Proactive Investors -

- FTSE 100 adds 62 points

- China confirms reopening plans

- Miners and China-related stocks lead risers

14.04pm: FTSE 100 remains in the green, UK banks announce forbearance measures

FTSE 100 continues to hold onto daily gains of 0.83%, in strong signs that the London-listed blue chips will end the year in positive territory barring a disappointing home stretch.

Chilean multinational Antofagasta PLC (LON:ANTO) remains the day’s top riser, having added 3.8%, trailed by insurance heavyweight Prudential PLC (LSE:LON:PRU)’s 2.5% run.

Although the London blue-chip index is one of the strongest globally, things are less rosy for the mid-cap FTSE 250.

Considered a better marker of UK-based equities, the 250 index is up 0.31% today, but remains nearly 21% down year to date.

If these trends hold out – almost a certainty – it will be the first time the mid caps underperformed against the large caps since 2018, and by a wider margin for decades.

Elsewhere in the market, major UK banks including HSBC (LON:HSBA), Barclays (LON:BARC), Lloyds Banking Group (LON:LLOY) and NatWest (LON:NWG) have agreed on measures to help struggling borrowers who are bracing for a surge in late mortgage payments and possible repossessions.

Forbearance measures negotiated between the banks and chancellor Jeremy Hunt are likely to include an extension of fixed-rate deals and the option to switch to interest-only deals.

11.24am: GBP dips and recovers against the euro, JPY tanks against all major currencies

As expected, the forex markets were fairly uneventful over the Christmas break, with one exception.

The yen tanked against all major currencies, spurred on by the Bank of Japan’s surprising announcement before the break to widen the allowance band around its yield target on 10-year bonds.

Governor Haruhiko Kuroda insisted it was "absolutely not a first step" towards an exit from ultra-loose monetary policy, but a move to "continue the implementation of a sustainable monetary easing.”

Still, uncertainty swept through the markets, with the euro and greenback gaining close to 2% across the past seven days, and the pound a lighter 1.3%.

Yesterday’s retail sales data certainly didn’t help the yen’s cause- year-on-year growth of 2.6% fell far below the 3.7% forecast.

To the main pairs, GBP/USD is changing hands at 1.207, exactly where it closed this time last week.

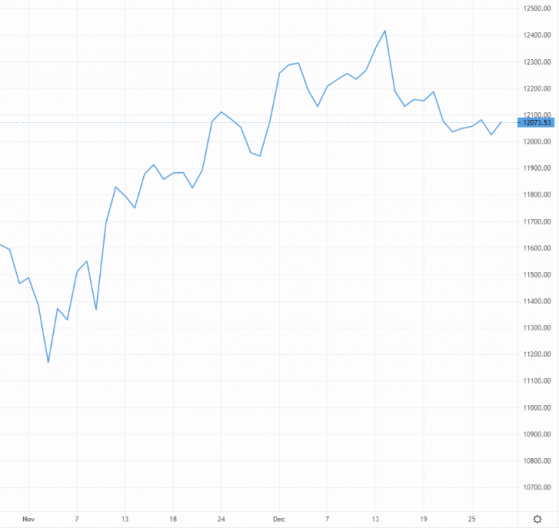

Cable trades sideways in the Christmas period – Source: capital.com

EUR/USD is showing a bit more activity, having gained 0.3% to 1.064 in the past seven days.

EUR/GBP took an interesting turn by gaining nearly half a percent to close at 88.43p, although the pair’s fortunes took a downturn in this morning’s Asia window. And is currently changing hands at 88.14p.

The FTSE is holding onto most of its early gains as trading continues.

Scottish Mortgage Investment Trust PLC is the index's big faller, no doubt a large part affected by the retail investor favourite having a big stake in Tesla Inc (NASDAQ:NASDAQ:TSLA) - its third-largest in fact at 4.9% of the portfolio.

Tesla stock bombed more than 11% yesterday and is heading lower again today, with analysts at Wedbush warning that more could come as "worries are growing around what the softening demand picture looks like for 2023 given the dark macro clouds and increasing domestic EV competition".

In pre-market trading the electric vehicle maker is heading for a 3% decline today, while Scottish Mortgage is down 2.5% today so far.

Tesla was a large part of SMT's success in recent years, with the investment trust flying over 450% higher between 2010 and 2020 from around 99p to well over £5, then added another 150%-odd in the pandemic to an all-time high above £15 in November last year, before tumbling since then and giving most of its Covid gains back to a few pennies over £7 today.

The London index is up 62 points or 0.83% at 7534.9 - while for 2022 it's up 29 points or 0.4%.

Top of the leaderboard is Antofagasta PLC (LON:ANTO), with a few retailers bouncing back from the pre-Christmas dip in JD Sports Fashion PLC and Next PLC, with similar for several housebuilders, including Barratt Developments (LON:BDEV) PLC, Taylor Wimpey PLC (LON:TW) and Persimmon PLC (LON:PSN).

BT Group PLC (LSE:LON:BT), Segro PLC and BP (LON:BP) PLC are also thereabouts too.

Meanwhile, the mid-caps are putting on a collective effort after an early rise-and-wobble, with the FTSE 250 up 102 points or 0.54% to 18,932.57.

Top of the mid-cap risers are Workspace Group PLC, OSB Group PLC (LSE:OSB), RHI Magnesita NV (LSE:RHIM), BlackRock (NYSE:BLK) World Mining Trust PLC, all up more than 3%, followed by Paragon Banking Group PLC, Synthomer (LON:SYNTS) PLC, Centamin (LON:CEY) PLC, Crest Nicholson PLC (LON:CRST) and Dr Martens PLC.

9.29am: Starting a new IPO streak

We have news on what will be the first London IPO of 2023: Streak Gaming PLC.

The 'conversational gaming' specialist, which uses the same OpenAI tech platform as the infamous ChatGPT chat bot, has raised £3mln, most of it from investment company AQRU PLC (AQSE:AQRU).

AQRU has bought £2.3mln worth of shares, which were priced at 3p apiece and are expected to begin trading on 5 January.

Streaks had wanted to raise between £5mln and £10mln from the IPO, but considering the state of the new issues market this year it has done pretty well.

Tennyson Securities is acting as the brokers and book runner for the company.

8.31am: Strong open

London's blue chips have dashed higher on the first day of trading after Xmas, taking the index back into positive territory for the year - one of the few around the world.

The FTSE 100 zoomed up 73 points to 7546 shortly after the open, led by mining heavyweights including Antofagasta PLC, Glencore PLC (LON:GLEN) and Anglo American PLC (LON:AAL).

“UK markets have reopened higher, playing catch up after the FTSE 100 which was closed for a public holiday on Tuesday," said market analyst Victoria Scholar at Interactive Investor.

"The UK index could end the year in positive territory despite the broad pressures on global equity markets, weighed down by rising interest rates, inflation, and the threat of recession."

National Grid PLC (LON:NG) and Prudential PLC (LON:PRU) were also among the top risers.

China's reopening news is likely to be behind the move for Prudential, which has a big focus on the People's Republic, as well as the mining companies as global demand for metals should get a boost if the move goes relatively smoothly.

Beijing said border controls will be eased from 8 January 2023, while management of Covid in China will be downgraded from 'class A' to 'class B', with international arrivals now only needing to take a PCR test within 48 hours before coming and only those with negative results able to enter the country.

Welcome to the most pointless week in markets of the year.— Marc-André Fongern (@Fongern_FX) December 28, 2022

7.45am: Boxing day shopping bounce

Fresh retail sector data from Springboard also shows there was a 38.8% year-on-year jump in shoppers’ footfall on Boxing Day, in what was the first festive period without pandemic restrictions in three years.

Central London saw a surge of 66%, UK footfall remains 18.2% below pre-pandemic levels in 2019.

"Boxing Day was far from doom and gloom this year," Diane Wehrle, insights director at Springboard, said in a statement.

"These positive results come in line with the first Christmas post-pandemic without any formal social restrictions and in spite of the cost of living crisis and the rail strikes, which inevitably affect retailers negatively."

7.14am: Footsie tipped to open higher

The FTSE 100 has been tipped to rise on Wednesday, the first trading day after Christmas, which could be enough to send the index back into positive territory before the end of the year.

London's blue-chip index is seen rising around 32 points, according to spread-betters, following a mixed session on Wall Street overnight.

At 7,473.01, where it closed before the festive holidays, the Footsie is down 32.14 in the year to date.

US and European stock futures are trading in a narrow range while trading volume continues to remain on the low side, pointed out Naeem Aslam, market analyst at Avatrade.

"Yesterday, we did see the US stock indices recording small gains, but the percentage gains in the US stock indices were still on the low side and hardly exciting enough to attract new capital. Investors are enthusiastic about China re-opening its economy. However, there are plenty of reports which suggest that covid cases are on the rise in China, which really threatens the supply chain," he said.

A second day of declines for oil futures was also noted by Aslam, who attributed this to traders worrying about oil demand.

With front-month crude oil prices falling below their 50-day simple moving average, which is currently around US$80.88, he said "this shows that the bulls are not in control of the price and the bearish price action could easily pick up more steam".

Oil price got a small boost yesterday, as Russia responded to the EU’s price cap on its oil exports, with Moscow deciding to stop exporting their oil to parties that "directly or indirectly use the mechanism of setting a price cap" until July 2023.

Other factors like the economic reopening of China and the cold snap in America are expected to put a floor under a further selloff in oil.

Read more on Proactive Investors UK