Proactive Investors -

- FTSE 100 down 13 points to 7,514

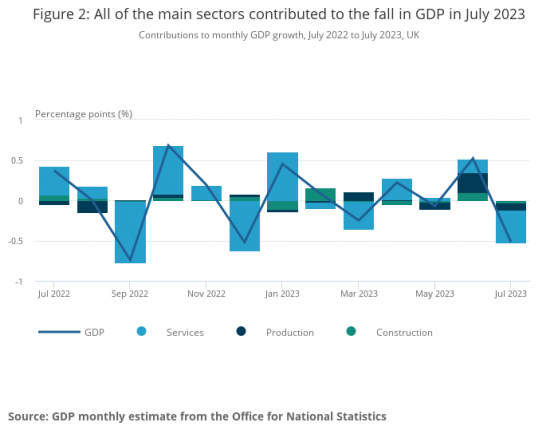

- UK economy contracts more than expected in July

- Housebuilders jump on hopes for lower peak in rates

City takes BP departure in its stride

The City has taken bews of the resignation of BP's chief executive Bernard Looney in its stride with shares down around 0.8%.

UBS said it expects a small negative reaction to this unexpected announcement given his track record and the uncertainty.

"This is mitigated in our view by the fact that CFO Auchincloss, who has been in his role since 2020 as well, has been an integral part of the elaboration of the strategy, providing continuity," it said.

But the Swiss bank pointed out Looney's departure was not related to performance or the strategy and he leaves the company in a "strong financial position and with a clear strategic direction."

The bank highlighted Auchincloss and chairman Helge Lund as likely leading internal candidates for the role.

Barclays (LON:BARC) said the news could actually see shares go higher.

"We have seen this before with bp and, as when Lord Browne resigned in 2007, the potential for value realisation to be accelerated is set to come into focus," it said.

"As such we think the share price reaction could be positive."

Russ Mould at AJ Bell believes that "assuming this is largely the end of the matter, even if an investigation by legal counsel remains ongoing, and chief financial officer Murray Auchincloss can lead the company through the transition to a new leader, then little harm may be done to the business."

But he cautioned: "The nagging worry is that this is the tip of an iceberg and is reflective of wider problems with BP’s workplace culture."

"Given this uncertainty, it may be a few weeks before shareholders are sitting comfortably again," he felt.

Housebuilders jump on hopes for lower peak in rates

Housebuilders have jumped following today's weak GDP figures which investors believe could see interest rates peaking at a lower level than previously expected.

Rising mortgage rates have dented activity in the housing market prompting sharp falls in housing sales.

Redrow (LON:RDW) was the latest builder to highlight the tough market reporting the sales market over the summer has been “challenging,” which resulted in sales per outlet per week for the first 10 weeks of the new financial year of 0.34, down from 0.61 the year before.

Matthew Pratt, chief executive said: “Cost of living and mortgage affordability continue to have a negative impact on the market.”

Housebuilders are pinning their hopes that a stabilisation in interest rates and mortgage rates will bring some confidence back to the depressed market.

The City certainly seems to think so - today at least.

In the FTSE 100, Persimmon PLC (LON:PSN) is the top riser, up 2.7%, closely followed by Taylor Wimpey PLC (LON:TW.), Barratt Developments (LON:BDEV) and Berkeley Group PLC (LON:BKGH).

Over in the FTSE 250, Redrow was 3.9% higher despite warning profit could halve in the coming year while Bellway (LON:BWY) was 2.2% to the good.

Pound falls after weak growth figures

The pound has fallen a touch after the GDP figures as stategists forecast continued slow growth in the UK.

Societe General's Kit Juckes notes the fall in GDP comes on the yesterday’s employment data which showed that public sector employment is rising while private sector employment is falling.

"The public finances won’t be able to sustain the rise in public sector employment for long, so weaker growth is here to stay," he thinks.

"Pessimism about the UK economy, and indeed about sterling, is nothing new, but this time around, the headwinds seem more serious because interest rate trends and (unusually) positioning are unhelpful," he explained.

"Today’s data do nothing to suggest that’s changing," he added, pointing out the market prices almost 2 25bp rate hikes by the BoE in the remainder of this year, compared to one by the ECB and none by the Fed.

Oil price extends gains

The oil price has continued to gain traction with Brent crude up a further 0.5% to $92.46 today, creeping ever close to $100.

Fiona Cincotta, senior financial markets analyst, City Index said the gains were boosted by tight supply and OPEC forecasting an expected supply shortfall in the coming quarters.

She noted according to the latest data published by OPEC, global oil markets face a shortfall of over 3 million barrels per day in the coming quarter, which could potentially be the largest deficit in more than a decade.

She noted high oil prices threaten to bring renewed inflationary pressures to the global economy with prices rising and American Airlines (NASDAQ:AAL) warning of increased costs.

However, the rise in crude oil prices could be limited as investors looked ahead to US inflation data and amid signs of a build in inventories, she suggested.

“Data from the API showed that crude oil inventories rose 1.2 million barrels in the week to Sept 8, missing forecasts of a 2 million barrel decline,” she explained.

The data also showed a 4 million build in gasoline stockpiles as the US summer driving season comes to an end, she added.