Proactive Investors -

- FTSE 100 up 27 points at 7,572

- Wage inflation eases in November

- BT (LON:BT) hit by planned Ofcom contract changes

UK mortgage arrears at six-year high

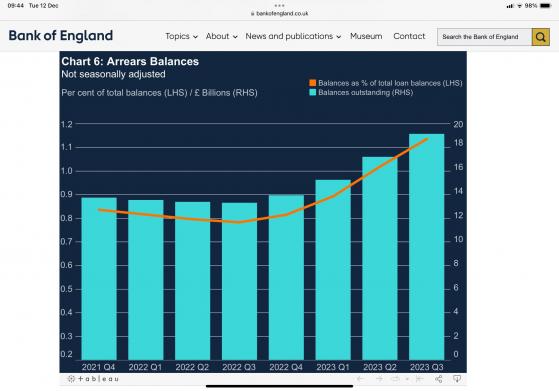

UK mortgage arrears increased to the highest rate in six years in the three months to September, according to data by the Bank of England, in a reversal of a longer-term decline and demonstrating the impact of higher interest rates on household finances.

The proportion of the total loan balances with arrears, relative to all outstanding mortgage balances, rose to 1.14% in the third quarter from 1.02% in the previous three months and the highest since the second quarter of 2017, figures showed.

New arrears cases decreased by 0.3 percentage points from the previous quarter to 15.8% of the total outstanding balances with arrears, but remained 5.1 percentage points higher than a year earlier.

The value of outstanding mortgage balances with arrears increased by 11.4% from the previous quarter, to £18.8 billion, and was 44.0% higher than a year earlier.

However, arrears remain well below their peak rates of 3.64% in the first quarter of 2009.

Copper supply challenges present tactical opportunity, says Morgan Stanley

Morgan Stanley (NYSE:MS) has taken a look into the world of copper and thinks its mounting supply challenges present a tactical opportunity, especially in the miners with better line of sight on 2024 volumes.

It likes the look of Canadian miner, Lundin, which it says “ticks all the boxes”, while Antofagasta/Glencore offer operating leverage, with Sweden’s Boliden looking the least attractive.

The investment bank pointed out that copper's worsening supply outlook continues to gather pace.

In the past two weeks alone, the market has lost >500kt of 2024 projected output, or 2.5% of global supply, across First Quantum (Cobre Panama), Anglo American (JO:AGLJ), Rio Tinto (LON:RIO) and Southern Copper.

It noted that in certain cases, the volume loss extends well beyond 2024 (e.g. Anglo American), but is far less clear in others such as First Quantum.

MS explained that First Quantum's and Anglo American's challenges have likely prompted many investors to look elsewhere for copper exposure, magnifying the scarcity aspects of pure-play equities.

“As such, the growing pool of capital is now chasing an ever smaller universe of copper-exposed equities, which are perceived to have better line of sight on 2024 volumes,” it said.

Against this backdrop, the recent equity re-rating impetus may have further room to run. and shift the bargaining power to the miners, the bank suggested:

It thinks the tightening concentrate supply and demand is shifting the bargaining power towards the miners at the expense of the smelters.

The bank thinks Antofagasta (LON:ANTO) (equal weight) offers upside risks as a pure-play with 2024 volume growth and low jurisdictional risks, although it already “prices in a lot.”

Among diversifieds, Glencore (LON:GLEN) (equal weight) may benefit vs peers given sizeable copper exposure (30% of 2024 spot EBITDA) while its equity valuation is “reasonable.”

PRA outlines tighter capital rules for lenders

It is turning to the day of the regulator.

Not to be outdone by the CMA and FCA , the Prudential Regulation Authority has outlined how it plans to impose tighter capital rules on lenders.

It has made a number of adjustments that it says will moderate the impact of the measures, known as the Basel 3.1 standards.

It estimates that the impact of Basel 3.1 requirements will be low and result in an average increase in Tier 1 capital requirements for UK firms of around 3% once fully phased in (ie in 2030).

The PRA pointed out this is lower than the European Banking Authority’s estimate of a Tier 1 increase of around 10% in the EU and the US agencies’ estimate of a CET 1 increase of around 16% for US firms.

The rules will promote the safety and soundness of the firms the PRA regulates and make capital ratios more consistent and comparable, it said.

Miners support FTSE, JPM upgrades Rio Tinto

The FTSE 100 continues to forge ahead with mining stocks supporting the rise.

JPMorgan (NYSE:JPM) has made some positive comments on the sector today, upgrading Rio Tinto to ‘overweight’ from ‘neutral’ and reiterating an ‘overweight’ rating on Anglo American, despite cutting its price target.

“We believe a mixed macro outlook presents an opportunity for investors to re-examine long-term structural themes in the sector, which can drive relative outperformance for select companies,” the investment bank said.

Notably, JPM believes emerging costs of carbon (both explicit & implicit) could drive structural shifts in certain subsectors (aluminium, iron & steel, coking coal) & offer significant opportunities for those miners positioned as either low CO2 producers in high CO2 intensive sectors and incumbents where restrictions could drive supply/demand tightening.

JPM remains ‘underweight ‘ on Antofagasta.

“While we see copper moving to deficit given recent supply cuts, EMEA copper miners screen relatively more expensive with greater idiosyncratic risks,” the broker said.

Shares in Rio are up 1.8%, shares in Antofagasta are up 1.2% and Anglo American is 0.8% to the good.