Proactive Investors -

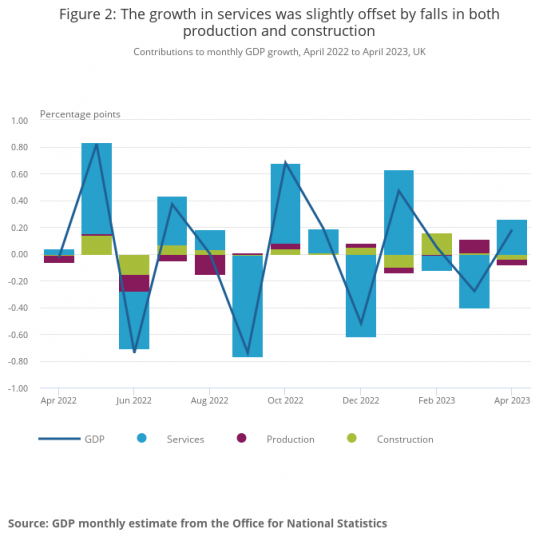

- FTSE 100 edges higher, UK GDP rises 0.2% in April

- Shell (LON:RDSa) to raise dividends, boost buybacks, trim spending

- Entain (LON:ENT) falls after fundung STS deal with discounted placing

UK economy flat-lining

Some reaction to today’s GDP figures:

Samuel Tombs at Pantheon Macroeconomics said: “GDP still is oscillating around a broadly flat trend, despite the recent improvement in many survey indicators of business activity.”

He continues “to expect GDP in Q2 as a whole to be unchanged from Q1.”

“Public sector strikes have continued to rumble on, and the lost working day for the King’s coronation probably inflicted a 0.2pp blow to GDP in May.”

“In addition, consumers’ confidence remains weak and their real disposable income remains under pressure from rapid price rises and refinancing mortgages at higher interest rates,” he pointed out.

Danni Hewson at AJ Bell said: ““There’s a tangled web being woven around the UK economy. On the one hand the fact that a smidgeon of growth has been eked out will be seen as good news, but that very resilience is helping keep inflation simmering too.”

“The jobs market is so tight that even companies considering downsizing are loathe to let any of their staff go and that’s helping create the very wage-price spiral the Bank of England had warned against.”

“People still in jobs have money to spend at pubs and in shops, and they’re still buying cars, even if their hard-earned cash isn’t paying for as many rounds or as many optional extras as it used to.”

Chris Scicluna at Daiwa said: “While yesterday’s data strongly suggested that the UK labour market remains very tight, this morning’s figures provided a reminder that UK economic activity can do little better than flat-line.”

“Sectors that grew in March largely fell back in April, and vice versa, with momentum looking weak across the economy.”

“While much-improved weather in the current month will have supported a rebound, we maintain our forecast that GDP will have failed to grow at all in Q2.”

“And with significant further monetary tightening from the BoE seemingly now in store, the risks to growth over coming quarters look skewed to the downside, with non-negligible risks of recession in 2024 in particular.”

Martin Beck at the EY ITEM Club said: “The likelihood of a weak May for GDP means the EY ITEM Club expects output to be flat or fall slightly in Q2 as a whole, before a firm recovery in Q3.”

“But the EY ITEM Club thinks the recovery will struggle to gain momentum thereafter, given the strong headwinds from still-high inflation and the lagged effects of tighter monetary policy.”

Guy Foster at RBC Brewin Dolphin, said: “UK GDP was in line with expectations – the official data was refreshingly boring, containing few surprises.”

“Nevertheless, the economy still languishes below its size at the end of 2019 and, beyond the services sector, other economic activity remains weak. Across services and productive sectors, the economy generally shrunk having been mostly supportive over recent months.”

“Future UK growth will be impacted by expected weakness in the housing market, driven largely by rising mortgage rates, and the lack of extra activity that can be generated from an economy operating beyond its productive capacity.”

Susannah Streeter at Hargreaves Lansdown (LON:HRGV) said: “The path of rates ahead, and the economy, is still clouded in uncertainty.”

“This is partly because the current reaction on markets could be doing the Bank of England’s job for it.”

“The expectation that rates could head to 5.5% has seen the better mortgage deals whipped away, which will dent the finances of 1.6 million households having to re-mortgage this year and is already set to reduce demand for goods and services.”

Entain pays a full price for Polish expansion

The FTSE 100 remains in the green, up 9 points, at 7,604, ahead of the US rate decision later today and after the UK economy posted marginal growth in April.

Leading the fallers was Entain PLC, down 10.5%, as investors digest the £750mln acquisition of Polish sports-betting operator STS via its Entain CEE joint venture.

The betting firm, which owns Ladbrokes and Coral, funded its part of the deal via a discounted placing raising £600mln at 1,230p, below the closing price on Tuesday of 1,321p.

Matt Britzman, equity analyst at Hargreaves Lansdown explained: “There’s some maths to the price drop, new shares will be issued that represent 8.3% of the ordinary share capital prior to this announcement – diluting the holdings of any investor not able to take part in the raise.”

But there were also question marks over the price paid by Entain.

Analysts at Davy think the price paid “looks relatively full” at 13.8x 20222 Ebitda, particularly in the context of Entain’s valuation.

Britzman agreed. “The price is a sticky point, and potential cost synergies of £10mln in the grand scheme of things are pretty thin.”

“The £750mln total cost values STS at 11 times its expected cash profit (EBITDA), that’ll drop to below 10 if the synergies are delivered – but still, that’s likely to be ahead of Entain’s current valuation. There’ll be plenty of pressure to make this work.,” he reckoned.

On the more positive side, analysts at Davy said Entain is acquiring a number-one sports operator (c.40% share) in an attractive market in a sector where scale is essential, it said.

Peel Hunt agreed. “Entain does deal after deal, the cumulative impact is material but under-appreciated,” the broker said.

“In our view, Entain is right to pay up to achieve market leadership; acquiring both growth and diversification.”

Britzman also felt strategically “the deal makes sense.”

“It continues the expansion into fast-growing regions and leverages many of Entain’s existing capabilities.”

Read more on Proactive Investors UK