Proactive Investors -

- FTSE 100 up 11 points to 7,538

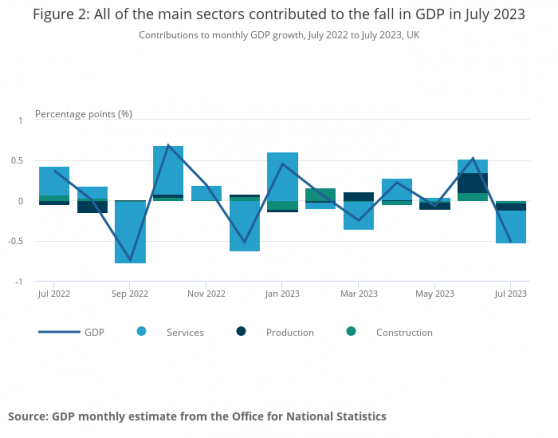

- UK economy contracts more than expected in July

- Aviva (LON:AV) sales raises hopes of shareholder returns

US stocks shrug aside strong inflation figures

US stocks climbed on Wednesday, shrugging off stronger-than-expected inflation figures which economists believe won't change the mindset at the Federal Reserve.

Shortly after the opening bell, the Dow Jones Industrial Average was up 93.39 points, 0.3%, at 34,739.38, the S&P 500 was up 11.59 points, 0.3%, at 4,473.49 while the Nasdaq Composite was up 44.45 points, 0.3%, at 13,818.06.

Andrew Hunter, deputy chief US Economist at Capital Economics thinks the Fed will "look through" the 0.6% m/m jump in headline CPI in August "as it was driven by the recent rally in energy prices."

"Although core prices also rose by a slightly stronger 0.3% m/m, there is little in the report to convince Fed officials that they need to raise interest rates further," he felt.

Apple Inc (NASDAQ:AAPL) was in the spotlight following the iPhone 15 launch event and as China Wednesday that it hasn't released official regulations to stop using foreign electronic devices.

"China hasn't issued any laws, regulations or policy documents banning purchase or use of foreign phones including Apple's iPhones," said Mao Ning, spokeswoman at China's foreign ministry, at a daily briefing.

The Wall Street Journal previously reported that some staff at government agencies were given instructions to stop using iPhones and other foreign-branded devices for work or bring them into the office, according to people familiar with the matter.

Shares eased 0.2%.

Citigroup Inc (NYSE:C) shares rose 0.8% as CEO Jane Fraser announced a corporate reorganisation, saying the move would cut down management layers and accelerate decisions.

Fraser said in a release that Citigroup would be divided into five main business lines that report directly to her.

Previously, the firm had two main divisions catering to consumers and large institutional clients.

CVS falls overdone says RBC

RBC Capital has pointed out CVS Group shares are off almost 30% and Pets At Home is down 8% on last week's news of the CMA market review into the vet practice market.

While CVS is more exposed to potential remedies than Pets At Home, RBC expects these to only be "behavioural at this stage, and think that CVS' exposure is mitigated by its existing online pharmacy, its Healthy Pet Club, and the likely significantly lower margin at its independent competitors that could limit the potential for more harsh changes."

It has lowered its price target by 15% to 1,900p from 2,2000p to account for the sentiment overhang and 'unknown unknowns' that could result from the review.

But it has upgraded the stock to outperform from sector perform as it thinks the shares have fallen too far.

RBC remains remain cautious on Pets At Home, however, as we continue to see downside risk to consensus for the retail division, and think that sentiment may also be challenged by the CMA review.

Shares in CVS are up 0.3% at 1,478p.

FTSE shrugs aside strong US inflation print

The FTSE 100 has pushed back towards opening levels despite slightly stronger-than-expected US inflation figures, now just 3 points lower at 7,525.

The US inflation rate was stronger than expected in August, according to new data posing a fresh dilemma for the Federal Reserve ahead of next week’s policy meeting.

Consumer prices rose 3.7% year on year, according to the Bureau of Labor Statistics, up from 3.2% in July and higher than consensus forecasts of 3.6%. On a monthly basis, prices increased 0.6%.

More than half of the monthly increase was driven by a jump in petrol prices.

Core inflation, which strips out volatile food and energy costs, was a touch above expectations with a month-on-month gain of 0.3% (consensus 0.2%) bringing the annualised rate down to 4.3% (consensus 4.3%) from 4.7% in July.

Neil Wilson at markets.com said the month-on-month rise in core inflation was "a tad hotter than expected and the Fed would have preferred a third +0.2% reading in a row."

"The implication may be that the Fed will be more minded to keep a rate hike on the table for this year even though I still think it will stand pat next week," he added.

John Leiper at Titan Asset Management said the figures contained "mixed messages," in part due to rising gasoline prices which bolstered the headline number.

"However it is reassuring to see core inflation for the year excluding energy and food coming in-line with expectations and 40 base points lower than the prior reading," he said.

He thinks it’s tempting to read too much into the month-on-month data in this "hyper data dependent central bank age but on balance I think this doesn’t move the needle too much."

"We still expect the Fed to hold on rates at the next meeting," he said.

A look at today's biggest rises and fallers

Risers

On the Beach Group shares jumped 13.5% to 118p as it said full-year profit will be at the top end of expectations, reflecting strong growth in bookings.

Fallers

Shares in IOG PLC (LON:IOG) tanked 36% to 1.08p after the company said its “financial position remains challenging” following a fall in the gas rate from its Blythe H2 well in the North Sea.

Medical technology company Belluscura PLC slumped more than 16% lower to 41.5p after it reported a widening of losses in its interim results.