Proactive Investors -

- FTSE 100 up 52 points at 7,654

- ONS revises up previous estimates of UK GDP

- Severn Trent (LON:SVT) raises £1 billion, plans £12.9 billion investment

Eurozone inflation cools more than expected

Consumer price inflation in the eurozone is expected to cool to 4.3% in September, more than expected, according to a flash estimate from Eurostat.

Inflation is expected to slow to a 4.3% annual rise in September from a 5.2% rise in August. Markets had expected the flash estimate to predict a 4.5% rise this month.

Euro area #inflation at 4.3% in September 2023, down from 5.2% in August. Components: food, alcohol & tobacco +8.8%, services +4.7%, other goods +4.2%, energy -4.7% - flash estimate https://t.co/kEf2Z9hOkH pic.twitter.com/SLY2o2CWEc— EU_Eurostat (@EU_Eurostat) September 29, 2023

On a monthly basis, Eurostat said the inflation rate is expected to cool to a 0.3% rise in September from a 0.5% rise in August.

Core inflation, which excludes energy, food, alcohol and tobacco, is expected to rise 4.5% on an annual basis in September, slowing sharply from a 5.3% rise in August.

Markets expected core inflation to cool to 4.5%.

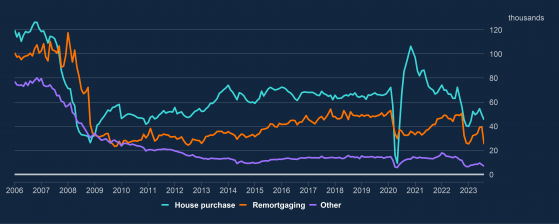

Mortgage approvals at six month low

UK mortgage approvals have fallen to their lowest level in six months, the latest sign that the Bank of England's rate rising spree has punctured the housing market.

The Bank of England said that net mortgage approvals for house purchases fell from 49,500 in July to 45,400 in August.

That’s the lowest number of home loans approved by lenders since February this year, and below the 47,400 consensus.

Net approvals for remortgaging saw “a significant decline” from 39,300 in July to 25,000 in August, the lowest since July 2012, the Bank said.

The ‘effective’ interest rate, the actual interest paid, on newly drawn mortgages saw a 16 basis point increase and now sits at 4.82%.

Net borrowing of consumer credit by individuals amounted to £1.6 billion in August, up from £1.3 billion in the previous month while households withdrew £0.3 billion from banks and building societies in August, following two consecutive months of net deposits.

Aston Martin motors as Stroll ups stake

Aston Martin Lagonda Global Holdings PLC (LON:AML) shares revved up on Friday morning, as Lawrence Stroll’s Yellow Tree Consortium upped its majority stake in the luxury manufacturer.

Yellow Tree agreed to purchase an additional 26 million shares in the company on Tuesday, lifting its holding by 3.27% to 26.23%, Aston Martin said in a statement.

Led by the Canadian businessman, Yellow Tree had initially built a majority stake in 2020, seeing Stroll become Aston Martin's executive chairman.

“The company has delivered a major turnaround since the Yew Tree Consortium's initial investment three years ago,” Stroll commented.

Shares are 11.6% at 291.40p.