Proactive Investors -

- FTSE 100 holds gains mid-morning, up 10 points

- House prices rise 1.1% in February - Halifax

- Pound vulnerable to US/ECB rate hikes - Bank's Catherine Mann

BoE's Mann says pound vulerable to US/ECB rate hikes

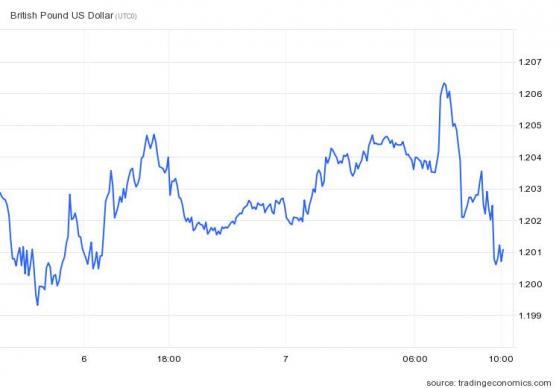

After a bright start sterling slipped as Bank of England policy maker Catherine Mann said the pound could weaken further in the coming months as investors absorb the implication of the US Federal Reserve and European Central Bank’s plans to raise interest rates.

“There has been a quite a hawkish tone coming from the Federal Reserve and ECB,” Mann said in an interview on Bloomberg TV on Tuesday.

"The important question for me with regard to the pound is how much of that existing hawkish tone is already priced into the pound," Mann said.

"If it's already priced in, then what we see is what we get. But if it's not completely priced in, then there could be depreciation pressure."

After opening higher the pound is now down 0.1% against the US dollar at US$1.2009.

Reach tumbles as profits slump

Shares in Reach PLC fell 8.2% after its chief executive Jim Mullen warned that the macro-economic ‘headwinds’ encountered last year 'would likely continue' in 2023.

His prediction accompanied full-year results from the publisher of the Daily Mirror and Express newspapers which showed inflation pressures resulted in a £40mln increase in costs in 2022.

Operating profits from the company, which also owns a stable of regional newspapers, dropped by 27% to £106.1mln in the 12 months ended December 31.

Revenue fell 2.3% year-on-year £601.4mln as advertising income began to weaken.

Mullen told investors: “We expect uncertain macroeconomic conditions to persist during 2023 but, as shown during the pandemic, we are effective at managing them, with an action plan in place to help mitigate the current headwinds. demand from advertisers.

Reach saw ad revenues plunge 15.9% in the year to December 25, while circulation fell 1.7% with falls limited by cover price increases in the second half of 2022.

Digital advertising, which has been a strong growth area for media firms, fell 2.7% in the second half of the year as the economic outlook worsened.

Meanwhile the FTSE 100 continues its lukewarm start to the day now at 7,935.34, up 5.55 points, or 0.070%.

In The Style out of fashion, Just Group on the money

Some other stocks on the move include In The Style PLC which plunged 76% after it announced it has agreed to be sold in a £1.2mln deal that avoids administration. The company will be acquired by private equity investor Baaj Capital.

The founder and boss Adam Frisby will take an equity position in the newly established bidco formed for the purposes of the sale, becoming the chief executive of the business upon completion.

In early trade, the stock was down 5.34p at 1.66p, valuing the business at just £870,000.

Over in the FTSE 250 and nestled between John Wood and Premier Foods in the risers list is Just Group PLC. Shares rose 10% to 90.20p after better than expected results. Peel Hunt noted: "The outlook remains positive with Just Group in 1Q concluding its largest pension transfer deal so far (£513m), and a strong new business pipeline for the rest of the year."

The broker continues to believe the stock is significantly undervalued and see 46% potential upside to its 120p price target.

FTSE hovers around opening levels

The FTSE 100 has pushed into positive territory now but remains around opening levels, up 7 points.

Susannah Streeter, head of money and markets, Hargreaves Lansdown said: “’Caution is set to stay the name of the game on financial markets as investors await testimony from the world’s most influential central banker.”

“With investors on tenterhooks about just how far interest rates will rise, and what effect this will have on the world’s largest economy, Fed chair Jerome Powell’s words in Washington as he speaks to senators later are likely to set off a ripple effect through indices.”

“Any hint that he's swirling the latest data and is finding a pattern of inflation that’s stubbornly hard to shift, could trigger fresh falls in equities, and may see bond yields edge up.”

Premier Foods surged 8.2% after a bullish trading statement. The owner of Mr Kipling, Ambrosia, Bird's Custard and Angel Delight, said it has continued to trade strongly in recent weeks, bringing the momentum it delivered in the third quarter into the final quarter of the year.

The company now expects revenue growth in the fourth quarter to be at least 10% ahead of the prior year led by a strong performance in the grocery business.

“Consequently, trading profit and adjusted profit before tax for this year are forecast to be ahead of the board's initial expectations and are now expected to be around £155mln and £135mln respectively, which equates to growth of approximately 10% compared to prior year,” Premier Foods said.

But heading the other way was Wincanton PLC which tumbled after it said it has lost a contract with HM Revenue and Customs (HMRC) for inland customs facilities with another provider taking over following a re-tendering process.

The logistics group added it is “extremely disappointed” by the decision after what it said has been acknowledged as a strong performance over the past two years.

The contract will be transferred in June 2023 with the impact to be felt in full year 2024.

Along with customer volumes and consumer spending being reduced generally due to the economic situation, results for the year to end March 2024 will now be "materially below" market forecasts of around £63mln, Wincanton said in a statement.