Proactive Investors -

- FTSE 100 down 41 points

- Royal Mail (LON:IDSI) owner IDS falls after losses

- Halma (LON:HLMA) and Spirax drop

12.38pm: Hefty borrowing increase helps pull pound lower

The pound has slipped further over the course of chancellor Hunt's autumn statement, which lasted around 53 minutes and unveild £55bn of tax rises and spending cuts.

It was down 0.69% at US$1.1831, having been down 0.54% at the start of the speech following the forecasts of a hefty increase in government borrowing.

The UK is forecast to borrow £177bn or 7.1% of GDP this financial year, up from an expectation of £98bn back in March.

???? Borrowing will hit £177bn this year and drop to £140bn, Hunt confirms. It's still £69bn by 2027/28. In March, the OBR reckoned borrowing would fall to £31.6bn in 2026/27. Big GDP downgrade is whacking revenues hard— Jack Barnett (@__JackBarnett) November 17, 2022

Meanwhile the FTSE 100 was barely moved by the announcements, down 41.9 points or 0.57% at 7309.29.

12.10pm: Business rate support package

A revaluation of properties for business rates will go ahead, but there will be a support package to help companies in the current difficult times.

Businesses are struggling with prices rising and growing uncertainty.This is why the government is providing a £13.6bn package of business rates support, to help businesses through these tough times. #AutumnStatement pic.twitter.com/zuxalJ7RgF

— HM Treasury (@hmtreasury) November 17, 2022

11.59am: Energy shares down

Energy shares are lower after the chancellor extended the energy windfall tax, saying he has no objection to such taxes if they genuinely are about windfall profits.

Hunt said: "From January 1st until March 28 we will increase the energy profits levy from 25% to 35%.

"The structure of our energy market also creates windfall profits for low carbon electricity generation. So from January 1st we’ve decided to introduce a new temporary 45% levy on electricity generators. Together these measures raised £14bn."

Drax Group (LON:DRX) is down 4.04%, SSE PLC (LON:SSE) is off 3.19% and Centrica PLC (LON:CNA) is off 1.52%.

11.50am: GDP to fall by 1.4% next year - OBR

Unlike Kwasi Kwarteng's mini-budget, this statement is accompanied by forecasts from the Office for Budget Responsibility.

One of those is that the OBR expects inflation to be 9.1% this year and 7.4% next year. As a reminder it is currenty 11.1%.

It says the UK is now in recession. This year the OBR expects growth of 4.2% compared to a 3.8% rise forecast in March.

Next year GDP is expected to fall by 1.4% then rise by 1.3% a year later.

Our November 2022 GDP growth forecast. Full forecast published after the Chancellor’s #AutumnStatement speech pic.twitter.com/U1iKT9KFaC— Office for Budget Responsibility (@OBR_UK) November 17, 2022

11.42am: US markets set for weak start

US stocks are expected to open lower with the feel-good factor from news of easing inflationary pressures dented by worrying earnings from the likes of retailer Target (NYSE:TGT) and a pick-up in retail sales.

The mixed picture of the wider economy emerging from the latest data and earnings appears to suggest that there will be further US interest rate increases in the current cycle even if a recession is likely.

Futures for the Dow Jones Industrial Average were down 0.5% in pre-market trading, while those for the S&P 500 were also 0.5% lower, and contracts for the Nasdaq-100 shed 0.4%.

“Better-than-expected US retail sales didn’t please investors yesterday, as it fuelled, again, inflation expectations,” noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The higher inflation expectations fuelled the hawkish Federal Reserve expectations and in turn recession worries, she added.

Advanced retail sales for the month of October increased by 1.3%, topping expectations of a 1.2% increase. Excluding autos, the figure was also 1.3%, ahead of expectations of 0.6%.

“Sour earnings from Target, which highlighted that nice-to-have stuff like clothes and electronics didn’t sell well in the latest quarter, because of rising prices, didn’t help lift investor mood,” said Ozkardeskaya.

Meanwhile, highlighting the recession theme, JP Morgan economists have said they expect the US to enter a mild recession next year because of rising interest rates and the tightening monetary conditions.

Elsewhere, the prospect of slower global economy, along with the de-escalation of geopolitical tensions on news that the rockets that hit Poland this week probably landed by accident, pulled oil prices lower.

11.39am: Markets wary as Hunt speaks

As chancellor Jeremy Hunt stand to deliver his statement, here is the state of play.

The FTSE 100 is down 40.25 points or 0.55%, and the pound is off 0.54% against the dollar at US$1.1849.

In the gilt market, the 5 year yield is up 0.038% at 3.214%, the 10 year is 0.036% ahead at 3.182% while the 20 year is 0.056% higher at 3.523%.

11.08am: Eurozone inflation continue to rise

Over in the eurozone and inflation continues to surge although it has come in lower than initially expected..

The euro area annual inflation rate was 10.6% in October 2022, up from 9.9% in September, according to Eurostat.

This is the highest rate since the introduction of the euro 23 years ago, but is a little less than the flash reading of 10.7%. A year earlier, the rate was 4.1%.

Euro area annual #inflation up to 10.6% in October https://t.co/43xXMIkUrz pic.twitter.com/m7oFZ7ZdIJ— EU_Eurostat (@EU_Eurostat) November 17, 2022

In the European Union as a whole, annual inflation was 11.5% in October 2022, up from 10.9% in September. A year earlier, the rate was 4.4%.

10.32am: Chancellor keen not to spook the markets

Markets are drifting as investors wait for the autumn statement later this morning, but remain in the red.

The FTSE 100 is down 26.74 points or 0.36% at 7324.45, while the mid-cap FTSE 250 is 0.26% lower at 19,062.08.

The chancellor will be hoping to placate the markets and not repeat the chaos following Kwasi Kwarteng's mini budget, said AJ Bell investment director Russ Mould

“If the mini-budget was what made the UK economy and its assets sickly, today is the day on which some painful medicine is delivered in the form of the Autumn Statement..

“By trailing many of the measures Chancellor Jeremy Hunt has gone out of his way to avoid any surprises, with the key aim to placate international investors in gilts and the pound. These are the markets the government will be watching as they look to gauge the reaction."

Here's a rundown of some of the things to expect from Hunt's statement.

10.15am: Hunt warns of difficult decisions to restore stability

The Treasury has released a video ahead of the autumn statement, with chancellor Jeremy Hunt warning of difficult decisions but promising to build a stronger economy and "look after our most vulnerable."

The UK is facing the effects of the global economic crisis.Difficult decisions need to be taken now to drive down inflation - the hidden tax eating into household budgets.

The Cabinet has set out why we are prioritising stability, growth and public services ⬇️ pic.twitter.com/VOUg5AMBeh

— HM Treasury (@hmtreasury) November 17, 2022

9.50am: Pound loses early gains against the dollar

The slide continues although there is nothing too dramatic ahead of the chancellor's autumn statement measures.

The FTSE 100 is currently down 40.63 points or 0.55% at 7310.56.

The leading faller at the moment is Ocado Group PLC (LON:OCDO), down 5.29% as it continues its recent weakness.

Both Halma PLC (LON:HLMA) and Spirax-Sarco Engineering have fallen back following their latest update, down 5.02% and 4.7% respectively.

The pound climbed to as high as US$1.958 against the dollar but is now down 0.27% at US1.1881.

But it is virtually flat against the euro at €1.1463.

9.20am: Autumn statement all about restoring credibility

There may not be any major surprises in the autumn statement, says Neil Wilson at Markets.com.

"The messaging from the Treasury thus far has been very clear – heapings of fiscal discipline and lashings of austerity, no uncosted borrowing," he said. ".. It’s about restoring credibility in the financial markets and very little else. A surprise or two? Chancellors love to pull a rabbit or two out of the hat and fiscal credibility goes hand in hand with winning the next the election as far as the Tories go, so it might not be as horrendous as some of the various test balloons floated by the Treasury in recent weeks would suggest.

"A credibility premium, though, is worth more right now and the surprises will be saved up for next year ahead of the election…when they can apply some soothing tax cuts and say they could only do that because of the difficult steps taken in 2022."

Susannah Streeter, senior invesment and markets analyst at Hargreaves Lansdown (LON:HRGV), agrees the statement needs to restore credibility after the chaotic mini-budget.

But there is a risk the measures could hamper economic recovery.

She said: "The UK government’s Autumn Statement will mark a complete about turn from the Truss administration’s plans for a sugar rush boost to growth through tax cuts which sparked mayhem on bond markets and saw the UK’s risk premium shoot up. Gilt yields have come down significantly since the September scare which threatened to destabilise the UK financial system, and the Sunak administration is desperate to hold onto credibility.

"By taking all these steps the government hopes to fill in the fiscal ‘black hole’ which has emerged because successive Conservative ministers have said they want to see net debt falling by 2025-2026. Sunak and Hunt are trying to dance to a tune they think the bond markets are playing, but by keeping so strictly to their perceived rules, they risk playing it too safe, and pushing the prospects of economic recovery far into the distance.‘’

8.54am: Halma falls after update

Safety equipment firm Halma PLC (LSE:HLMA) is high among the fallers in the leading index after underwhelming half year results.

Pretax profits dropped 13% to £145.5mln, although the decline was due to a gain on disposal last year of £34mln which was not repeated.

It also said half year revenues had reached record levels, its order book was strong and it was on track for further progress in the second half.

Its shares however have fallen 3.36% following the update.

Elsewhere Hargreaves Lansdown PLC (LSE:HL.) is down 1.79% to 855.6p after analysts at RBC cut their recommendation from outperform to sector perform.

They also reduced their price target from 1650p to 1050p, but this is still much higher than the current market price.

Overall the FTSE 100 is now down 24.66 points or 0.34% to 7326.53.

Victoria Scholar, head of investment at interactive investor said: “European markets have opened mostly higher with the DAX outperforming thanks to strong results from Siemens while the FTSE 100 is lagging behind, trading below the flatline [ahead of the autumn statement]."

Just over 6 points of the decline can be attributed to companies seeing their shares go ex-dividend, including Pershing Square (NYSE:SQ) Holdings which is down 1%.

8.34am: US Fed members hawkish on rate rises

The hawkish signals from US Federal Reserve officials came thick and fast yesterday.

Kansas City Fed president Esther George cautioned about prematurely ending rate hikes in a Wall Street Journal interview, saying that “the more important question for this committee, looking out over next year, is being careful not to stop too soon”

Mary Daly, president of the San Francisco said it was reasonable to think rates could rise to between 4.75% and 5.25%, with the top end of that range higher than the 4.92% currently priced in by markets.

And Fed governor Christopher Waller said he was becoming more comfortable with the next rate rise being 50 basis points rather than 75 after the more benign inflation readings recently.

But he added that getting inflation down to target would require rate rises into next year: "We still have a ways to go."

8.13am: Markets calm ahead of chancellor's statement

Leading shares have slipped back ahead of the delayed autumn statement, with increased taxes and spending cuts widely expected.

With a decline on Wall Street after poor results from Target (NYSE:TGT) and some hawkish comments from Federal Reserve members, the FTSE 100 is down 11.16 points or 0.15% at 7340.03.

But investors are mainly keeping their powder dry until chancellor Jeremy Hunt has made his pronouncements.

Ipek Ozkardeskaya, senior analyst at Swissquote, said: "The UK braces for ‘austerity in steroids’ wrote Bloomberg, reminding that Sunak government must fill in a £55bn hole by increasing taxes and cutting spending.

"For investors, though, austerity means a more stable budget, less negative pressure on the sovereign bonds, and an ideally stronger British pound...

"Maybe we won’t see a kneejerk positive reaction right away, because politicians tend to overpromise and underdeliver. But in all cases, we are confident that the budget announcement under Sunak won’t trigger the same chaos as under Liz Truss."

Among the early movers, Royal Mail owner International Distributions Services PLC (LSE:IDS) is down 3.63% after it reported an operating loss of £163mln compared to a profit of £311mln this time last year.

The company was hit by weak parcel volumes, an inability to deliver productivity improvements and the impact of the current industrial dispute.

7.49am: Gilts rise, Sterling stands its ground against US dollar as autumn statement approaches

Today brings the delayed UK autumn budget, with tax policy and spending cuts front and centre of expected policy- it’s just a matter of how much and how severe.

With the Office for Budget Responsibility forecasting an excess of £70bn to the government’s borrowing budget, chancellor Jeremy Hunt’s acknowledged that "we are going to see everyone paying more tax” in a BBC interview, but the government is also wary of hobbling business investment at the risk of stagflation.

Not to mention that adding more pain to the cost-of-living crisis would be both unreasonable and a political own goal.

Yet it comes at a time when 10-year gilt yields just fell to their lowest level in two months while Cable has been making solid gains, indicating at least some optimism in the UK’s economic prospects.

Despite the pair cutting back 20 pips this morning, GBP/USD still holds strong at US$1.189.

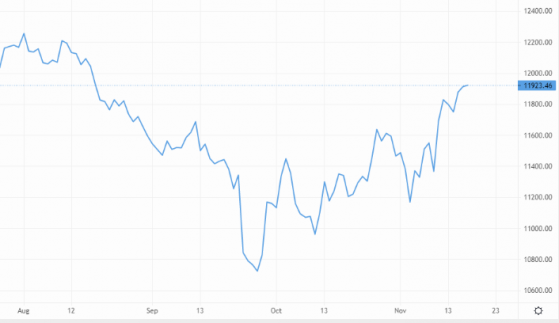

GBP/USD awaits chancellor Hunt’s autumn statement – Source: capital.com

EUR/GBP has been rangebound for the past two weeks and this morning was no different. The pair hit a high of 87.3p this morning before cutting back to 87.15p.

Euro area inflation data is due this morning, with forecasts pointing to a record high of 10.7% year on year.

Against that backdrop, EUR/USD is in an indecisive mood, with the pair cutting back to US$1.036 before inching higher to US$1.039 during this morning's Asia trading session.

7.00am: FTSE 100 seen lower ahead of Autumn Statement

FTSE 100 set to open slightly lower with the chancellor taking centre stage as he delivers his autumn statement which is expected to contain a raft of tax increases and spending cuts.

Spread betting companies are calling the lead index down by around 10 points.

Jeremy Hunt has already warned that some “eye-watering” decisions need to be made on spending cuts and tax increases.

Michael Hewson chief market analyst at CMC Markets UK said: “Over the past few weeks, we’ve heard an array of estimates of the size of the fiscal black hole at the heart of the public finances, ranging from £40bn to £55bn, however this week we got a new one in the form of a higher number, this latest one being £70bn, begging the question as to how big the fiscal hole is.”

“While we know a good proportion of this is due to higher borrowing costs due to high inflation, as well as the potential for a slowdown in the UK economy, it seems odd that the size of the hole has gone up at the same time UK gilt yields have gone down, along with natural gas prices.”

Before that, there will be a busy morning of financial news, including from Royal Mail owner International Distributions Services PLC, which will report half-year results amid a continued uncomfortable atmosphere for investors, management and workers.

Burberry Group PLC (LON:BRBY), Great Portland Estates, Halma PLC and Intermediate Capital Group (LON:ICP) are other companies reporting today.

In the US markets ended a subdued day the wrong side of the line with all three major indices ending in negative territory.

At the close the Dow Jones Industrial Average was down 39 points, or 0.12%, to 33,554, the S&P 500 fell 33 points, or 0.83%, to 3,959, and the Nasdaq Composite dipped 174 points, or 1.54%, to 11,184.

Read more on Proactive Investors UK