Proactive Investors -

- FTSE 100 little changed, up 1 point

- Diageo (LON:DGE) leaves Dublin

- Tesco (LON:TSCO) firms after top-end results

Copper prices reached their highest level in a month at US$4.1/lbs amid a weak dollar, expectations of elevated demand and concerns surrounding low supplies.

Data from the London Metal Exchange highlighted inventories fell to 56,000 tonnes, the lowest since 2005, which has sparked concerns over reserves.

To add to woes, Chile, the world’s largest copper producer, said its state-owned Codelco expects output in 2023 to shrink by 7%, adding to a 10.6% decline in 2022.

Such low levels of supplies sparked commodity trader Trafigura to forecast copper prices at record highs later this year, breaking the peak in March 2022 of US$4.75/lbs.

Shares in Glencore (LON:GLEN) were up 1% to 488p, while Antofagasta (LON:ANTO) gained 1.4% to 1,602p.

The broader FTSE 100 market was flat at 7,824 points.

Guinness supplier dumps Dublin

Diageo has seemingly bucked the trend of companies fleeing London after it decided to ditch its listings on Euronext Paris and Euronext Dublin.

The Guinness producer leaving Dublin may spark some controversy in Ireland, especially as US President Joe Biden is set for a press opportunity outside the Guinness Storehouse.

A London Stock Exchange release said the decision was taken following a review of the trading volumes, costs, and administrative requirements related to its listings in Paris and Dublin.

Delistings are expected to take place at the end of May.

Diageo’s London shares were little changed on the news, changing hands at 3,675p, while the broader FTSE 100 market was trading flat at 7,824p.

10.56am: Burberry welcomes LVMH (EPA:LVMH) results

Shares in Burberry welcomed news in Europe from luxury fashion brand LVMH after the company reported a 17% rise in global sales in the first quarter of 2023.

Ran by the world's richest man Bernard Arnault, the company behind brands including Moët and Louis Vuitton recorded revenues of £18.5bn.

First quarter results, boosted by a “significant rebound” in China, showed luxury brands remain steadfast in the face of the cost-of-living crisis.

Burberry was the fifth largest riser on the FTSE 100, with shares up 2% to 2,551p, while Rolex seller Watches of Switzerland was unchanged, up 0.3% to 760p.

LVMH was up 4.5% to 874p.

Market rundown

Here is a quick run-down on some of the stories making today's headlines.

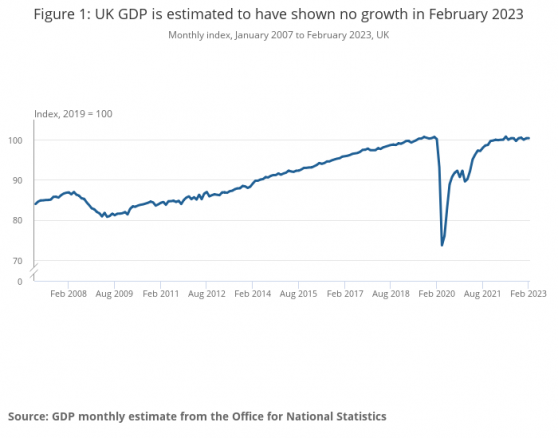

FTSE 100 remains little changed, down three points to 7,882 as the latest GDP figures from the Office of National Statistics showed the UK economy ground to a halt in February.

Tesco said it expects full-year revenue and operating profit at the top of the end of City forecasts. The supermarket urged caution for the year ahead, however, warning of flat profits.

Elsewhere among London’s blue chips, Imperial Brands (LON:IMB) said it is on track to achieve full-year profit and revenue growth. The tobacco-focused company added it has completed more than half of its £1bn buyback.

Healthcare and consumer goods company PZ Cussons (LON:PZC) reported a 6.2% uptick in third-quarter revenue. Performance was boosted by growth in sales of its Imperial Leather and Cussons Creations portfolio.

Among the small caps, Pennant International said acquired the rail services company Track Access Productions. The group said the move will “significantly” enhance its own rail offering.