Proactive Investors -

- FTSE 100 climbs 0.7%

- UK manufacturing data improves, inflation pressures ease

- Bank of England boss says 'nothing is decided' on interest rates yet

BoE undecided

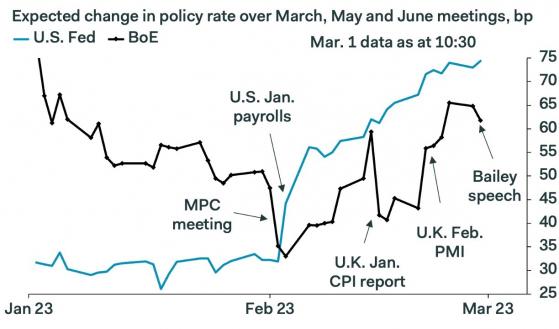

Bank of England governor Andrew Bailey has given a speech where he emphasised that "nothing is decided" yet by the monetary policy committee about interest rates, which the market is putting its own spin on.

"At this stage, I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more.

"Some further increase in Bank Rate may turn out to be appropriate, but nothing is decided."

Markets are reducing their expectations for further increases in the base rate, having priced-in a further 65bp increase over the next three meetings before the speech.

"Rightly" so said Sam Tombs at Pantheon Macro, putting forward his firm's view that the meeting on March 23 will see no hike, but with a 40% chance of a 25bp rate rise.

"Either way, it is clear from Mr. Bailey’s speech that [the MPC] is placing more emphasis on the substantial tightening already delivered and would like to call time on its hiking cycle as soon as it feasibly can."

The FTSE just hit 7938, nears its week's high but has backed off a couple of points.

Footsie back on the front foot

The FTSE 100 is heading higher again, after traders took some time to mull all the data and results out earlier. GBP/USD has also softened to provide some help.

It's up 54 points or 0.7% to 7930. The FTSE 250 is also showing more spirit, up 0.3% to 19,971.

Other data that emerged earlier from the Bank of England showed mortgage approvals fell less than expected.

Almost 39.7K house purchase mortgage approvals were recorded for January, down from an upwardly revised 40.54K the month before but not as low as the 38.5K that was forecast.

Consumer credit also rose more that estimated, to £1.597bn from £0.79bn, with the consensus pointing to £0.80bn. Households' total liquid assets increased by £3.5bn.

Implictions for inflation and the BoE

Reactions to the PMI data from Gabriella Dickens at Pantheon Macroeconomics, who said the survey "suggests that the downturn in manufacturing output is drawing to a close".

"While the headline index remained below 50, it rose for the third month in a row and reached its highest level since July 2022."

Backlogs of work index remained well below the 50 mark that separates expansion and contraction, implying that output still is above the level consistent with the flow of new orders.

"Nonetheless, demand is stabilising, both at home and abroad; the new orders balance jumped to a nine-month high of 49.6, from 44.4, while the new export orders index rose to 49.0, from 44.1."

The future activity index increased to 75.0, further above its 72.3 average since the question first featured in the survey in July 2012.

"Still, with households’ real disposable incomes unlikely to recover until the second half of this year, business investment likely to fall this year in response to higher interest rates, and the government set to reduce the generosity of its energy price support for businesses in April, any recovery in manufacturing output this year will be very gradual."

For how this will affect the Bank of England's thinking, Dickens said: "Meanwhile, the MPC will be happy to see a further decline in the prices balances."

With the price index at its lowest level since July 2020 and input prices back below the average since 1992 and shipping costs back at their pre-Covid levels and wholesale gas prices down sharply from their peaks last year, "we expect core goods CPI inflation to fall sharply to about zero by the end of this year".

FTSE consolidates as PMI data comes in stronger

The latest UK purchasing managers index data for the manufacturing sector has come out stronger than expected, but the FTSE is little-moved by this news, up 30 points still at 7909.

Sterling is feeling slightly encouraged, up 0.4% against the US dollar at 1.2070.

The manufacturing PMI increased to 49.3 in February, from 47.0 in January, above the consensus and the flash estimate of 49.2.

This survey, which was collected between February 10 and 23, saw the headline index rise for the third month in a row to its highest level since July 2022.

The downturn in manufacturing output halted, as stabilising client demand and improved supply chains boosted production, said S&P Global.

Inflationary pressures also eased further, with costs rising to the least marked extent since July 2020.

Rob Dobson at S&P said: “UK manufacturing showed encouraging signs of resilience in February. Output rose for the first time in eight months, boosted by weaker cost inflation and reduced supply chain disruptions."

The slowing of input prices and im[proved supplier performance for the first time in three-and-a-half years "offset some of the ongoing negative impacts from strikes, the cost of living crisis and lower order intakes", he said.

Aston Martin impresses

The FTSE 100 has not kept up all its initial oomph, retreating slightly to 7906, for a gain so far of 30 points or 0.4%.

Over in the mid-caps, the FTSE 250 had a less sure-footed start but is also up 30 points at 19,933.

Leading the way is Aston Martin, despite the results not really seeming to blow the doors off with its annual results, but the shares have leapt 18% higher in early trading.

Just basic competence during tough times for the auto industry was enough to impress investors after a string of disappointing years, with the shares having skidded below 90p last autumn, down over 93% since before the pandemic and around 98% over five years.

They have climbed back into at least first gear with these results.

Boosted by inflation, the company achieved a record average selling price of more than £200,000 per vehicle, while wholesale volumes increased just 4% year-on-year to 6,412, though this was lifted by a strong fourth quarter.

Revenue in the final three months of the year was higher than expected, with wholesale volumes increasing 22%.

Executive chairman Lawrence Stroll - well known to viewers of Netflix's F1 drama-documentary series Drive to Survive - said the company ended the year “with significantly improved growth, margin enhancement and positive free cash flow in Q4, exiting 2022 with the strongest order book in many years”.

For 2023 he expects to deliver “significant growth in profitability”, primarily driven by an increase in volumes and higher gross margin, with positive free cash flow in the second half of the year.

Market analyst Joshua Warner at City Index tipped his hat at the company successfully navigating a very tough year, including component shortages and supply chain disruption.

"The outlook is improving. Aston Martin is aiming to deliver 7,000 vehicles in 2022, which was just short of the 7,350 forecast by analysts. However, investors should not be concerned with the miss considering Aston Martin said its sharpened focus on profitability will allow it to achieve its financial targets with significantly lower volumes than previously thought.

"That is a big deal considering Aston Martin has disappointed shareholders with numerous profit warnings since it went public back in 2018."