Proactive Investors -

- FTSE 100 climbs, up 18 points at 7,435

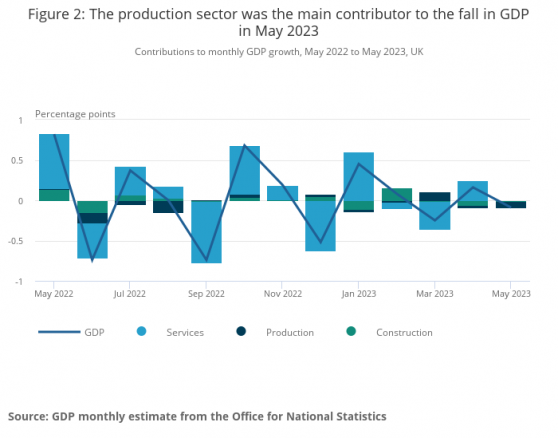

- UK economy contracts in May but beats City forecasts

- Pound hits 15-month high after weak US inflation data

UK national debt could hit 300% of GDP by 2070s warns OBR

The UK’s national debt could hit 300% of GDP by the 2070s as the aftershocks of the events of early 2020s continue to take their on public finances, the Office for Budget Responsibility has warned.

In its latest Fiscal Risks and Sustainability Report, the OBR warned public finances have come under growing pressures, due to the Covid-19 pandemic, rising health-related economic inactivity from 2020, the energy price shock, and now rising interest rates.

Our updated long-term projection sees debt surpass 300% of GDP in 50 years’ time.And it would go even higher if rising debt pushes interest rates up further or shocks over the next 50 years prove to be as frequent and costly as those over the past two decades#OBRfiscalrisks pic.twitter.com/w2tQ8x5Awp

— Office for Budget Responsibility (@OBR_UK) July 13, 2023

These challenges have already pushed UK public debt above 100% of GDP in May and the OBR reckons that the national debt could triple, as a share of the economy, within 50 years.

“Against this more vulnerable backdrop, an ageing society, a warming planet, and rising geopolitical tensions no longer loom in the distance but pose significant fiscal risks during this decade, and could push debt above 300 per cent of GDP by the 2070s.”

The OBR cites three key threats to the public finances: the aging baby boomers, global heating, and rising security threats.

As the ‘baby boom’ cohorts enter retirement and high inflation ratchets up the cost of the triple lock, state pension spending is expected to be £23bn (0.8% of GDP) higher in 2027-28 than at the start of the decade; rising take-up of electric vehicles is forecast to cost £13bn year in forgone fuel duty by 2030, and increased defence spending is seen costing an extra £13bn.

Pound jump as peak in the US rates seen near

Sterling continued to rise, hitting a 15-month high, as weaker-than-expected US inflation figures increased expectations that interest rates were close to peaking across the pond.

This is in sharp contrast to the UK where the Bank of England is expected to continue hiking rates as it battles stubborn domestic pricing pressures.

The headline US CPI figure showed annual growth of 3.0%, the lowest level since April 2021, while core inflation - which excludes items such as food and energy - was 4.8% in June, down from 5.3% in May.

Both figures were better than Street expectations.

The US central bank is still likely to raise rates at its July meeting but the expectation is this could be the last increase of this monetary tightening cycle.

A rate hike on July 26 remains the most likely outcome but the end of its hiking cycle is "in sight", Ebury analyst Matthew Ryan believes.

But in the UK, with inflation stuck at 8.7%, there remains plenty for the BoE to do to get the figure down to its 2% remit.

JP Morgan has warned rates could rise as high as 7% although the market is currently pricing in a peak around 6.5% compared to the current level of 5%.

This divergence helps explain the strength in the pound and the weakness in the dollar with sterling up a further 0.54% today at US$1.3057.

Hays reports fall in UK hiring

Hays PLC (LON:HAYS) reported a 7% drop in fees in the UK & Ireland in a further sign the UK jobs market may be slowing down.

The recruitment firm said overall net fees fell 2% in the quarter to June 30, the fourth quarter of its financial year.

In the UK & Ireland, which makes up around 20% of the group total, temp fees were flat, however tougher conditions saw permanent placements drop 15% as activity levels slowed.

Hays expects full-year operating profit in line with market expectations of £196.2mln.

Shares fell 1.4% while Pagegroup shares eased 1.0%.

On Tuesday, figures showed a rise in the unemployment rate to 4.0% and a drop in vacancy numbers.