Proactive Investors -

- FTSE 100 falls sharply, inflation rises in France and Spain

- Ocado Group tumbles as Ocado Retail posts loss

- UK food inflation at new high of 17.1% - Kantar

Ocado "so much promise and so little joy"

Shares in Ocado Group are now down more than 10%. Russ Mould at AJ Bell described the firm, as offering "so much promise and so little joy."

"Three years ago, it was on the cusp on a significant shift in consumer behaviour. The pandemic forced people to buy their groceries online, meaning any company that didn’t have a robust set-up to pack and deliver food and drink to households had to think fast to gain this capability," he noted.

“Ocado had the best moment in its existence to sell its technology platform to grocers around the world. Sadly, the deals have been few and far between, leaving investors wondering when it will ever make a sustainable profit."

He was scolding on the figures saying they are as "appetising as a bucket of sick."

"Revenue growth has ground to a halt, pre-tax losses are getting worse and net debt has ballooned."

He feels the "retail joint venture with Marks & Spencer looks stuck in the mud."

"Consumers are pulling back from doing big shops which is problematic for Ocado. It’s more cost and time efficient to fill a van with a big customer order than lots of little ones, so the shift in shopping behaviour creates a headwind."

“Ocado has long argued that it needs to spend money to make money, but patience is wearing thin for the long-suffering shareholders," Mould concluded

Shares in Ocado were down 10.4% at 560p each in London Tuesday while the FTSE 100 has conceded the 7,900 mark, at 7,896.85, down 38.26 points.

Inflation rises in Spain and France

Inflation is never far away from investor’s minds and news today in Europe and the UK suggests pricing pressures aren’t going away as fast as hoped.

Inflation figures in Spain and France both rose in February while the latest grocery price survey from Kantar in the UK showed food price inflation hit a record high, up 17.1%.

Over in France, consumer price inflation stood at 6.2% in February, up from 6% in January, as a result of accelerating food and services prices.

French CPI (Y/Y) Feb P: 6.2% (est 6.1%; prev 6.0%)- French CPI EU Harmonised (Y/Y) Feb P: 7.2% (est 7.0%; prev 7.0%)

- French CPI (M/M) Feb P: 0.9% (est 1.0%; prev 0.4%)

- French CPI EU Harmonised (M/M) Feb P: 1.0% (est 1.0%; prev 0.4%)

— LiveSquawk (@LiveSquawk) February 28, 2023

The harmonised index, which is important for the ECB, stood at 7.2% compared to 7% in January. Month-on-month, consumer prices rose by 0.9% compared to 0.4% in January.

ING Economics said the data indicates, “that French inflation has still not peaked.”

“Both headline and core inflation are likely to continue to rise in the coming months, giving the ECB further reason to continue raising rates beyond the first quarter.”

“It will probably take until the second quarter to see the peak in inflation in France and until the summer to see inflation really come down,” ING forecast.

In Spain, inflation rose in February to 6.1% from 5.9% last month. Harmonised inflation followed the same move to 6.1% from 5.9% in January. Core inflation reached 7.7% in February from 7.5% last month, it has has now risen continuously for 22 consecutive months.

Spanish CPI (Y/Y) Feb P: 6.1% (est 5.8%; prev 5.9%)- Spanish CPI EU Harmonised (Y/Y) Feb P: 6.1% (est 5.7%; prev 5.9%)

- Spanish CPI (M/M) Feb P: 1.0% (est 0.7%; prev -0.2%)

- Spanish CPI EU Harmonised (M/M) Feb P: 1.0% (est 0.9%; prev -0.4%)

— LiveSquawk (@LiveSquawk) February 28, 2023

ING expects Spanish inflation to be around 4.3% for the full year 2023, reaching 2.7% by the end of the year.

“It will probably take until the second half of 2024 for headline inflation to return to the ECB's 2% target,” it predicted.

ING still expects growth of 1.3% in Spain in 2023, but with ECB rate hikes on the way it forecast Spanish economic growth would fall to 0.8% in 2024.

Pricing pressures remain in Europe

London’s blue chips made a weak start on Tuesday with Ocado Group PLC top of the fallers after reporting widened full year losses as its Ocado Retail joint venture swung into the red.

At 9.00am the FTSE 100 was at 7,908.38, down 26.73 points, or 0.34%.

Equities were further hit by strong inflation figures in France and Spain which raised fears that pricing pressures are not falling as fast as hoped. French CPI edged higher to 6.2% in February from 6% in January, just ahead of consensus forecasts of 6.1%. In Spain, inflation also rose in February to 6.1% from 5.9% last month.

Pantheon Macroeconomics noted the increase in the headline rate in France was not driven by higher energy inflation but by higher food inflation and a rise in the core rate.

Rising food prices were also evident in London as Kantar latest figures showed grocery inflation hit 17.1% in the four weeks to 19 February, the highest level ever recorded by Kantar, with households facing an £811 increase to their average annual bill if they buy the same items.

Adding to the food retail theme, Ocado Group tumbled 7% after reporting wider full-year losses.

The firm said revenue was broadly flat at £2.5bn in the 12 months to 31 December 2022, up 0.6%, with strong growth in Solutions revenue offset by a decline at Ocado Retail. Ocado Retail's revenue fell 3.8% to £2.2bn, with robust customer growth offset by lower value baskets.

But pre-tax losses at the online food retailer widened to £501mln compared to £176.7mln in 2021 due to rising costs and investments made at Ocado Retail and £349mln depreciation and amortisation.

Ocado Retail, a joint venture between Ocado Group and Marks and Spencer Group PLC, posted an EBITDA loss of £4mln compared to a profit of £150.4mln in 2021.

Sophie Lund-Yates at Hargreaves Lansdown said: “Ocado Retail has seen losses mushroom. Despite a 13% increase in active customers, volumes haven’t followed suit, meaning the cost to serve all those online orders has become a burden.”

“Ocado is in the eye of the cost-of-living storm because its offering isn’t synonymous with being the best value, it’s a higher-end option, without the same benefits of enticing people in with tangible, physical goods like M&S or Waitrose can.”

“One quarter of British shoppers are struggling as grocery price inflation goes above 17% for the first time, according to new data from Kantar. It was a year ago that food inflation climbed above 4%, meaning consumers now feel like there’s a hole in their wallet every time they reach the checkout,” he pointed out.

Leading the FTSE 100 risers was St James’s Place PLC where shares rose 3% after results.

Peel Hunt said the numbers were, “slightly ahead of consensus, with good progress towards five year strategy.”

While in the FTSE 250 top billing was taken by Man Group PLC which surged 6.7% after forecast busting results.

Core EPS of 48.7c beat consensus of 44.3c while core performance fee pre-tax profits of US$489mln beat consensus of US$438mln.

Food inflation hits new high, up 17.1%

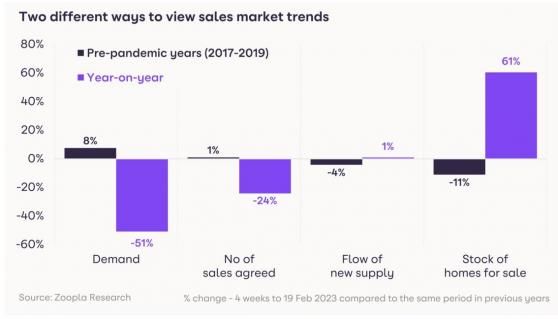

Grocery price inflation has risen again to 17.1% in the four weeks to 19 February 2023, the highest level ever recorded by Kantar, with households facing an £811 increase to their average annual bill if they buy the same items.

Fraser McKevitt at Kantar said: “Shoppers have been facing sustained price rises for some time now and this February marks a full year since monthly grocery inflation climbed above 4%. This is having a big impact on people’s lives.”

“Our latest research shows that grocery price inflation is the second most important financial issue for the public behind energy costs, with two-thirds of people concerned by food and drink prices, above public sector strikes and climate change.”

Aldi pushed its market share to a new record this period hitting 9.4%.

It remains the fastest growing grocer, with sales up by 26.7%, closely followed by Lidl which increased sales by 25.4% taking its market share to 7.1%.

Frozen food specialist Iceland also won share, taking 2.4% of market sales, up from 2.3% last year as spending through its tills increased by 10.8%.

Ocado put in a strong performance, bucking the overall trend in online sales. While online fell by 0.9% over the 12 weeks, the digital specialist grew sales by 11.3% to achieve its largest ever market share of 1.9%.

Tesco edged slightly ahead in the battle between Britain’s biggest retailers, with sales up by 6.6%. Sainsbury’s and Asda were just behind with sales rising by 6.2% and 5.9% respectively. Morrisons’ sales decline of 0.9% was its best performance since May 2021.

Waitrose returned to growth, nudging up sales by 0.7%. It has a market share of 4.7%. Convenience retailer Co-op increased sales by 3.4% while independents and symbols were up by 1.8%.