500 Trust (ARCA:SPY). On May 23rd, GameStop hit our top ten when it was trading at $18.32.

Screen capture via Portfolio Armor on 5/23/2024

Our core strategy in our trading Substack is to buy equal dollar amounts of Portfolio Armor's top ten names, put trailing stops of 15% to 20% on them, and replace them with new top names when we get stopped out. In my personal account I hadn't gotten stopped out of any of my top ten the week GME appeared, so I didn't buy the stock, but I did try to place an options trade on it on May 24th.

GameStop was a @PortfolioArmor top ten name last night, so I put in a low-ball option trade order on it in case it dropped a little more today. Should have been less stingy. $GME pic.twitter.com/be0CXDddJCI didn't get a fill on that bullish trade, unfortunately. After Sunday's news, I tried to place a bearish bet on GME at about $40 (a credit call spread), but didn't get a fill on that either.— David Pinsen (@dpinsen) May 24, 2024

I have a few other promising trades open though, and as usual, I will post them on the Portfolio Armor Substack as soon as they get filled (or sooner, if they look likely to get filled). If you're not a subscriber yet, feel free to subscribe below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga