Proactive Investors -

- FTSE 100 posts modest gains ahead of US inflation data

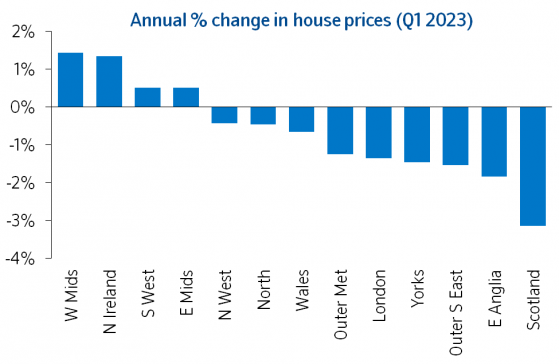

- UK fourth quarter GDP revised upwards, house prices fall

- Eurozone inflation eases in March, beats forecasts

Eurozone inflation eases in March, beats forecasts

Eurozone inflation has fallen sharply to its lowest level for a year in March following a decline in energy costs.

Harmonised consumer prices in the euro area rose 6.9% year-on-year, down from 8.5% in February to reach its lowest level since February 2022. The figure was better than forecasts for a dip to 7.1%.

Euro area #inflation at 6.9% in March 2023, down from 8.5% in February. Components: food, alcohol & tobacco +15.4%, other goods +6.6%, services +5.0%, energy -0.9% - flash estimate https://t.co/JanK9NcMzB pic.twitter.com/WzYZfXCEeM— EU_Eurostat (@EU_Eurostat) March 31, 2023

The decline was driven by a 0.9% fall in energy prices

EMIS tumbles as CMA launches further probe into United Health deal

Shares in Emis Group Plc (LON:EMISG) plunged after the UK's competition watchdog referred its planned acquisition by UnitedHealth (NYSE:UNH) Group for an in-depth investigation.

The Competition and Markets Authority said on the basis of information currently available this merger may be expected to result in a substantial lessening of competition within a market or markets in the UK.

Therefore it has launched a phase 2 investigation into the deal.

In a statement Emis, a Leeds-based healthcare software producer said UnitedHealth's had proposed a remedy to the CMA of selling Optum UK's Medicines Optimisation and Population Health businesses in the UK.

But the CMA rejected this idea noting that it would not "achieve as comprehensive a solution as is reasonable".

In June last year, Emis had said it had agreed to a £1.24bn takeover offer by Optum Health Solutions UK, which is a subsidiary of Minnesota-based healthcare and insurance firm UnitedHealth.

Emis shares fell 22% in London on Friday morning following the announcement.

British Airways owner lifted by Deutsche upgrade

Deutsche Bank (ETR:DBKGn) has has upgraded a number of European airlines including British Airways owner, International Consolidated Airlines Group (LON:ICAG).

The German bank thinks the outlook for the sector has materially improved and as a result has raised IAG, Air France-KLM (LON:0LN7) and Deutsche Lufthansa (ETR:LHAG) to buy from hold.

The broker lifted its price target for IAG to 200p from 180p, for Air France to €2.3 from €1.75 and for Deutsche Lufthansa to €14 from €10.5.

Analyst Jamie Rowbotham said despite exercising prudence on yields, on non-fuel unit costs and on oil itself "we nonetheless see the potential for operating profits in 2023 to now be >20% higher than we previously envisaged, and ~18% above current Bloomberg consensus estimates on average."

Shares in IAG rose 1.9%, Air-France jumped 3.2% and Deutsche Lufthansa firmed 2%.

Read more on Proactive Investors UK