Proactive Investors -

- FTSE 100 makes solid early progress

- Quarter four GDP revised upwards, house prices fall

- Rolls Royce appoints BP (LON:BP) exec as new finance chief

Ocado rises after legal win

Shares in Ocado Group PLC rose 4% in early exchanges after it said had "comprehensively won" the patent infringement suit brought by AutoStore.

The UK High Court ruled that the Autostore patents were invalid and, in any event, Ocado did not infringe them.

Autostore had originally asserted six patents against Ocado in October 2020. Of these six patents, two were invalidated by the European Patent Office before judgment was handed down, two were withdrawn by Autostore shortly before the hearing started and the remaining two patents were invalidated on Thursday,

The decision follows Ocado's victory over AutoStore in the International Trade Commission in the USA last year. Ocado's claims against AutoStore for infringing Ocado's IP are continuing in Germany and New Hampshire, USA.

FTSE continues good run

FTSE 100 pushed higher in early exchanges despite a mixed bag of news on the health of the UK economy.

At 8.15am London's lead index was at 7,637.87, up 17.44 points, or 0.23% while the FTSE 250 edged higher to 18,927.44, up 19.70 points, or 0.10%.

The differing economic news included UK GDP being revised up marginally, an upbeat business survey from Lloyds (LON:LLOY) Bank but data showing falling house prices from Nationwide.

Quarter four GDP figures showed the UK narrowly avoided recession with economic growth revised upwards slightly to 0.1% from zero before, according to figures from the Office for National Statistics.

But as Gabriella Dickens at Pantheon Macroeconomics noted the UK is still is the only G7 economy in which GDP has not recovered yet to its level in quarter four 2019, before the pandemic struck.

“Indeed, GDP still was 0.6% lower than it was three years ago in the UK, whereas it was 5.1% higher in the US, 2.9% higher in Canada, 0.8% in Japan, 1.2% in France, 1.9% in Italy and just back in line in Germany,” she added.

She reckons the economy likely will continue to flatline in the first half of this year.

But there was gloomier news on house prices which are falling at the fastest annual rate since the aftermath of the financial crisis, according to Nationwide.

Sarah Coles, head of personal finance at Hargreaves Lansdown (LON:HRGV) noted the "house price slip has become a slump, with the biggest annual price drop in 14 years. The pace of descent accelerated, and we're already almost 5% below the peak in August. Unfortunately, the indications for the future aren’t looking terribly promising either."

"Buyers have been broken by rampant inflation, jacked-up mortgage rates, a stagnating economy, and the threat that there could be worse to come. RICS figures for February showed that buyer demand fell again – for the tenth consecutive month. Buyer enthusiasm is likely to have been dampened even further by the fact the gradual fall in mortgage rates stalled in March," she noted.

Shares in Ocado Group PLC rose 4.4% after another legal win in a patent dispute against AutoStore AS. The UK High Court verdict concerned two patents. Autostore back in October 2020 had claimed online grocer and warehouse technology firm Ocado infringed on six of its patents, though two of those claims were invalidated by the European Patent Office before a judgment was made. Another two were withdrawn by Autostore before a hearing started. The remaining two patents were invalidated by a judge in Thursday's verdict.

News of a new CFO ar Rolls-Royce Holdings PLC (LON:RR) was welcomed by the market with shares marked 1.3% higher while shares in Spire Healthcare Group Plc firmed 2.8% after Jefferies upgraded the stock to buy with a 250p price target.

But NCC Group PLC tumbled 48% after warning annual profit will be lower than previously expected.

Mike Maddison, Chief Executive commented: "Macro-economic headwinds, market volatility and uncertainty are undermining business confidence, particularly in the technology sector where we are well represented, and as a result we are seeing demand fall in the form of projects being further delayed, reduced or cancelled."

UK house price fall at fastest rate since 2009 - Nationwide

UK house prices are falling at the fastest annual rate since the aftermath of the financial crisis, new figures from Nationwide showed.

The building society reported that UK house prices fell for the seventh month running in March, as the aftermath from the disastrous mini-budget continued to hammer the housing market.

This month, they fell by 3.1% compared to a year ago, which is the largest annual decline since July 2009. Economists had forecast a 2.2% decline.

Across the UK, prices fell by 0.8% month on month, leaving the average UK house price at £257,122.

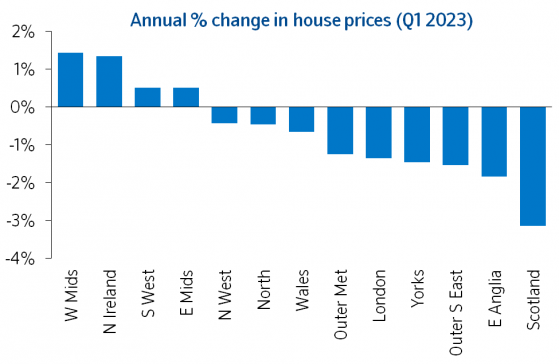

All regions of the UK saw a slowing in price growth in Q1, with most seeing small year-on-year falls. West Midlands was the strongest performing region, while Scotland remained the weakest.

Robert Gardner, Nationwide’s chief economist, commented: "March saw a further decline in annual house price growth, with prices down 3.1% compared with the same month last year. March also saw a further monthly price fall (-0.8%) – the seventh in a row – which leaves prices 4.6% below their August peak (after taking account of seasonal effects)."

“The housing market reached a turning point last year as a result of the financial market turbulence which followed the mini-Budget. Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago."

Rolls-Royce names BP exec as new CFO

Rolls-Royce Holdings PLC has rejigged its leadership team as new boss Tufan Erginbilgic continues his transformation of the engineering company.

The headline news is a new CFO with Helen McCabe joining later this year from BP where she is currently senior vice president, Finance for the Customer & Products division running a business with reported EBITDA of US$13.7bn last year.

She also holds accountabilities for BP's global refining portfolio.

Erginbilgic, also a former BP exec, said: "I have experienced her abilities first-hand and her skillset will complement the existing capabilities of the Executive Team."

Panos Kakoullis will remain as CFO until at least 31 August 2023.

The company also appointed Rob Watson as head of its important civil aerospace business with immediate effect, while Adam Riddle becomes the new head of its defence business, and chair and chief executive of Rolls-Royce North America.