Proactive Investors - FTSE 100 slips as inflation remains stubbornly high.

The FTSE 100 fell in early exchanges as stubborn inflation data in the UK increased the chances of a further increase in interest rates.

At 8.15am London’s lead index was standing at 7,881.86, down 27.58 points, or 0.35% while the FTSE 250 dipped to 19,177.96, down 118.36 points, or 0.61%.

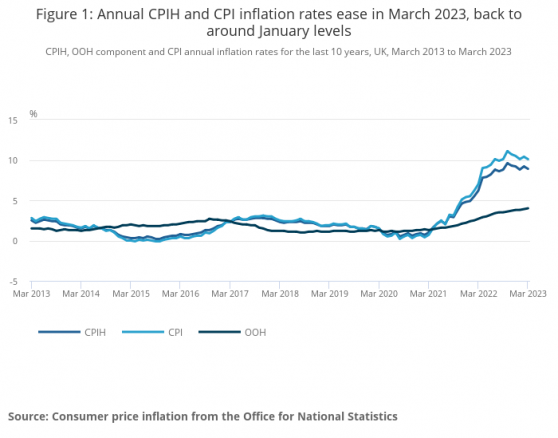

UK inflation eased in March but not by as much as City commentators had hoped and remains stubbornly in double digits, official figures stated.

The Consumer Prices Index rose by 10.1% in the 12 months to March 2023, down from 10.4% in February, according to the Office for National Statistics.

Economists had expected a fall to 9.8%.

The fall in prices mainly reflected changes in the transport division, particularly for motor fuels.

But food prices continue to rise, up to 19.2% in March from 18.2% in February.

Susannah Streeter, head of money and markets, Hargreaves Lansdown (LON:HRGV):

‘’The heat has been turned down on the bubbling cauldron of prices, but inflation is still scalding and interest rates look set to be pushed up again to try and cool it down rapidly.”

“Instead of retreating below double digits, CPI is staying stubbornly high, causing more pain for companies and consumers.”

Samuel Tombs at Pantheon Macroeconomics felt the fall is likely too modest for the MPC to hold back from raising Bank Rate one final time next month.

He calculated that core CPI rose by 0.7% month-to-month on a seasonally-adjusted basis, which equates to a rapid annualised increase of 9.1%.

“We now expect the MPC to hike Bank Rate one last time to 4.50%, from 4.25%, at next month’s meeting,” he said.

There was better news on annual producer input price inflation which cooled to 7.6% in March from an upwardly revised figure of 12.8% in February. Market consensus had been expecting a reading of 9.8%.

In company news, Glencore PLC (LON:GLEN) turned up the heat in its attempts to woo shareholders of Canadian mining firm, Teck Resources.

It said it willing to consider making improvements to its proposal and prepared to to make an offer directly to shareholders if there is no engagement from Teck management.

In an open letter to shareholders of Teck, Glencore said its proposal was a "merger and not a takeover" and is "demonstrably superior" to Teck's own separation plan.

It noted its proposal would buy out shareholders of their coal exposure. They would receive either US$8.2bn in cash or 24% of CoalCo.

Elsewhere, National Express jumped 6% as it said revenue jumped 25% in the first quarter despite the impact of bus strikes in the UK.

Ignacio Garat, National Express group chief executive, commented: "I am pleased to report another quarter of progress at National Express with group revenues in-line with expectations, albeit affected by the bus driver strike in the UK, and recognising that the most significant trading periods for our US School Bus and UK and Spanish coach operations still lie ahead.”

Solid trading at National Express

National Express PLC (LON:NEX) reported first quarter revenue growth of 17%, in line with expectations, despite the impact of bus strikes in the UK.

In a trading update the bus and rail operator said revenue in the period rose by £153.9m to £774.4mln, a rise of 25%.

Ignacio Garat, Group Chief Executive, said: "I am pleased to report another quarter of progress at National Express with Group revenues in-line with expectations, albeit affected by the bus driver strike in the UK, and recognising that the most significant trading periods for our US School Bus and UK and Spanish coach operations still lie ahead.”

The firm highlighted continuing strong performance in ALSA, particularly in Long Haul and Morocco and contract wins in North America in new target cities and segments.

National Express expects average price rises of 13% in US School Bus contracts as contracts expire and reported a strong recovery in UK Coach and German Rail, although UK Bus was affected by a six-day bus driver strike.

The company is implementing a productivity improvement and cost-reduction programme in response to ongoing industry and economic uncertainties but stressed front-line roles would not be cut.

A bond refinancing in November this year is expected to increase incremental annualised interest costs by around £12mln.